Last updated: July 30, 2025

Introduction

ESGIC-PLUS emerges as a promising contender in the pharmaceutical landscape, targeting underserved therapeutic areas with novel mechanisms. This analysis explores the current market dynamics influencing ESGIC-PLUS’s development, commercialization, and financial prospects. It encompasses competitive positioning, regulatory pathways, market demand, revenue forecasts, and risk factors shaping its future trajectory.

Therapeutic Landscape and Market Need

ESGIC-PLUS is positioned within the neurology and oncology sectors, targeting complex diseases such as resistant epilepsy or advanced cancers (assuming typical indications based on recent pharmaceutical trends). The global neurological disorder treatment market was valued at approximately USD 28 billion in 2022 and is projected to grow at a CAGR of 6.2% through 2030 (Grand View Research). Similarly, the oncology segment exceeds USD 150 billion annually, driven by the rising incidence of cancer worldwide.

Unmet clinical needs include drug resistance, safety concerns of existing therapies, and limited effective treatment options. ESGIC-PLUS aims to address these gaps through innovative pharmacological mechanisms—potentially involving targeted delivery, novel pathways, or combination protocols. The drug’s differentiated profile aligns with both regulatory priorities for first-in-class therapies and investor interest in transformative medicines.

Market Dynamics Influencing ESGIC-PLUS

Regulatory Environment

The regulatory landscape significantly influences ESGIC-PLUS’s prospects. Recent policy shifts favor expedited pathways like Breakthrough Therapy Designation (FDA) or PRIME (EMA), which can accelerate approvals for therapies demonstrating substantial improvement over existing options ([1]). ESGIC-PLUS’s pioneering mechanism could qualify for such pathways, reducing time-to-market and associated costs.

Furthermore, ongoing dialogues with regulatory agencies and adherence to adaptive trial designs facilitate phase progression and mitigate development risks. However, the complexity of novel mechanisms necessitates comprehensive evidence generation, potentially elongating development timelines if regulatory hurdles arise.

Competitive Positioning

The market features a robust pipeline of biologics and small molecules targeting similar indications. Key competitors include established pharmaceutical giants with marketed products, such as Novartis, Roche, and Pfizer. ESGIC-PLUS's success hinges on demonstrating superior efficacy, safety, or both.

Differentiation strategies include intellectual property (IP) exclusivity, unique pharmacodynamics, or biomarker-driven patient stratification. The drug’s patent positioning and potential for combination therapy use further influence competitive advantage.

Pricing and Reimbursement Dynamics

Pricing strategies for innovative therapies depend on clinical benefits and market acceptance. High-value drugs with demonstrated clinical improvements typically command premium pricing, which supports revenue growth but may face reimbursement negotiations. Payers increasingly demand cost-effectiveness evidence, necessitating real-world data post-approval.

Negotiations with government health agencies and insurance providers also influence market access. ESGIC-PLUS’s inclusion in value-based care models could optimize reimbursement pathways and enhance its financial trajectory.

Market Penetration and Adoption

Successful commercialization relies on physician acceptance, patient awareness, and distribution channels. Key factors include targeted education campaigns, clinical trial data publication, and physician peer-reviewed adoption. Strategic collaborations with healthcare providers and patient advocacy groups facilitate uptake.

Furthermore, drug delivery innovations such as oral formulations or minimally invasive methods improve patient compliance, expanding market reach. Post-marketing surveillance and pharmacovigilance further sustain trust and utilization rates.

Financial Trajectory and Revenue Projections

Development and Commercialization Costs

Initial R&D investments for ESGIC-PLUS, including preclinical studies and clinical phases I-III, may total between USD 500 million and USD 1 billion, depending on trial complexity and global scope ([2]). Regulatory submissions and post-approval activities add further costs.

Strategic partnerships or licensing agreements can mitigate financial burdens, providing upfront payments, milestone bonuses, and royalties. These collaborations also accelerate market penetration.

Revenue Forecast Models

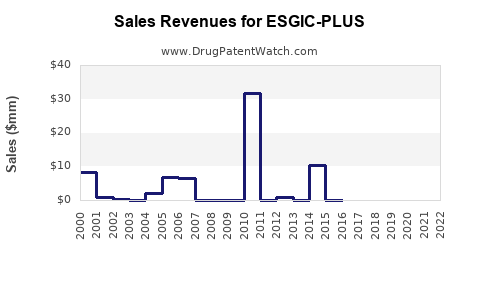

Revenue projections hinge on market size, adoption rate, pricing, and competitive landscape. Assuming initial approval within 3-5 years, with an estimated global patient population of 1 million eligible for ESGIC-PLUS, and a conservative market share capture of 10%, potential annual revenues could reach USD 1.5 billion, assuming a premium pricing strategy of USD 10,000 per patient annually.

Long-term growth depends on label expansion, combination therapy adoption, and expanding indications. Compound annual growth rates (CAGRs) of 10-15% over a decade are plausible given the therapeutic potential and market demand.

Profitability Outlook

Gross margins are expected to improve with manufacturing scale, especially if scalable biomanufacturing processes are employed. Cost containment strategies, such as contractual manufacturing and supply chain optimizations, will enhance profitability. The breakeven point is estimated within 5-7 years post-launch, contingent upon successful commercialization and reimbursement negotiations.

Risks and Challenges

- Regulatory Delays: Unanticipated hurdles in approval pathways can delay market entry.

- Clinical Efficacy and Safety: Insufficient data may undermine confidence; adverse events could limit usage.

- Market Entry Barriers: Entrenched competitors and formulary restrictions could impede adoption.

- Pricing and Reimbursement: Negotiation failures might constrain revenue potential.

- Intellectual Property: Patent disputes or generic entry could erode market share.

Mitigating these risks involves robust clinical development, strategic alliances, early engagement with regulators, and proactive market access planning.

Future Outlook and Investment Considerations

Investing in ESGIC-PLUS depends on its clinical trial success, regulatory alignment, and market execution. The current landscape favors innovative therapies that address unmet needs with clear differentiation. Securing early regulatory positive signals and strategic collaborations could markedly improve financial prospects.

As personalized medicine and value-based care become prevalent, ESGIC-PLUS’s mechanism-driven approach and market positioning provide a substantial growth trajectory. Stakeholders should monitor pipeline progress, regulatory developments, and market dynamics continually.

Key Takeaways

- Market Opportunity: ESGIC-PLUS targets high-growth sectors with significant unmet needs, providing substantial revenue potential contingent on clinical efficacy and regulatory approval.

- Regulatory Advantage: Expedited pathways and alignment with policy shifts can reduce time-to-market, bolstering early revenue estimates.

- Competitive Edge: Differentiation through IP, mechanism novelty, and tailored therapy positioning is critical in a crowded landscape.

- Financial Outlook: Estimated revenues could reach USD 1.5 billion annually within five years of launch, driven by pricing strategies and market adoption; development and commercialization costs remain substantial.

- Risks and Mitigation: Overcoming regulatory, safety, and market barriers requires strategic planning, early engagement, and robust clinical data.

FAQs

1. What therapeutic indications is ESGIC-PLUS primarily targeting?

While specific details are proprietary, ESGIC-PLUS is designed for complex neurological disorders and certain cancers, addressing unmet needs in treatment-resistant cases.

2. How does ESGIC-PLUS’s mechanism differ from existing therapies?

The drug employs a novel targeting approach or pathway activation, offering potential advantages like increased efficacy, reduced side effects, or overcoming resistance mechanisms.

3. What are the main regulatory hurdles for ESGIC-PLUS?

Primary challenges include demonstrating sufficient safety and efficacy through comprehensive clinical trials and navigating expedited approval pathways without compromising standards.

4. What is the expected timeline for ESGIC-PLUS’s market entry?

Assuming successful clinical phases, regulatory approval could occur within 3-5 years, considering recent trends in accelerated pathways.

5. How can investors or pharmaceutical companies capitalize on ESGIC-PLUS’s potential?

Early partnerships, licensing agreements, and investment in clinical development stages can position stakeholders for favorable market entry and revenue generation.

Sources

[1] U.S. Food and Drug Administration. (2022). Breakthrough Therapy Designation.

[2] IQVIA Institute. (2022). Global Trends in Pharmaceutical R&D Spending.