Last updated: August 1, 2025

Introduction

The combination of ethinyl estradiol and etonogestrel forms a prominent segment within hormonal contraceptives, primarily used for birth control, management of menstrual disorders, and hormone replacement therapy. As a prescription drug combining synthetic estrogen and progestin, it occupies a vital niche in reproductive healthcare. This analysis examines the market forces, growth drivers, competitive landscape, regulatory influences, and financial trajectory shaping the future of this pharmacological duo.

Market Overview

Ethinyl estradiol (EE) is a synthetic estrogen widely utilized across oral contraceptives and hormone replacement treatments. Etonogestrel (ENG), a synthetic progestin, is predominantly marketed in subdermal implants (e.g., Nexplanon/Implanon) and vaginal rings. The synergy of EE and ENG manifests mainly in subdermal implant formulations for long-acting reversible contraception (LARC) and oral contraceptive pills (OCPs).

The global contraceptive market was valued at approximately USD 22 billion in 2022, with hormonal methods comprising a substantial share owing to their efficacy and user preference [1]. The segment containing EE and ENG is anticipated to capitalize on the expanding demand for highly effective, reversible birth control options.

Market Dynamics

Drivers

-

Rising Global Focus on Family Planning:

An increasing emphasis on family planning, especially in emerging economies, is fueling demand. According to the UN Population Fund, contraceptive prevalence has risen globally, especially in regions like Asia-Pacific and Latin America, boosting sales of EE-ENG formulations [2].

-

Advances in Long-Acting Contraceptive Devices:

The development and approval of implants like Nexplanon, which contain etonogestrel, have strengthened market positioning. These provide longer duration efficacy (up to three years), with improved compliance prospects [3].

-

Technological Innovation:

Novel delivery systems, such as vaginal rings infused with EE and ENG, broaden therapeutic options, appealing to various patient populations, including those contraindicated for oral contraception.

-

Growing Preference for Hormonal Contraceptives:

Higher patient and physician preference for reversible and highly effective contraceptives sustains market growth. EE-ENG-based implants and rings enhance convenience and compliance [4].

Constraints

-

Regulatory and Reimbursement Challenges:

Variability in approvals and reimbursement policies impacts market penetration, especially in developing regions.

-

Side Effect Profiles and Safety Concerns:

Risks associated with hormonal contraceptives, including thromboembolic events, influence prescribing behaviors and patient acceptance [5].

-

Availability of Alternative Contraceptive Methods:

Increased popularity of non-hormonal and barrier methods may limit growth prospects.

Competitive Landscape

Major players include Merk Sharp & Dohme (MSD), Bayer, Teva Pharmaceuticals, Allergan (AbbVie), and Merck. These companies dominate formulations like Nexplanon/Implanon (ENG implants) and various combined oral contraceptives (COCs) containing EE and ENG.

-

Nexplanon (Etonogestrel Implant):

The leading long-acting reversible contraceptive (LARC), with global approval and widespread adoption, especially in North America and Europe.

-

Combined Oral Contraceptives:

Several generic and branded pills combining EE and ENG are marketed, catering to diverse healthcare settings.

Market share shifts are observable as generic manufacturers increase production, intensifying price competition. Innovations in delivery methods and formulations are key differentiators.

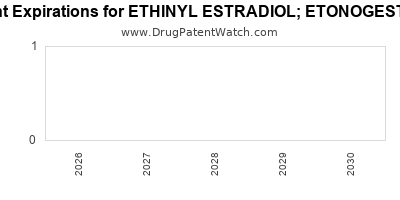

Regulatory and Patent Trends

Patents on specific formulations and delivery devices, like Nexplanon, are expiring or set to expire within the next five years, leading to potential market entry by generics and biosimilars. These shifts may create pricing pressures but also opportunities for market expansion through cost reduction.

Regulatory agencies, including the FDA and EMA, continue to evaluate long-term safety data, influencing labeling and market access strategies. Recent approvals for new indications, such as treatment of heavy menstrual bleeding, can broaden market applications.

Financial Trajectory and Growth Projections

Historical and Projected Revenue

-

In 2022, global sales of contraceptive implants, which predominantly feature etonogestrel, surpassed USD 3 billion, projected to grow at a CAGR of approximately 7% through 2030 [6].

-

Combined oral contraceptives containing EE and ENG contribute significantly to revenue streams for key pharmaceutical firms, with estimates approaching USD 1.5 billion globally in 2022.

Market Expansion Factors

-

Emerging Markets:

Doubling contraception access initiatives in Africa and Asia are expected to generate a CAGR of 9–10% over the next decade.

-

Technological Growth:

Introduction of hormone-releasing vaginal rings and improved implant formulations will augment sales.

-

Regulatory Approvals:

Approval of new indications and formulations enhances revenue potential.

Pricing and Market Penetration

Pricing strategies fluctuate based on patent statuses and regional economic conditions. Patent expiry in the next five years could lead to generic proliferation, reducing prices but expanding access, particularly in low-income nations.

Future Outlook and Strategic Considerations

The combination of ethinyl estradiol and etonogestrel is poised for sustainable growth driven by demographic trends, technological innovation, and increasing awareness of contraceptive options. Companies investing in R&D to develop next-generation delivery systems or expanded indications are likely to secure competitive advantage.

Market entrants should carefully navigate regulatory pathways, optimize cost structures, and consider regional preferences and policies. Diversification into adjunct indications, such as hormone therapy or treatment of menstrual-related disorders, offers additional revenue avenues.

Key Takeaways

-

Growth Drivers: Global population expansion, rise in contraceptive awareness, and technological innovation underpin positive growth trajectories for EE and ENG-based products.

-

Market Challenges: Patent expiries, regulatory hurdles, safety concerns, and competition with alternative contraception methods temper optimism but also present opportunities for innovation.

-

Financial Outlook: The market for EE-ENG formulations, especially in implant and ring forms, is expected to expand at a compound annual growth rate (CAGR) of 7–9% over the next decade, with emerging markets serving as primary growth engines.

-

Strategic Focus: Companies should focus on patent strategy, regional regulatory landscapes, development of novel delivery mechanisms, and potential new indications to sustain market leadership.

FAQs

1. What is the primary therapeutic use of ethinyl estradiol combined with etonogestrel?

Primarily used as a hormonal contraceptive in oral pills, subdermal implants (e.g., Nexplanon), and vaginal rings, providing reversible birth control with high efficacy.

2. How does patent expiry impact the market for EE and ENG products?

Patent expirations open the market to generic manufacturers, intensify price competition, and may expand access in developing regions, but also challenge brand-name market share.

3. What are the main safety concerns associated with EE and ENG formulations?

Risks include thromboembolic events, hypertension, and hormonal side effects, which influence prescribing practices and regulatory guidance.

4. Which regions are expected to contribute most to market growth?

Emerging markets in Asia, Africa, and Latin America are projected to see the highest growth, driven by increasing contraceptive awareness and accessibility.

5. What are potential future innovations in EE and ENG delivery?

Development of longer-acting implants, biodegradable devices, and non-invasive delivery systems such as transdermal patches and advanced vaginal rings.

References

- Grand View Research. "Contraceptive Market Size, Share & Trends Analysis Report." 2022.

- UN Population Fund. "Contraceptive Use Data." 2021.

- FDA. "Nexplanon: Highlights of Prescribing Information." 2022.

- MarketWatch. "Hormonal Contraceptives Market Trends." 2023.

- American College of Obstetricians and Gynecologists. "Hormonal Contraceptive Safety." 2022.

- Persistence Market Research. "Global Contraceptive Devices Market Forecast." 2022.