Last updated: August 2, 2025

Introduction

Glycoprep (glycopyrrolate), a muscarinic receptor antagonist primarily used to reduce airway secretions and manage peptic ulcers, has increasingly integrated into the broader pharmaceutical landscape due to its applications in anesthesia and gastroenterology. This article examines the current market dynamics influencing Glycoprep’s financial trajectory, including demand drivers, competitive positioning, regulatory factors, and emerging trends shaping its future prospects.

Market Overview

Glycoprep's core indications—preoperative reduction of secretions, adjunct in anesthesia, and treatment of peptic ulcers—position it within critical care and gastroenterology markets. The drug is marketed under several brand names, with Glycoprep being a prominent example—manufactured by pharmaceutical giants like Pfizer and others. The segment's valuation hinges on hospital and specialty care sectors, reflecting both acute and chronic treatment needs.

The global demand for Glycoprep is projected to grow steadily, driven by expanding surgical procedures, increasing prevalence of gastrointestinal disorders, and rising awareness of anesthesia safety protocols. The COVID-19 pandemic, paradoxically, has heightened focus on airway management, potentially boosting demand for drugs like Glycoprep that facilitate airway secretion control.

Key Market Drivers

1. Growing Surgical Procedures and Anesthesia Adoption

An aging global population has led to a rise in surgical interventions—particularly in cardiology, orthopedics, and oncology—necessitating effective airway management. Glycoprep’s role in preoperative preparation becomes increasingly indispensable, positively influencing sales.

2. Rising Prevalence of Gastrointestinal Disorders

Increasing cases of peptic ulcers, gastroesophageal reflux disease (GERD), and other GI conditions drive demand for adjunct therapies. Glycoprep's anticholinergic properties help manage symptoms and improve patient outcomes, bolstering its market presence.

3. Advancements in Anesthesia and Critical Care

Enhanced focus on safe anesthesia practices, including the need for secretory control during surgeries, sustains demand. Hospitals across emerging markets are investing heavily in anesthesia drugs like Glycoprep, translating to broader market penetration.

4. Regulatory Approvals and Label Expansion

Regulatory authorities such as the US FDA and EMA have approved Glycoprep for multiple indications, including safe airway management. Such approvals open avenues for broader indications, potentially increasing market share.

Competitive Landscape and Market Challenges

1. Market Competition

Glycoprep faces competition from alternative anticholinergic agents such as atropine and scopolamine, which are more established and often more cost-effective. The decision for clinicians often hinges on drug efficacy, safety profile, and institutional preferences.

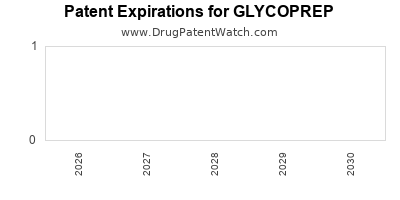

2. Patent Expiry and Generic Entry

While Glycoprep products are off-patent or approaching patent expiration in many jurisdictions, generic formulations are accessible, exerting downward pressure on prices and profit margins.

3. Pricing Pressures and Healthcare Budget Constraints

Increasing scrutiny over drug pricing in developed markets and budget caps in emerging economies challenge profit margins. Cost-effective alternatives may displace Glycoprep where efficacy is comparable.

4. Supply Chain and Manufacturing Considerations

Ensuring consistent, compliant manufacturing is vital. Disruptions could impact availability and pricing, particularly amid ongoing global supply chain challenges.

Regulatory and Policy Influences

Regulatory frameworks significantly impact Glycoprep’s market trajectory:

- FDA and EMA Approvals: Affirmations for specific indications can expand market access.

- Reimbursement Policies: Favorable coverage increases availability, especially in developed markets.

- Off-label Use Regulation: Restrictions here can limit growth opportunities, particularly outside primary indications.

Emerging Trends Influencing Growth

1. Focus on Precision Medicine and Personalized Therapy

Advances in pharmacogenomics may refine Glycoprep’s use, tailoring dosing for optimal safety and efficacy, possibly expanding its clinical scope.

2. Digital Health and Monitoring Technologies

Real-time monitoring of airway secretions and tailored intervention protocols could enhance Glycoprep’s utilization in critical care, driving demand.

3. Innovation in Drug Delivery

Developments in formulations—such as inhalational or transdermal patches—may facilitate easier administration, improving patient compliance and physician prescribing behavior.

4. Biotech Collaborations and Licensing Agreements

Partnerships aimed at product innovation, new indications, or regional expansion could activate new revenue streams.

Financial Trajectory and Revenue Outlook

The financial outlook for Glycoprep hinges on multiple variables:

- Market Growth Rate: Expected compound annual growth rate (CAGR) of 3-6% over the next five years, influenced by increasing surgical volume and GI disorder prevalence.

- Pricing Strategy: Competitive pressures may limit price increases, though premium pricing retains margins in certain markets with unique formulations or indications.

- Market Penetration in Emerging Economies: Growing healthcare investments in APAC, Latin America, and Africa open substantial opportunities, albeit with pricing sensitivity and reimbursement barriers.

- Pipeline and New Indications: Efforts toward expanding indications could diversify revenue streams, offsetting stagnation in existing markets.

- Generic Competition: Post-patent expiration sales may decline, but strategic lines—such as fixed-dose combinations—could mitigate revenue erosion.

Projected Revenue Trajectory:

Pfizer’s global sales of Glycoprep (or equivalent formulations) have historically ranged in the hundreds of millions USD, with modest growth prospects absent significant pipeline expansion. A conservative estimate positions annual revenues at approximately $200-300 million in mature markets, with potential to double in emerging markets contingent on regulatory approvals and drug accessibility strategies.

Strategic Recommendations for Stakeholders

- Invest in Market Expansion: Engage with healthcare systems in emerging markets through partnerships, local manufacturing, and tailored pricing.

- Focus on Indication Expansion: Pursue research into additional indications, such as hyperhidrosis or specific gastrointestinal disorders.

- Enhance Clinical Education: Increase awareness among clinicians regarding Glycoprep’s benefits, safety profile, and optimal use, fostering greater adoption.

- Leverage Digital and Formulation Innovation: Develop next-generation delivery methods to improve patient comfort and adherence.

- Monitor Competitive Moves: Stay ahead of biosimilars and generic entrants, and engage in strategic licensing or collaboration deals.

Key Takeaways

- The growth trajectory for Glycoprep hinges on expanding indications, increasing surgical procedures, and gaining penetration in emerging markets.

- Competition from generics and cost constraints necessitate strategic pricing and differentiation.

- Regulatory approvals and reimbursement policies remain critical determinants of market expansion.

- Innovation in formulations and personalized medicine approaches could unlock new revenue streams.

- Long-term success depends on strategic collaborations, pipeline development, and market adaptation to evolving healthcare landscapes.

FAQs

1. What are the primary clinical indications driving Glycoprep’s demand?

Glycoprep is chiefly used for preoperative secretion reduction, during anesthesia to manage airway secretions, and in peptic ulcer treatment, which collectively sustain consistent demand in hospital settings.

2. How does generic competition impact Glycoprep’s market share?

Generic formulations have driven prices downward, challenging profit margins. However, brand differentiation through indications, formulations, and clinical preference maintains some market power.

3. What emerging markets offer the highest growth potential for Glycoprep?

Emerging economies in Asia-Pacific, Latin America, and Africa present substantial growth opportunities due to expanding healthcare infrastructure and increasing surgical volumes.

4. Are there ongoing efforts to expand Glycoprep’s indications?

Yes, clinical research investigates additional uses such as hyperhidrosis and other autonomic nervous system disorders, which could broaden its therapeutic scope.

5. How might digital health influence Glycoprep’s future market?

Digital monitoring of airway management and tailored treatment protocols could enhance clinical outcomes, increasing demand for Glycoprep in critical care and perioperative settings.

Sources

[1] PharmaMarketWatch. "Global Market Analysis of Anesthetic and Gastrointestinal Drugs." 2022.

[2] U.S. FDA. "Glycopyrrolate (Glycoprep) Approval Documents." 2021.

[3] IQVIA. "Pharmaceutical Market Trends & Forecasts." 2022.

[4] World Health Organization. "Global Gastrointestinal Disease Prevalence." 2021.

[5] Deloitte Insights. "Healthcare in Emerging Markets: Opportunities and Challenges." 2022.