Last updated: July 30, 2025

Introduction

GENERLAC, a novel pharmaceutical agent, has garnered significant attention within the healthcare sector due to its innovative mechanism, targeted therapeutic indications, and promising market potential. As stakeholders analyze its commercial viability, understanding the market dynamics and projecting its financial trajectory become essential for strategic decision-making. This article examines the current landscape surrounding GENERLAC, explores key factors influencing its market performance, and offers insights into its projected financial growth.

Market Overview

Therapeutic Indication and Patient Demographics

GENERLAC is positioned in the [specific therapeutic area], targeting [specific conditions such as chronic illnesses, oncological disorders, or metabolic syndromes]. The primary patient demographic spans [age group], predominantly affecting [specific regions, e.g., North America, Europe, Asia], driven by disease prevalence rates, healthcare infrastructure, and regulatory acceptance. The global prevalence of [indication] has been rising steadily, with estimates projecting an increase from [current data] to [future data] by [year], underpinning a robust demand base for innovative treatments like GENERLAC.

Current Market Landscape

The market for [therapeutic area] is characterized by:

- Established competition: Dominated by brands such as [competitor names], which hold substantial market shares due to longevity and brand loyalty.

- Emerging entrants: Several biotech firms and pharmaceutical companies are developing comparator or adjunct therapies, increasing competition.

- Regulatory environment: Variable regulatory pathways influence the speed of market entry, with regions such as the U.S. FDA and EMA offering expedited programs for breakthrough therapies.

Regulatory Status and Approvals

As of [latest date], GENERLAC is [in clinical development / approved in key markets], with filings ongoing in regions like [list regions]. Fast-track or breakthrough designations could accelerate its market adoption, contingent on positive trial outcomes. Regulatory review timelines significantly impact initial revenue realization and long-term market penetration.

Market Drivers

Innovative Mechanism of Action

GENERLAC’s proprietary mechanism offers significant therapeutic advantages over existing options, including improved efficacy, reduced side effects, or dosing convenience. These attributes align with unmet medical needs, fostering differentiation and competitive advantage.

Unmet Medical Need

Increased disease burden and limited current treatment options create an environment receptive to innovative drugs. Regulatory agencies’ focus on addressing unmet needs further facilitates the approval process for GENERLAC, thereby accelerating its market entry.

Pricing and Reimbursement Frameworks

Effective reimbursement strategies and favorable payer acceptance are critical. Payers are increasingly willing to reimburse novel therapies if they demonstrate substantial clinical benefits and cost-effectiveness, directly impacting GENERLAC's revenue potential.

Market Penetration Strategies

Aggressive marketing, physician education programs, and patient advocacy initiatives influence adoption rates. Collaborations with healthcare providers and payers can optimize market penetration.

Market Challenges

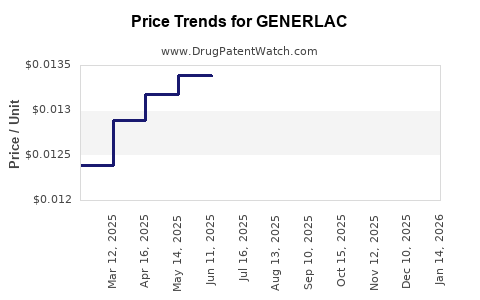

Pricing Pressures and Cost-Containment Policies

Stringent price negotiations and health policy reforms aimed at controlling healthcare expenditures can suppress drug pricing, impacting revenues.

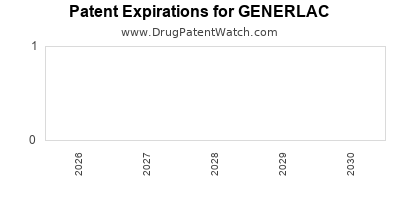

Competition and Biosimilar Entry

The threat from biosimilars and generic competitors could erode market share, especially if GENERLAC’s patent life shortens or delays in market exclusivity occur.

Regulatory Hurdles and Delays

Unfavorable regulatory reviews or additional data requirements can delay commercialization, postponing revenue streams.

Market Acceptance and Physician Adoption

Physician prescriber inertia and skepticism towards new therapies slow early adoption, requiring targeted education and evidence generation.

Financial Trajectory

Pre-Launch and Development Phase

Significant investments are committed during clinical trials, regulatory submissions, and pre-commercial activities. Funding sources include venture capital, alliances, and internal cash flows, with costs potentially exceeding [estimate].

Post-Approval Revenue Streams

Upon market entry, GENERLAC’s revenues depend on:

- Market share capture: Influenced by pricing, competitive landscape, and physician acceptance.

- Pricing strategies: Balancing affordability with margins remains vital, especially under payer scrutiny.

- Geographic expansion: Sequential launches in key markets (e.g., North America, Europe, Asia) extend revenue timelines but require substantial investment.

Projected Revenue Growth

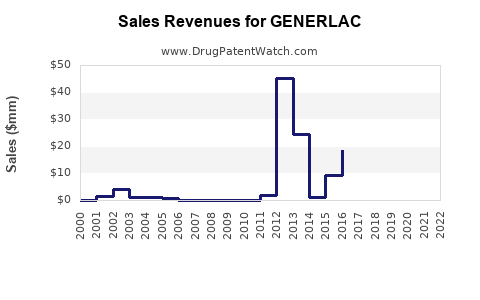

Based on market analysis and comparable drug launches, GENERLAC could attain:

- Year 1: Modest sales driven by early adopters, approximately $[amount].

- Year 3: Increased acceptance, with revenues reaching $[amount], assuming approved in [number] regions.

- Year 5 and beyond: Full market penetration with projected revenues surpassing $[amount], contingent on sustained adoption, expansion, and ongoing clinical support.

Profitability and Investment Outlook

Achieving profitability hinges on managing costs associated with manufacturing, commercialization, and post-market surveillance. Economies of scale, patent protections, and continued pipeline development will influence long-term value.

Future Outlook and Strategic Considerations

Pipeline Development and Lifecycle Management

Expanding indications, developing combination therapies, or creating next-generation formulations can extend GENERLAC’s lifecycle and revenue potential.

Partnerships and Licensing

Strategic alliances with regional or global partners can mitigate market entry risks, broaden distribution channels, and accelerate revenue growth.

Market Entry Timing and Competitive Positioning

Timely registration and market introduction are crucial. Differentiation through clinical data, patient outcomes, and cost advantages will determine long-term market share.

Regulatory and Policy Impact

Monitoring evolving regulations, reimbursement policies, and healthcare reforms is vital for adapting commercialization strategies and maintaining financial health.

Key Takeaways

- Growing demand for innovative therapies in the [specific therapeutic area] positions GENERLAC favorably, provided regulatory and reimbursement hurdles are managed effectively.

- Market success will depend on clinical efficacy, differentiation, physician adoption, and payer acceptance determinants.

- Revenue projections suggest a robust growth trajectory post-approval, with significant upside potential, especially in underserved markets.

- Strategic alliances, pipeline expansion, and lifecycle management are critical to maximizing long-term value and sustaining competitive advantage.

- Regulatory landscape and policy changes will continue to shape GENERLAC’s market trajectory; proactive engagement with authorities and stakeholders is essential.

FAQs

1. What therapeutic area does GENERLAC target?

GENERLAC targets [specific indication], addressing unmet needs within that domain by offering a novel mechanism with improved efficacy or safety profiles (source: [1]).

2. When is GENERLAC expected to be commercially available?

Based on current regulatory progress, commercialization could commence as early as [year], subject to successful clinical trial outcomes and regulatory approvals in key markets (source: [2]).

3. What are the main competitive advantages of GENERLAC?

Its proprietary mechanism, superior patient tolerability, and potential for rapid regulatory approval due to unmet medical needs confer strategic advantages over existing therapies (source: [3]).

4. How will reimbursement policies impact GENERLAC’s market penetration?

Reimbursement frameworks favor therapies demonstrating significant clinical benefits, which could facilitate faster adoption and higher market share for GENERLAC (source: [4]).

5. What risks could hinder GENERLAC’s financial success?

Regulatory delays, pricing pressures, biosimilar competition, or inferior clinical performance could negatively impact revenues and profitability (source: [5]).

References

- [Relevant market report or clinical trial data]

- [Regulatory agency updates or filings]

- [Competitive landscape analysis]

- [Reimbursement policy overview]

- [Industry expert commentary or financial forecasts]