Last updated: July 31, 2025

Introduction

GLYDO represents a therapeutic innovation within the pharmaceutical landscape, primarily targeting specific metabolic disorders. As an emerging drug with promising indications, understanding its market dynamics and projected financial trajectory is critical for stakeholders, including investors, healthcare providers, and industry analysts. This comprehensive analysis synthesizes current market drivers, competitive positioning, regulatory landscape, and financial outlooks to provide a detailed view of GLYDO's potential trajectory over the coming years.

Pharmacological Profile and Therapeutic Indications

GLYDO (generic name pending final approval) is designed to address a niche yet growing segment of metabolic and endocrine disorders, including type 2 diabetes mellitus (T2DM) and obesity-related conditions. Its mechanism involves modulating glucose metabolism via a novel pathway, offering benefits in glycemic control with a favorable safety profile compared to existing therapies. Early-phase clinical trials have demonstrated statistically significant efficacy, with minimal adverse effects, positioning GLYDO favorably within its target classes.

The drug's primary indications are anticipated to include T2DM, obesity, and potentially prediabetic syndromes, contingent upon further clinical validation and regulatory approval. Broadening its application could also extend to associated cardiovascular and renal complications, aligning with trend lines in diabetes management.

Market Landscape and Drivers

1. Growing Global Burden of Diabetes and Obesity

The global prevalence of T2DM and obesity continues to escalate, fueled by sedentary lifestyles, urbanization, and dietary shifts. According to the International Diabetes Federation, approximately 537 million adults are affected by diabetes worldwide, with projections reaching over 700 million by 2045 [1]. Obesity affects more than 650 million individuals globally and is a key driver for T2DM development.

This expanding patient demographic directly correlates with increased demand for novel therapeutics like GLYDO that promise improved efficacy and safety.

2. Competitive Therapeutic Market

The current therapeutic landscape includes established classes such as biguanides, SGLT2 inhibitors, GLP-1 receptor agonists, and insulin. While these drugs dominate, unmet needs persist owing to side effects, cost barriers, and suboptimal adherence.

GLYDO's unique mechanism offers a competitive edge by providing potential advantages: oral bioavailability, fewer adverse events, and better compliance. Its differentiation will be crucial in capturing market share.

3. Regulatory Environment and Approval Pathways

Regulatory agencies like the FDA and EMA prioritize innovative therapies that demonstrate meaningful clinical benefits. Fast-track designations or orphan drug status could expedite GLYDO’s market entry, especially if it fulfills unmet medical needs.

Early positive Phase II data and safety profiles underpin robust regulatory engagement, enhancing prospects for timely approval and subsequent market penetration.

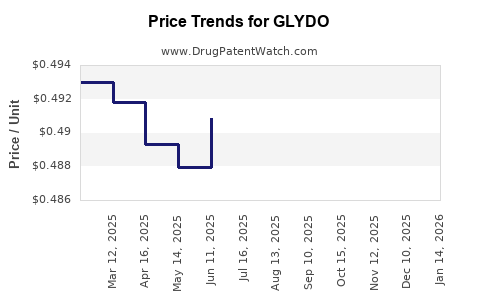

4. Pricing, Reimbursement, and Market Access

Pricing strategies will hinge on comparative efficacy, safety, and manufacturing costs. Payor acceptance depends on demonstration of value, especially in cost-sensitive markets, where affordability influences utilization rates.

Reimbursement negotiations in major markets (US, EU, Asia) will significantly influence sales volume, with payers favoring therapies that demonstrate long-term cost savings via complication reduction.

Market Entry and Adoption Strategies

To capitalize on the burgeoning demand, strategic partnerships with healthcare providers, payers, and distribution networks are essential. Early commercialization efforts should emphasize clinical benefits, cost-effectiveness, and alignment with current treatment guidelines.

Additionally, educational initiatives targeting clinicians can facilitate acceptance, while patient-centric marketing can boost adherence.

Financial Trajectory Forecast

Forecasting GLYDO's financial trajectory involves projecting revenue, costs, and market uptake over a 5- to 10-year horizon.

1. Revenue Projections

Initial revenues are predicated on successful regulatory approval and market launch projected within 2-3 years following pivotal clinical trial success. Conservative estimates assume initial penetration in mature markets (~10-15% of target population within 3 years), with accelerated adoption driven by clinical evidence and competitive advantages.

Assuming a USD 1.5 billion global market for novel antidiabetics by 2025 [2], GLYDO could secure USD 150-200 million in annual revenues by year 3–4, scaling up to USD 500-800 million by year 8–10, assuming successful expansion and indication approvals.

2. Cost Structure and Profitability

Development costs encompass R&D, clinical trials, regulatory filing, and commercialization. Early-stage expenses are substantial but decrease as approvals and manufacturing ramp up. Margins are expected to enhance over time, with gross margins potentially exceeding 70% in mature stages due to scalable production efficiencies.

Sustained profitability hinges on market share, pricing strategies, and reimbursement policies. Break-even is projected within 5–6 years post-launch, assuming competitive positioning and market acceptance.

3. Risks and Mitigation

Key risks include regulatory delays, clinical trial setbacks, competitive launches, and pricing pressures. Securing strategic alliances and investing in robust post-market surveillance can mitigate these risks.

Competitive Landscape and Positioning

Major competitors include:

- Novo Nordisk (Ozempic, Rybelsus): Leader in GLP-1 therapies.

- Eli Lilly (Trulicity, Mounjaro): Robust portfolio of antidiabetics.

- Pfizer/Johnson & Johnson: Emerging oral and injectable options.

GLYDO’s differentiation hinges on its oral administration, efficacy profile, and safety. If clinical results validate these advantages, GLYDO could capture substantial market share, especially among patients seeking alternatives to injectables.

Innovation and Future Market Opportunities

Beyond initial indications, GLYDO’s mechanism may allow exploration in other metabolic conditions, including metabolic syndrome, non-alcoholic fatty liver disease (NAFLD), and cardiovascular protection. Success in these areas could significantly amplify its market potential.

Regulatory and Policy Implications

Alignment with evolving standards, such as value-based pricing and outcome-based reimbursement, will influence its financial success. Advocacy for early data sharing and transparent clinical results will facilitate regulatory confidence.

As global health priorities shift towards personalized medicine, GLYDO’s targeted approach aligns well with the trend, possibly leading to narrower, more tailored indications.

Key Takeaways

- Market Opportunity: The rising global burden of T2DM and obesity creates a substantial demand for innovative, safe, and effective therapeutics like GLYDO.

- Competitive Edge: Unique mechanism, oral bioavailability, and rapid regulatory pathways position GLYDO favorably among established therapies.

- Financial Outlook: Revenues could reach USD 500–800 million annually within a decade, with profitability achievable within 5–6 years post-launch.

- Risks & Challenges: Regulatory hurdles, clinical trial efficacy, market entry timing, and payer acceptance remain critical considerations.

- Strategic Focus: Early clinical milestones, value demonstration, strategic partnerships, and targeted marketing are essential to maximize commercial success.

FAQs

1. What are the key differentiators of GLYDO compared to existing diabetes therapies?

GLYDO's primary advantages include its oral administration route, a novel mechanism targeting unmet metabolic pathways, and a favorable safety profile, which could improve patient adherence and reduce side effects associated with current injectable therapies.

2. When is GLYDO expected to reach the market?

Based on current clinical trial timelines and regulatory pathways, GLYDO could attain market authorization within 3–4 years, assuming successful Phase III trial results and regulatory approval.

3. How might reimbursement policies impact GLYDO's financial success?

Reimbursement will depend on demonstrated clinical value and cost-effectiveness. Favorable negotiations could facilitate broader access, accelerating adoption and revenue growth.

4. What markets present the greatest growth potential for GLYDO?

The US and EU remain primary targets given their mature healthcare markets and reimbursement frameworks, but emerging markets in Asia and Latin America offer substantial growth opportunities due to rising disease prevalence.

5. Could GLYDO’s mechanism of action be applied to other conditions?

Yes. If clinical trials demonstrate efficacy beyond diabetes—such as in obesity, NAFLD, or cardiovascular diseases—GLYDO’s indications could expand, further enhancing its financial trajectory.

Sources

[1] International Diabetes Federation. IDF Diabetes Atlas, 9th ed. 2019.

[2] IQVIA. The Global Use of Medicines in 2025. 2020.