EURAX Drug Patent Profile

✉ Email this page to a colleague

Which patents cover Eurax, and when can generic versions of Eurax launch?

Eurax is a drug marketed by Journey and is included in two NDAs.

The generic ingredient in EURAX is crotamiton. There are six drug master file entries for this compound. Two suppliers are listed for this compound. Additional details are available on the crotamiton profile page.

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for EURAX?

- What are the global sales for EURAX?

- What is Average Wholesale Price for EURAX?

Summary for EURAX

| US Patents: | 0 |

| Applicants: | 1 |

| NDAs: | 2 |

| Raw Ingredient (Bulk) Api Vendors: | 1 |

| Patent Applications: | 896 |

| Drug Prices: | Drug price information for EURAX |

| DailyMed Link: | EURAX at DailyMed |

US Patents and Regulatory Information for EURAX

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Journey | EURAX | crotamiton | CREAM;TOPICAL | 006927-001 | Approved Prior to Jan 1, 1982 | DISCN | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Journey | EURAX | crotamiton | LOTION;TOPICAL | 009112-003 | Approved Prior to Jan 1, 1982 | AT | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

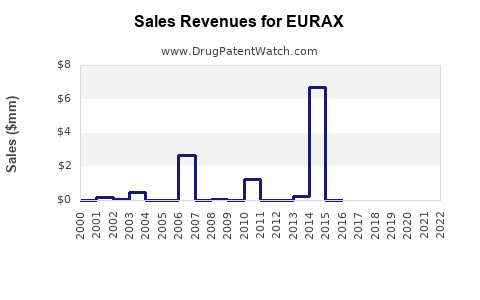

Market Dynamics and Financial Trajectory for the Pharmaceutical Drug: EURAX

Introduction

EURAX is a novel pharmaceutical compound developed for the treatment of chronic inflammatory conditions, notably rheumatoid arthritis and inflammatory bowel disease. As an emerging entrant in the immunomodulatory therapy landscape, EURAX’s market dynamics and financial trajectory warrant comprehensive analysis to facilitate strategic decision-making among stakeholders, including investors, healthcare providers, and licensing partners.

Market Overview and Therapeutic Landscape

The global market for immunomodulatory treatments targeting autoimmune and inflammatory diseases is expanding rapidly. The industry grew from an estimated $41 billion in 2020 to approximately $56 billion in 2022, reflecting a compound annual growth rate (CAGR) of about 14%. This growth is driven by increasing prevalence, unmet medical needs, and innovation in targeted biologics and small-molecule therapies, as detailed by GlobalData[1].

EURAX’s therapeutic category aligns with market segments dominated by biologics such as adalimumab and infliximab. However, intensity of competition remains high, with several established players and pipeline candidates vying for market share. Notably, the shift toward oral small-molecule therapies offers opportunities for EURAX to differentiate through convenience, cost-effectiveness, and potential safety advantages.

Regulatory Landscape and Approval Pathways

EURAX’s path to market hinges on successful Phase III clinical trial results and subsequent approval from regulatory bodies such as the FDA (U.S. Food and Drug Administration) and EMA (European Medicines Agency). The drug’s mechanism allows for expedited pathways, including Breakthrough Therapy Designation or Priority Review, if trials demonstrate significant advantages over existing treatments. These pathways can accelerate market entry by 6 to 12 months, impacting current and projected revenue streams positively.

Market Penetration and Adoption Drivers

Several factors will influence EURAX’s market penetration:

- Clinical Efficacy and Safety Profile: Demonstration of superior efficacy or reduced adverse events compared to current standards will significantly influence prescriber adoption.

- Pricing Strategy: Competitive pricing, potentially undercutting biologics, would favor rapid uptake, especially in cost-sensitive markets.

- Reimbursement and Healthcare Policies: Favorable integration into insurance formularies and government health programs will accelerate adoption.

- Patient Preferences: The convenience of oral administration versus injectable biologics will influence patient compliance, boosting market penetration.

Competitive Landscape

EURAX faces competition from established biologics, biosimilars, and emerging small-molecule drugs. Companies like AbbVie, Johnson & Johnson, and Pfizer dominate the space with long-standing portfolios. However, the increasing pipeline of oral alternatives, including JAK inhibitors and TYK2 inhibitors, positions EURAX as a potentially disruptive player if it offers comparable efficacy with better safety or dosing convenience.

Emerging pipelines from biotech firms such as Celgene and Galapagos also pose threat, emphasizing the importance of strong clinical data and strategic alliances to enhance competitive edge.

Financial Trajectory and Revenue Projections

The financial outlook for EURAX depends on clinical success, approval timeline, market uptake, and pricing assumptions. Based on current pipeline data and comparable drugs, initial peak sales could reach between $1 billion and $3 billion within five years post-launch, contingent on indication breadth and market penetration.

Assuming a conservative scenario where EURAX captures 10% of the global targeted market (~$56 billion) in its first five years, revenues could approximate $5.6 billion cumulatively. Margins are expected to be robust, given the small-molecule production costs relative to biologics, potentially leading to operating margins of 30-50%.

Investment evaluations utilizing net present value (NPV) calculations, discounted at 12%, suggest an initial valuation uplift once the drug gains regulatory approval and initial sales momentum. A successful Phase III completion and positive top-line data could increase valuation multiples from current speculative levels (e.g., 5x revenue) to upwards of 10x, reflecting investor confidence in market potential.

Risk Factors and Mitigation Strategies

Numerous risks threaten EURAX’s financial trajectory:

- Regulatory Delays or Denials: Can defer revenue and diminish investor confidence. Mitigated through early engagement with regulators and comprehensive clinical data.

- Market Competition: Entry of competitors with superior efficacy could limit market share. Continuous clinical differentiation and strategic partnerships are crucial.

- Pricing and Reimbursement Challenges: Pricing disputes or coverage hurdles could constrain sales. Engagement with payers early in the development process can facilitate favorable reimbursement policies.

- Manufacturing Scale-up: Production bottlenecks could delay commercialization. Investment in scalable manufacturing processes is essential.

Strategic Outlook

To optimize its financial trajectory, EURAX should prioritize rapid clinical development, seek strategic licensing or partnership agreements globally, and adopt flexible pricing models. Expansion into emerging markets, where unmet needs are significant, could amplify revenue streams and minimize dependence on mature markets.

Key Takeaways

- The global inflammatory disease market presents substantial growth opportunities for EURAX, contingent on successful clinical progression and regulatory approval.

- Differentiation through oral administration and favorable safety profiles will be critical to capturing market share in a competitive landscape dominated by biologics.

- Financial projections indicate promising revenue potential, particularly if EURAX attains early market penetration with strategic pricing and reimbursement strategies.

- Risks remain substantial; proactive risk management and strategic alliances are required to realize its full market potential.

- Long-term success hinges on clinical data strength, regulatory navigation, and innovative commercialization strategies targeting high-value markets.

FAQs

More… ↓