Last updated: August 1, 2025

Introduction

Enulose, also known as lactulose, is a synthetic disaccharide primarily used in the management of hepatic encephalopathy and chronic constipation. As a well-established pharmaceutical, Enulose's market landscape is shaped by clinical efficacy, regulatory frameworks, industry competition, and emerging therapeutic indications. This analysis explores the current market dynamics and forecasts the financial trajectory of Enulose, providing critical insights for stakeholders including pharmaceutical companies, investors, and healthcare providers.

Pharmacological Profile and Clinical Applications

Enulose (lactulose) functions as an osmotic laxative, increasing water content in the bowel to facilitate bowel movement. Additionally, it reduces serum ammonia levels by altering gut flora, thus making it a treatment cornerstone for hepatic encephalopathy. Its safety profile and longstanding clinical use bolster its continued relevance in gastroenterology and hepatology, ensuring persistent demand in these sectors.

Market Landscape and Competitive Environment

Established Market Position

Lactulose-based formulations such as Enulose have enjoyed a dominant position within the therapeutic arsenal for hepatic complications. Their low toxicity and proven efficacy create formidable barriers for alternative treatments to displace them.

Key Players

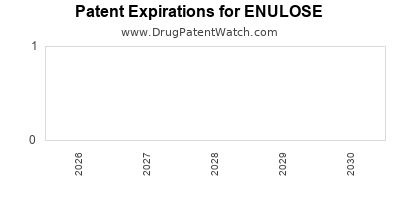

Major pharmaceutical manufacturers, including Ferring Pharmaceuticals (which markets the brand "Enulose"), Boehringer Ingelheim, and generic companies, dominate the manufacturing landscape. The entry of generic versions post-patent expiry has intensified price competition and expanded accessibility, especially in emerging markets.

Regulatory Environment

Regulatory agencies worldwide, notably the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), maintain evolving guidelines for lactulose formulations. Approvals of generic versions have significantly propelled market penetration, though stringent quality standards continue to influence market entry and pricing strategies.

Market Drivers

Rising Prevalence of Liver Disease

An increase in cases of liver cirrhosis, hepatitis, and other hepatic conditions globally has expanded the patient pool requiring lactulose therapy. The World Health Organization (WHO) estimates that over 1.5 billion people suffer from liver diseases, with many progressing to stages necessitating lactulose intervention.

Aging Population

The aging demographic amplifies the demand for chronic constipation remedies and hepatic disorder management, further fueling Enulose's market sales.

Treatment Paradigm Stability

Enulose’s status as a first-line treatment for hepatic encephalopathy remains largely unchallenged due to its clinical validation, supporting sustained demand.

Expanding Indications

Emerging research suggests potential roles for lactulose in gut microbiota modulation, colon cancer prevention, and other gastrointestinal conditions, creating opportunities for product line extensions and increased utilization.

Market Challenges

Generics and Price Competition

The expiration of patents has led to a surge in generic lactulose formulations, exerting downward pressure on prices and margins for branded products like Enulose.

Availability of Alternatives

Novel therapies, such as rifaximin and other non-absorbable antibiotics, are increasingly used alone or in combination for hepatic encephalopathy, creating substitution risks.

Regulatory Hurdles

Strict quality control and regulatory requirements in different markets can delay market entry of new formulations or biosimilars, impacting revenue streams.

Supply Chain Constraints

Global supply chain disruptions, particularly for raw materials like synthetic sugars, can hamper production capacity and affect availability.

Financial Trajectory and Future Outlook

Historical Performance

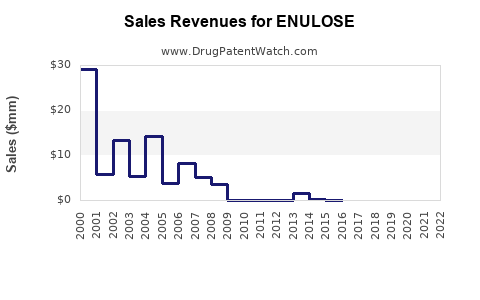

Enulose’s revenue has demonstrated steady growth over the past decade, primarily driven by the rising burden of liver diseases and chronic digestive complaints. Premium pricing in developed markets sustains healthy margins, while volume growth in emerging economies fuels overall expansion.

Projected Growth Drivers

- Market Expansion in Emerging Economies: Countries like India, China, and Brazil exhibit escalating prevalence rates for liver and gastrointestinal disorders, offering fertile ground for growth.

- Product Line Diversification: Developing formulations with improved stability, palatability, or delivery routes can capture additional market share.

- Strategic Partnerships and Licensing Agreements: Collaborations with regional manufacturers can facilitate market penetration and reduce regulatory timelines.

Forecasted Revenue Trends

Industry analysts project a compound annual growth rate (CAGR) of approximately 3-5% for the lactulose segment over the next five years. Factors underpinning this include increasing license renewals, expanding indications, and ongoing clinical research support. The global lactulose market is forecasted to reach USD 650 million by 2027, with Enulose representing a significant share owing to its established brand presence.

Emerging Market Opportunities

Affordable generic options and rising healthcare infrastructure investments are expected to accelerate adoption, particularly in low- and middle-income countries. Variations in healthcare policies and insurance coverage will influence growth trajectories in different regions.

Risks and Mitigation Strategies

Market entrance barriers in certain territories, regulatory delays, and competitive pricing pressures pose risks. To counteract these, strategic investments in R&D, quality assurance, and regional regulatory compliance are essential.

Conclusion

Enulose’s market outlook remains cautiously optimistic, supported by its clinical efficacy, expanding demand from aging populations, and evolving therapeutic applications. The primary growth challenges stem from aggressive generic competition and emerging alternative therapies. Companies that innovate around formulation, explore new indications, and expand into underpenetrated markets are poised to maximize revenue streams and sustain long-term profitability.

Key Takeaways

- Stable Demand Base: Enulose maintains consistent demand in hepatic and gastrointestinal treatment markets due to its proven safety and efficacy.

- Growth Opportunities: Emerging economies and expanding indications present significant growth avenues; strategic expansion and product innovation are key.

- Competitive Landscape: Fragmented with a mix of branded and generic competitors; price sensitivity in emerging markets necessitates cost-effective strategies.

- Regulatory and Supply Chain Risks: Vigilance in regulatory compliance and raw material sourcing is vital for uninterrupted supply.

- Investment Outlook: The lactulose segment’s moderate CAGR, coupled with regional market expansion, indicates promising financial prospects over the medium term.

FAQs

1. What factors influence the pricing strategy of Enulose?

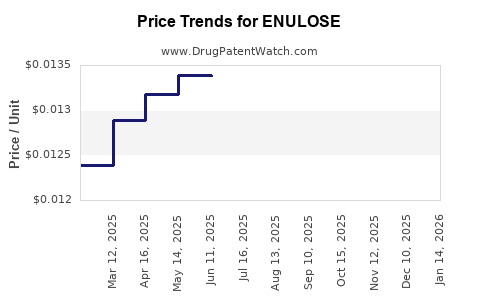

Pricing depends on manufacturing costs, competition from generics, regulatory status, and regional healthcare reimbursement policies. In developed markets, premium pricing sustains margins, whereas in emerging markets, price competition prevails.

2. How will emerging research affect Enulose’s market share?

Innovative research indicating new therapeutic uses can expand Enulose’s market scope, potentially leading to increased sales and new formulation development, strengthening its position.

3. What are the primary regulatory challenges for Enulose in global markets?

Navigating diverse regulatory standards, obtaining approvals for generic formulations, and maintaining consistent quality across markets are key challenges impacting market entry and expansion.

4. How does the aging population impact Enulose’s future demand?

An aging population increases the prevalence of liver disease and constipation, driving sustained demand for Enulose, especially in mature markets with higher healthcare expenditure.

5. What strategic moves can manufacturers adopt to sustain growth in this segment?

Focusing on R&D for improved formulations, exploring new therapeutic indications, forming regional partnerships, and optimizing supply chains are effective strategies for growth sustainability.

References

- World Health Organization. Global Hepatitis Report 2017.

- MarketWatch. "Lactulose Market Size, Share & Trends Analysis," 2022.

- Ferring Pharmaceuticals Annual Report 2022.

- European Medicines Agency. "Regulatory Guidelines for Gastrointestinal Products," 2021.

- IMARC Group. Lactulose Market Outlook 2023-2028.