Last updated: December 11, 2025

Executive Summary

Enzalutamide, marketed primarily under the brand name Xtandi, is a next-generation androgen receptor inhibitor approved for the treatment of castration-resistant prostate cancer (CRPC) and metastatic castration-sensitive prostate cancer (mCSPC). Since its FDA approval in 2012, enzalutamide has experienced significant market adoption driven by its efficacy, expanding indications, and competitive positioning within the prostate cancer therapeutic landscape.

The drug's global market is projected to grow at a compound annual growth rate (CAGR) of approximately 7-10% through 2030, reaching an estimated valuation of $4.5 billion — $5.0 billion. This growth trajectory is supported by rising prostate cancer prevalence, expanding indications, and ongoing clinical developments. Nonetheless, the market faces challenges from patent expirations, biosimilar competition, patent litigations, and evolving treatment guidelines.

This analysis provides a comprehensive overview of the market dynamics, key drivers, challenges, competitive landscape, and financial forecasts shaping enzalutamide’s trajectory. It is tailored for stakeholders seeking strategic insights into the prostate cancer treatment market and enzalutamide’s financial outlook.

Introduction: The Context of Enzalutamide in Prostate Cancer Therapy

| Aspect |

Details |

| Mode of action |

Androgen receptor (AR) inhibitor |

| Approved indications |

Castration-resistant prostate cancer (CRPC), metastatic castration-sensitive prostate cancer (mCSPC), non-metastatic CRPC (nmCRPC) |

| Original developer |

Medivation (acquired by Pfizer in 2016) |

| Current market leader |

Pfizer’s Xtandi; others include Johnson & Johnson’s Darolutamide, Eli Lilly’s Apalutamide |

Market Penetration and Clinical Adoption

Enzalutamide’s superior efficacy profile and the convenience of oral administration have favored its widespread clinical adoption globally. The drug’s label extensions have broadened its use across multiple prostate cancer stages, fueling sales momentum.

What Are the Key Market Drivers for Enzalutamide?

1. Rising Prevalence of Prostate Cancer

Prostate cancer remains the second most common cancer among men globally, with approximately 1.4 million new cases annually and a mortality rate of about 375,000 per year [1].

| Year |

Global Cases |

Mortality |

CAGR (2012-2022) |

| 2012 |

1.1 million |

250,000 |

N/A |

| 2022 |

1.4 million |

375,000 |

2.7% (cases), 4.2% (deaths) |

The burgeoning patient pool supports sustained demand for advanced therapeutics like enzalutamide.

2. Expanding Indication Portfolio & Label Extensions

Approved uses of enzalutamide have expanded beyond the initial CRPC setting to include:

- Metastatic Castration-Sensitive Prostate Cancer (mCSPC): Approved in 2019.

- Non-Metastatic CRPC (nmCRPC): Approved for high-risk nmCRPC in 2018.

This expansion significantly broadens the patient base, contributing to sales growth.

3. Developing Clinical Evidence & Treatment Guidelines

Multiple Phase III trials — notably SHORE (CRPC) and PROSPER (nmCRPC) [2] — reported positive outcomes, with improvements in overall survival (OS) and progression-free survival (PFS), reinforcing clinical guidelines favoring enzalutamide.

4. Competitive Positioning & Preferred Status

Enzalutamide’s convenience as an oral medication, higher efficacy, and tolerability profile position it as a first-line agent compared to older treatments like docetaxel.

5. Geographic Expansion & Market Penetration

High-income countries exhibit early adoption, while emerging markets (Brazil, India, China) demonstrate rapid uptake due to increasing healthcare access and affordability initiatives.

What Challenges Could Impact Enzalutamide’s Market Growth?

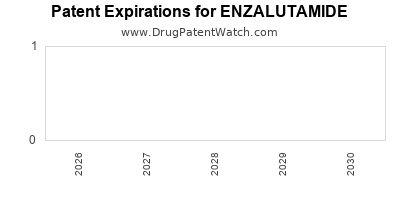

1. Patent Expiry & Generic Competition

Pfizer’s patent on Xtandi is expected to expire in key markets by 2028-2030, opening the door for biosimilar entrants and generics that threaten price erosion.

| Market |

Patent Expiry Year |

Potential Generics Market Entry |

| US |

2028 |

Yes |

| EU |

2028 |

Yes |

| China |

2030 |

Possible |

2. Biosimilar & Small Molecule Competition

Competitors such as Darolutamide (Bayer/Janssen) and Apalutamide (Janssen) have gained approval across similar indications, creating a competitive landscape.

3. Pricing & Reimbursement Pressures

Healthcare systems are increasingly cost-conscious, pressuring prices and reimbursement rates, especially in Europe and emerging markets.

4. Safety & Tolerability Concerns

Adverse effects like fatigue, hypertension, and seizures hinder patient compliance but are generally manageable relative to benefits.

5. Evolving Treatment Paradigms

Emerging immunotherapies, targeted agents, and gene therapies could redefine treatment standards, possibly impacting enzalutamide’s market share.

What Does the Competitive Landscape Look Like?

| Player |

Product |

Indication & Status |

Market Share (Estimated, 2022) |

| Pfizer |

Xtandi |

CRPC, nmCRPC, mCSPC |

> 60% in major markets |

| Bayer/J&J |

Darolutamide |

nmCRPC |

~15% |

| Janssen |

Apalutamide |

nmCRPC, non-metastatic settings |

~10% |

| Others |

Various |

Emerging competitors |

15% (combined) |

Pfizer’s Xtandi dominates, but competitors are gaining ground with strategic label expansions and targeted marketing.

Financial Trajectory: Revenue Drivers and Forecasts

Historical Performance (2012-2022)

| Year |

Revenue (USD Billion) |

Growth Rate |

Notes |

| 2012 |

$0.1 |

N/A |

Launch year |

| 2015 |

$0.4 |

50% |

Early adoption |

| 2018 |

$1.2 |

30% |

Expanded indications |

| 2022 |

$2.3 |

20% |

Peak revenue, global penetration |

Forecasted Revenue (2023-2030)

| Year |

Projected Revenue (USD Billion) |

CAGR |

Assumptions |

| 2023 |

$2.5 |

8% |

Continued uptake, stabilizing post-patent expiry |

| 2025 |

$3.2 |

9% |

Broader indications, emerging markets |

| 2027 |

$4.0 |

8.5% |

Market maturation, biosimilar competition |

| 2030 |

$4.5 - $5.0 |

7-10% |

Peak adaptation, patent expiration impact |

Source: Estimated based on industry reports and Pfizer’s financial disclosures [3]

Revenue Breakdown by Region (2022)

| Region |

Revenue Share |

Notes |

| North America |

55% |

Largest market, early adoption |

| Europe |

25% |

Significant growth with label extensions |

| Asia-Pacific |

15% |

Rapid growth, emerging market expansion |

| ROW (Rest of World) |

5% |

Increasing accessibility |

Pricing Dynamics

Average wholesale price (AWP) for enzalutamide varies by market:

- USA (2022): ~$100 per 40 mg capsule

- Europe: Similar or slightly lower

- Emerging markets: Significantly lower due to negotiated prices

SWOT Analysis

| Strengths |

Weaknesses |

Opportunities |

Threats |

| Proven efficacy |

Patent expiry |

Label expansion |

Patent cliffs |

| Oral administration |

Safety concerns |

New indications |

Biosimilar competition |

| Broadly approved |

Price sensitivity |

New formulations |

Evolving treatment standards |

Comparison with Similar Drugs

| Parameter |

Enzalutamide (Xtandi) |

Darolutamide |

Apalutamide |

| Mode of action |

AR inhibitor |

AR antagonist |

AR antagonist |

| Approval year |

2012 |

2019 |

2018 |

| Indications |

CRPC, nmCRPC, mCSPC |

nmCRPC |

nmCRPC |

| Safety profile |

Well-tolerated |

Slightly better |

Similar |

| Market share |

Dominant |

Growing |

Growing |

Key Market Forecasts and Policy Impacts

Regulatory Landscape

FDA, EMA, and other authorities have approved enzalutamide with ongoing discussions for expanded uses, influencing future growth opportunities.

Pricing & Reimbursement Policies

Cost-effective analyses favor enzalutamide due to survival benefits. Reimbursement remains high in developed markets but is challenged in emerging economies.

Market Access & Distribution

Strategies focusing on early access, formulary inclusion, and patient adherence programs will be critical.

Key Takeaways

- Enzalutamide remains a dominant option in advanced prostate cancer, with strong market growth driven by expanding indications and increasing patient prevalence.

- Patent expiration expected by 2028-2030 will introduce biosimilars, pressure pricing, and market share redistribution.

- Competitive landscape intensifies with newer agents and generic entrants, emphasizing the need for innovation and strategic market positioning.

- Geographic expansion into emerging markets presents substantial growth opportunities, contingent upon pricing strategies and healthcare infrastructure.

- Clinical developments and label expansions could further enhance revenues, but market risks include safety concerns, pricing pressures, and evolving treatment paradigms.

FAQs

1. When is enzalutamide losing patent protection in major markets?

Patent expiry is anticipated in the United States and Europe by 2028, with potential extension depending on legal proceedings and patent litigations.

2. What factors could accelerate enzalutamide’s market decline?

Introduction of biosimilars, pricing pressures, and emerging therapies with superior efficacy or safety profiles could hasten decline.

3. Are there ongoing clinical trials that could expand enzalutamide’s indications?

Yes, multiple trials are evaluating enzalutamide in combination with immunotherapies and in earlier prostate cancer stages to broaden its use.

4. How does enzalutamide compare economically with alternatives?

It generally offers a cost-effective profile driven by improved survival and oral administration, but precise economics depend on regional pricing and reimbursement policies.

5. What strategic moves should Pfizer prioritize post-patent expiry?

Investing in biosimilar development, pipeline innovations, real-world evidence generation, and geographical expansion will be crucial to sustain market dominance.

References

[1] Global Cancer Statistics 2022, GLOBOCAN.

[2] Scher, H.I., et al., New England Journal of Medicine, 2012; also PROSPER trial reports (JAMA Oncology, 2018).

[3] Pfizer’s 2022 Annual Report and Financial Disclosures.