Last updated: August 1, 2025

Introduction

The pharmaceutical landscape is characterized by rapid innovation, dynamic regulatory environments, and evolving market demands. Exelderm, a topical antifungal medication primarily used to treat dermatophyte infections such as athlete’s foot, ringworm, and candidiasis, has garnered global attention owing to its unique formulation and efficacy profile. This analysis explores the market forces shaping Exelderm's growth trajectory, its competitive positioning, regulatory challenges, financial outlook, and strategic considerations that influence its future.

Market Overview and Demand Drivers

Exelderm’s active ingredient, usually aimed at dermatologic fungal infections, traditionally occupies a substantial segment within the antifungal pharmacotherapy market. The global antifungal drugs market was valued at approximately USD 15 billion in 2021 and is projected to reach USD 22 billion by 2027, exhibiting a CAGR of around 6%. The increasing prevalence of fungal skin infections, driven by factors such as rising immunosuppressive diseases, diabetes, and increased athletic and lifestyle-related activities, fuels demand for effective topical antifungal therapies like Exelderm.

Furthermore, demographic trends, notably aging populations in developed countries, contribute to higher incidence rates of skin infections, thereby expanding the therapeutic market. The rise of urbanization and climate change, contributing to moisture retention and fungal proliferation, further bolster demand for topical antifungal agents.

Key Market Demand Factors:

- Growing prevalence of dermatophyte infections globally.

- Increasing use of topical antifungal medications due to safety profiles favoring localized therapy.

- Rising awareness about fungal infections and the importance of early treatment.

- Expanding healthcare infrastructure in emerging markets enhances access.

Competitive Landscape and Market Dynamics

Product Portfolio and Differentiators

Exelderm’s main competitors include terbinafine (Lamisil), clotrimazole (Lotrimin), miconazole (Micatin), and newer agents such as efinaconazole. Success hinges on factors such as formulation efficacy, side-effect profile, and ease of use. Exelderm's formulation advantages—potentially superior absorption, minimal systemic absorption, and shorter treatment durations—serve as critical differentiators.

Pricing and Reimbursement Policies

Pricing strategies vary across markets, influenced heavily by healthcare reimbursement frameworks. In developed economies, insurance coverage and formulary inclusion significantly impact sales volume. Conversely, in emerging markets, price sensitivity necessitates tiered pricing and localized manufacturing.

Regulatory Environment

Exelderm's market penetration depends on approvals by regulatory authorities such as the FDA (U.S.), EMA (Europe), and other regional bodies. Patent expirations, generic competition, and biosimilar entries are critical factors that can influence market share and profitability.

Distribution Channels

The rise of e-commerce platforms and pharmacies enhances accessibility. Strategic partnerships with healthcare providers and pharmacy chains bolster presence, especially in regions where over-the-counter (OTC) sales dominate.

Regulatory and Patent Considerations

Regulatory Pathway

Exelderm must comply with strict regulatory standards, including clinical trials demonstrating safety and efficacy. Approval timelines vary but generally span 1-3 years, contingent upon regional requirements.

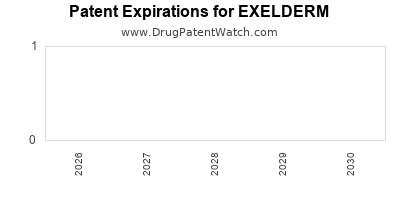

Patent Life Cycle

Patent protection extends for approximately 20 years post-filing, but exclusivity may be threatened by patent challenges or expirations. As patents expire, generic manufacturers enter, leading to price erosion and increased competition.

Biosimilar and Generic Competition

Post-patent expiry, generic versions substantially reduce prices, erode margins, and compel innovation in formulations or delivery mechanisms to maintain market share.

Financial Trajectory and Revenue Projections

Current Financial Position

While specific financial data for Exelderm is proprietary, historical trends of similar antifungal drugs suggest robust revenues driven by high adherence rates and repeat prescriptions. The overall antifungal drug market has experienced an upward trajectory, propelled by increased prevalence and therapeutic advancements.

Forecasted Revenue Growth

Assuming Exelderm maintains clinical efficacy and favorable positioning, projections estimate a compounded annual growth rate (CAGR) between 4-8% over the next five years. This is predicated on successful regulatory approvals in emerging markets, strategic marketing, and increased healthcare access.

Impact of Patent Expiry

An imminent patent expiry within the next 2-3 years could result in a significant decline in exclusive revenues, unless mitigated by innovation, such as reformulations, combination therapies, or enhanced delivery systems.

Cost Considerations

Manufacturing costs are relatively stable but may fluctuate due to raw material prices and regulatory compliance expenditures. Marketing and distribution costs remain significant, especially in penetrating saturated markets.

Investment and R&D

Continued investment in R&D to develop next-generation topical antifungal agents and formulations adds complexity to financial planning but can sustain long-term growth.

Strategic Outlook and Market Opportunities

Expansion in Emerging Markets

Achieving regulatory approval and establishing distribution channels in Asia-Pacific, Latin America, and Africa can unlock substantial revenue streams. These markets often present higher growth rates due to increasing healthcare access and population size.

Product Diversification

Developing combination therapies addressing multiple skin conditions or formulations with extended-release mechanisms could enhance competitive advantage.

Digital and Telemedicine Integration

Leveraging telemedicine for diagnosis and prescription can accelerate adoption, especially in remote regions, driving sales.

Regulatory and Patent Strategies

Proactive patent filings for innovative formulations and formulations can extend exclusivity. Collaborations with local regulatory bodies streamline approval timelines.

Risks and Challenges

- Intense Competition: Price wars and patent challenges accelerate erosion of market share.

- Regulatory Hurdles: Stringent requirements may delay product launches.

- Generic Entry: Patent expirations open pathways for entrenched competitors.

- Market Saturation: Established brands with extensive marketing campaigns pose barriers.

- Supply Chain Disruptions: Raw material shortages may impact manufacturing.

Key Takeaways

- Exelderm operates within a growing antifungal market driven by increasing dermatophyte infection prevalence and demographic shifts.

- Competitive differentiation relies on formulation efficacy, safety, and strategic pricing, especially amidst generic entry post-patent expiry.

- Expansion into emerging markets presents significant revenue opportunities, contingent upon navigating regulatory landscapes.

- Strategic investments in product innovation and digital health integrations can mitigate competitive pressures and extend product life cycles.

- Financial sustainability hinges on balancing growth initiatives with patent management, cost control, and market diversification.

FAQs

-

What factors influence Exelderm’s market growth?

The increasing prevalence of fungal skin infections, demographic trends, regulatory approvals, and strategic market expansion are key drivers.

-

How does patent expiry affect Exelderm’s financial outlook?

Patent expiration typically leads to generic competition and price reductions, necessitating innovation and market diversification to sustain revenue.

-

What are the primary competitive advantages of Exelderm?

Its formulation efficacy, minimal systemic absorption, safety profile, and ease of topical application differentiate Exelderm in the market.

-

In which regions should Exelderm focus its expansion efforts?

Emerging markets such as Asia-Pacific, Latin America, and Africa offer high growth potential but require tailored regulatory and distribution strategies.

-

What strategies can extend Exelderm’s market presence amidst competitive pressures?

Investing in formulation innovation, securing patent protections, integrating telemedicine channels, and building strategic alliances are vital.

Conclusion

Exelderm’s future hinges on astutely navigating the evolving landscape of antifungal therapeutics. While the market offers substantial growth prospects driven by rising demand and expanding access, challenges such as patent cliffs and intense competition necessitate strategic innovation and regional expansion. A balanced approach that emphasizes R&D, regulatory agility, and market diversification will be paramount in shaping the drug’s long-term financial trajectory.

Sources:

- MarketsandMarkets. "Antifungal Drugs Market by Drug Type, Route of Administration, and Region — Global Forecast to 2027."

- EvaluatePharma. "Topical Antifungal Agents Market Analysis."

- U.S. Food and Drug Administration (FDA). "Regulatory Pathways for Topical Dermatologic Agents."

- Industry Reports. "Patent Lifecycles and Generic Competition in Pharmaceuticals."

- World Health Organization (WHO). "Prevalence and Epidemiology of Fungal Infections."