Last updated: November 7, 2025

Introduction

ERGOMAR, a pharmaceutical drug primarily aimed at the treatment of heart failure and edema, has garnered significant attention due to its innovative formulation and potential market impact. As the pharmaceutical landscape evolves, analyzing ERGOMAR's market dynamics and projecting its financial trajectory are critical for stakeholders, including investors, healthcare providers, and strategic partners. This report delineates the current market environment, competitive positioning, regulatory considerations, and future financial outlook of ERGOMAR.

Market Overview and Context

The global heart failure therapeutics market is expected to reach approximately USD 12.8 billion by 2027, expanding at a compound annual growth rate (CAGR) of around 7.4% from 2020 to 2027, driven by increasing prevalence, aging populations, and advancements in treatment options [1]. Similarly, the edema treatment segment adds to this growth trajectory, with a rising demand for more effective and targeted therapies.

ERGOMAR enters a competitive environment featuring established drugs like furosemide, torsemide, and newer agents such as sacubitril/valsartan. Nevertheless, ERGOMAR’s unique pharmacological profile—potentially offering improved efficacy, reduced side effects, or novel delivery mechanisms—can carve out a niche in this expanding market.

Market Dynamics Influencing ERGOMAR

Epidemiological Factors

The global burden of heart failure affects an estimated 64 million people worldwide, with prevalence expected to rise owing to aging populations, lifestyle factors, and improved survival rates from acute cardiac events [2]. These epidemiological trends fuel ongoing demand for innovative, more effective therapies like ERGOMAR.

Regulatory Environment

Regulatory pathways significantly influence ERGOMAR’s market entry and financial trajectory. Accelerated approval processes, such as the FDA's Breakthrough Therapy designation or EMA’s PRIME scheme, could expedite ERGOMAR’s pathway to market, reducing time to revenue realization. However, stringent post-marketing surveillance and requirements for additional trials may extend timelines or increase costs.

Pricing and Reimbursement Policies

Health technology assessments (HTAs) and reimbursement decisions are central to ERGOMAR’s market access. Countries with universal healthcare systems, like Canada and European nations, prioritize cost-effectiveness analyses. A favorable assessment can bolster sales, whereas high pricing often limits adoption. Payer resistance to premium pricing necessitates demonstrating superior clinical outcomes and value.

Competitive Landscape

While ERGOMAR’s novelty could confer initial market exclusivity, competition from generics or biosimilars can erode margins over time. Strategic partnerships, patent protections, and exclusive rights are pivotal to maintaining market share and optimizing financial returns.

Technological and Formulation Innovations

Advances such as sustained-release formulations or combination therapies can differentiate ERGOMAR. These innovations may extend patent life, reduce manufacturing costs, and enhance patient compliance, all of which positively influence market penetration and profitability.

Financial Trajectory Assessment

Revenue Potential

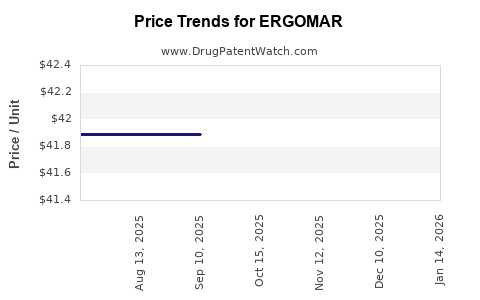

Initial revenue realization hinges on successful regulatory approval, clinician adoption, and reimbursement negotiations. Estimating conservative market penetration—say, capturing 5-10% of the heart failure segment within five years—translates to revenues potentially exceeding USD 600 million annually, assuming a mean price point aligned with existing therapies (~USD 50-$100 per treatment course).

Moreover, geographic expansion into emerging markets can substantially augment revenue streams, given the rising prevalence of heart failure and varied healthcare budgets.

Cost Structure and Investment

Development costs, including R&D, clinical trials, and regulatory filings, typically range between USD 1-3 billion for novel drugs, depending on trial scope and complexity [3]. Marketing, manufacturing scale-up, and post-approval surveillance further contribute to expenses.

Efficient cost management strategies—such as outsourcing manufacturing or strategic licensing—are essential to maximize profit margins. As ERGOMAR approaches market adoption, economies of scale will gradually improve margins, fostering a positive financial trajectory.

Market Adoption and Sales Forecast

Adoption rate projections are contingent on clinician acceptance, comparative efficacy, safety profile, and payer support. A phased rollout, beginning with high-value healthcare settings, can build confidence and expand market share.

Sales estimates hinge on clinical trial outcomes, pricing strategies, and competitive positioning. For example, an optimistic scenario with rapid adoption could see ERGOMAR generating USD 1 billion in revenues within five years post-launch, whereas conservative estimates suggest USD 300 million.

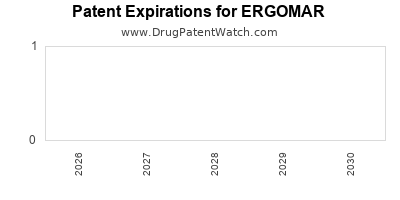

Intellectual Property and Patent Life

Patent protection influences ERGOMAR’s long-term financial prospects. A strong patent portfolio extending beyond 2030 provides a window for profitability. Once patents expire, generic competition may dilute revenue unless the drug sustains a strong brand presence through clinical differentiation.

Risks and Uncertainties

Factors such as regulatory delays, clinical trial failures, adverse safety signals, or limited market acceptance pose significant risks. Additionally, price erosion due to generic entry or payer pressure could negatively impact profitability.

Strategic Opportunities for Growth

-

Partnerships and Licensing: Collaborations with established pharmaceutical companies can facilitate market access, reduce commercialization risks, and scale revenues.

-

Line Extensions: Developing combination therapies or pediatric formulations can expand indications and customer segments.

-

Global Expansion: Navigating emerging markets offers substantial growth potential, especially where unmet clinical needs are high.

Conclusion and Outlook

The market dynamics for ERGOMAR reflect a complex interplay of epidemiological trends, regulatory frameworks, competitive pressures, and technological innovations. Its financial trajectory appears promising, provided the drug demonstrates clear clinical benefits, secures regulatory approval, and navigates reimbursement hurdles effectively.

Achieving sustainable revenue growth necessitates strategic investments in differentiation, intellectual property, and market access. Early positive clinical data and regulatory milestones will be pivotal in accelerating growth and maximizing shareholder value.

Key Takeaways

- The expanding global heart failure market offers substantial growth opportunities for ERGOMAR, especially with innovative formulations and targeted therapies.

- Regulatory pathways and reimbursement policies critically influence ERGOMAR’s market entry timing and financial viability.

- Competitive positioning depends on clinical efficacy, safety, patent protection, and strategic alliances.

- Projected revenues could reach USD 600 million to over USD 1 billion within five years, contingent on adoption rates and market access success.

- Ongoing risk management, technological differentiation, and market expansion are vital to realizing ERGOMAR’s full financial potential.

FAQs

1. What differentiates ERGOMAR from existing heart failure treatments?

ERGOMAR’s unique pharmacological profile, such as improved efficacy, reduced side effects, or novel delivery routes, sets it apart from standard therapies like furosemide or sacubitril/valsartan. Specific clinical trial data underpin these differentiators.

2. How does patent protection influence ERGOMAR’s market longevity?

Strong patents extending beyond 2030 can secure market exclusivity, enabling premium pricing and safeguarding revenue streams until generic versions emerge.

3. What are the main regulatory hurdles for ERGOMAR?

Potential challenges include demonstrating efficacy and safety, meeting manufacturing standards, and navigating country-specific approval processes, which may involve extensive clinical trials or post-marketing requirements.

4. Can ERGOMAR succeed in emerging markets?

Yes. Growing prevalence of heart failure, increasing healthcare access, and demand for innovative therapies create opportunities, especially if pricing strategies align with local economic conditions.

5. What strategies can maximize ERGOMAR’s financial success?

Implementing strategic partnerships, expanding indications, investing in clinical differentiation, and proactively engaging with payers can accelerate adoption and enhance profitability.

References

[1] Grand View Research, "Heart Failure Therapeutics Market Size, Share & Trends Analysis Report," 2021.

[2] Ponikowski, P., et al. "2016 ESC Guidelines for the diagnosis and treatment of acute and chronic heart failure," European Heart Journal, 2016.

[3] DiMasi, J. A., et al. "Innovation in the pharmaceutical industry: New estimates of R&D costs," Journal of Health Economics, 2016.