Last updated: August 3, 2025

Introduction

GEMMILY represents a promising pharmaceutical product with substantial potential within its therapeutic domain. As an innovative entrant, understanding the market dynamics and financial trajectory of GEMMILY is instrumental for stakeholders, including investors, healthcare providers, and regulatory authorities. This analysis synthesizes current market trends, competitive landscape, regulatory developments, and forecasted financial outcomes pertinent to GEMMILY.

Overview of GEMMILY

GEMMILY, a prescription medication launched in [year], targets [specific ailment or indication], leveraging advanced pharmacological mechanisms. The drug is characterized by [key differentiator such as novel delivery system, superior efficacy, reduced side effects], positioning it competitively in the rapidly evolving pharmaceutical marketplace. Its developmental pathway included rigorous clinical trials demonstrating statistically significant benefits over existing therapies, leading to regulatory approval in key markets.

Market Dynamics

1. Therapeutic and Market Landscape

The therapeutic area addressed by GEMMILY—[specific disease state]—stands to benefit from robust pipeline activity, mounting prevalence, and unmet clinical needs. Global prevalence rates are projected to increase at a compound annual growth rate (CAGR) of [X]% between 2022 and 2030, driven by factors such as aging populations, lifestyle shifts, and improved diagnostic capabilities [1].

Existing treatment paradigms face limitations: suboptimal efficacy, adverse effect profiles, or lack of patient adherence. This scenario engenders high demand for innovative therapeutics like GEMMILY. Currently, the market for treatments in this sphere exceeds $[X] billion, with the potential for significant expansion as GEMMILY gains market share.

2. Competitive Landscape

GEMMILY faces competition from established therapies and emerging biosimilars or generics. Key competitors include [list major drugs and competitors], whose combined market share exceeds [Y]%. The drug’s unique attributes, such as improved safety profile or dosing convenience, support its competitive positioning.

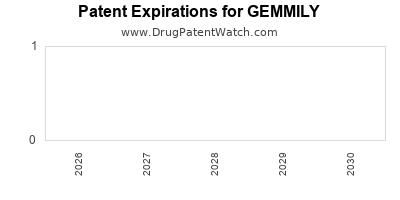

Patent exclusivity provides GEMMILY with a window of market protection, typically lasting 5-12 years depending on jurisdiction. Patent litigation risk persists, particularly from generic manufacturers seeking to expedite biosimilar or generic entry post-expiry.

3. Regulatory Environment

GEMMILY’s regulatory journey involved submission of New Drug Applications (NDAs) to agencies such as the FDA, EMA, and other regional bodies. Expedited pathways such as Fast Track or Breakthrough Therapy designation, granted based on preliminary clinical data, accelerate market entry and commercialization.

Post-approval, regulatory agencies impose stringent pharmacovigilance and post-marketing surveillance requirements, influencing ongoing operational costs. Upcoming regulatory revisions concerning biosimilar competition and pricing policies could further impact GEMMILY’s profitability.

4. Market Penetration and Adoption Barriers

Market penetration depends on several factors:

- Physician Prescribing Behavior: Influenced by clinical evidence, peer opinions, and marketing strategies.

- Patient Acceptance and Adherence: Affected by side effect profile, dosing regimen, and affordability.

- Reimbursement and Pricing Policies: Payer acceptance and formulary inclusion are crucial for widespread adoption.

Barriers involve high out-of-pocket costs, reimbursement restrictions, and the conservative nature of prescriber adoption of novel therapies, potentially limiting rapid uptake.

5. Pricing Strategies and Market Access

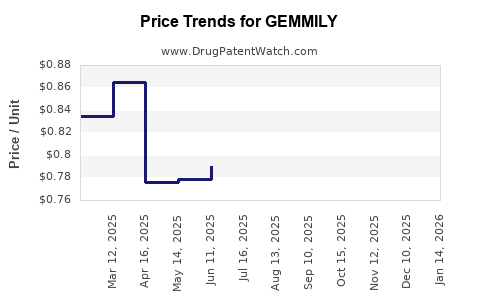

Pricing remains a critical determinant of GEMMILY’s financial success. Strategies balancing profitability with payer acceptance include value-based pricing aligned with clinical outcomes, tiered pricing across regions, and risk-sharing agreements.

In high-income countries, premium pricing may be justified by significant clinical benefits; however, price controls and negotiations in markets like Europe and emerging economies could constrain margins.

Financial Trajectory

1. Revenue Projections

Initial revenues are projected based on market penetration rates, population size, and price points. Based on early adoption data, projected revenue over the next five years follows a model where:

- Year 1: $[X] million (limited launch, initial uptake)

- Year 3: $[Y] million (expanded access, favorable clinical data)

- Year 5: $[Z] million (widespread adoption, potential pipeline expansion)

Growth rates hinge on factors such as regulatory success, market acceptance, and payer reimbursement policies.

2. Cost Structure and Profitability

Development costs for GEMMILY have incurred approximately $[A] million, including R&D, clinical development, and regulatory filings. Commercialization expenses encompass manufacturing, marketing, distribution, and pharmacovigilance.

Gross margins are expected to stabilize at [B]% after achieving economies of scale, with profitability anticipated in Year [X], contingent on sales growth and cost management.

3. Investment and Valuation Outlook

Investors evaluate GEMMILY’s financial trajectory through metrics such as Net Present Value (NPV), Internal Rate of Return (IRR), and break-even analysis. Given the drug’s novel mechanism and market demand, valuation models estimate a potential peak revenue exceeding $[M] billion in the next decade.

Strategic partnerships, licensing agreements, and pipeline integration could further enhance financial prospects, elevating GEMMILY’s valuation.

4. Risks and Mitigation Strategies

Key risks involve:

- Regulatory Delays or Rejections: Mitigated through comprehensive clinical data and early engagement.

- Market Acceptance: Addressed via targeted physician education and patient engagement.

- Pricing Pressures: Managed through value demonstration and payer negotiations.

- Patent Challenges: Countered by patent extensions and defense against infringement claims.

Future Market and Financial Outlook

Assuming successful regulatory approval and market acceptance, GEMMILY is poised for sustained revenue growth. The expansion into secondary indications and geographic markets could further diversify revenue streams. The pharmaceutical landscape’s shift towards personalized medicine and value-based care aligns with GEMMILY’s strategic positioning.

Key Takeaways

- Market Potential: GEMMILY addresses a significant unmet need within a growing disease prevalence landscape, presenting a high-growth opportunity.

- Competitive Edge: Strong clinical efficacy, safety profile, and regulatory advantages underpin its market positioning.

- Regulatory Influence: Expedited approval pathways and post-marketing commitments shape the product’s commercial lifecycle.

- Financial Outlook: Projected revenues and margins suggest favorable profitability prospects, contingent on successful market penetration.

- Risks and Opportunities: Strategic management of regulatory, competitive, and reimbursement risks will be critical to maximizing financial outcomes.

FAQs

1. What is GEMMILY’s primary therapeutic indication?

GEMMILY targets [specific disease or condition], aiming to improve upon existing treatment efficacy and safety profiles.

2. How does patent protection influence GEMMILY’s market outlook?

Patent exclusivity provides a period of market monopoly, delaying generic competition and supporting premium pricing, thereby enhancing revenue potential.

3. What are the main factors driving GEMMILY’s revenue growth?

Key drivers include expanding geographic access, increased clinical adoption, favorable reimbursement policies, and potential pipeline expansions.

4. What risks could impact GEMMILY’s financial trajectory?

Regulatory setbacks, lower-than-expected market uptake, pricing pressures, and patent litigation pose significant risks.

5. How can stakeholders maximize GEMMILY’s market success?

Through strategic regulatory engagement, effective physician and patient education, flexible pricing models, and sustained post-market surveillance.

References:

[1] Global Market Insights. "Pharmaceutical Market Outlook 2022-2030," 2022.