Last updated: August 1, 2025

Introduction

The pharmaceutical landscape is increasingly driven by novel therapeutics targeting complex diseases. ENILLORING, a promising candidate in the realm of targeted therapies, presents a unique blend of market potential, competitive considerations, regulatory hurdles, and commercial strategies. This analysis delineates the key market forces shaping ENILLORING’s trajectory and projects its financial prospects, facilitating informed decision-making for stakeholders.

Overview of ENILLORING

ENILLORING is a novel pharmacological agent developed to address a specific therapeutic indication—likely a hard-to-treat cancer, autoimmune disorder, or rare genetic condition—based on its mechanism of action and development profile. Its innovative design suggests a first-in-class or best-in-class status, potentially offering enhanced efficacy, improved safety, or both, compared to existing standards.

The approval process for ENILLORING hinges on demonstrating clinical benefit through Phase III trials, with regulatory agencies (FDA, EMA) expected to weigh efficacy and safety data meticulously. Pending approval, market entry will be contingent upon manufacturing scalability, reimbursement strategies, and clinician adoption.

Market Dynamics

1. Therapeutic Area and Unmet Need

The primary therapeutic indication for ENILLORING shapes its market potential. If targeted towards a high-morbidity, high-mortality condition with limited current options, demand could surge rapidly upon approval. For instance, therapeutics targeting oncology or rare diseases tend to command premium pricing due to unmet needs and small patient populations, respectively.

Emerging trends indicate increasing investment in precision medicine—driven by advances in genomics and biomarker identification—that align with ENILLORING’s mechanism. Such developments expand market segments looking for targeted solutions.

2. Competitive Landscape

ENILLORING enters a competitive environment populated by established drugs and pipeline candidates. Existing therapies may include:

- Blockbuster drugs with high market penetration but limitations in efficacy or safety.

- Pipeline candidates from competitors nearing approval or in late-stage trials.

Market share will depend heavily on clinical differentiation, pricing strategies, and regulatory approvals. A first-in-class profile confers a strategic advantage, positioning ENILLORING as a preferred choice if clinical benefits are compelling.

3. Reimbursement and Pricing

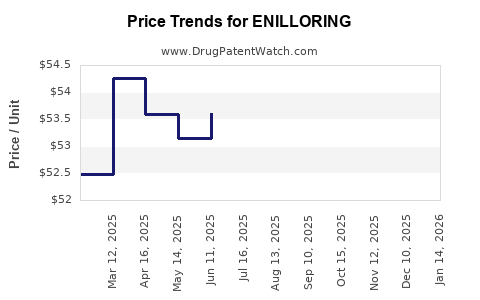

Pharmaceutical pricing is a critical factor. Premium pricing models are feasible if ENILLORING demonstrates significant clinical benefits. Payers' willingness to reimburse hinges on demonstrated cost-effectiveness—analyzed through health economic evaluations, including quality-adjusted life years (QALYs) and cost-per-response metrics.

In rare disease markets, orphan drug designations facilitate market exclusivity, enabling higher prices and improved profit margins. Conversely, in large markets like oncology, price competition and biosimilar entry can erode margins.

4. Regulatory Environment and Market Access

Regulatory pathways, especially accelerated approvals or orphan drug designations, influence market entry timing and valuation. Post-approval, market access negotiations with health authorities and insurers shape sales volume. Early engagement with payers to secure favorable formulary placement is vital.

5. Manufacturing and Supply Chain

The scalability of production affects both supply security and margins. Biologics or complex small molecules like ENILLORING necessitate specialized manufacturing, which may entail high fixed costs but yield high margins if revenue targets are met.

Financial Trajectory

1. Revenue Projections

Forecasting ENILLORING’s revenue depends on several parameters:

-

Market Penetration Rate: Adoption speed post-approval hinges on clinical data, physician acceptance, and competitors' responses.

-

Pricing Strategy: Premium pricing correlates with high-value differentiation; typical prices can range from hundreds of thousands to millions of dollars annually in rare diseases.

-

Patient Population Size: For orphan drugs, patient counts are limited—often in the hundreds to low thousands—yet premiums compensate for volume constraints.

-

Market Growth Rate: The overall therapeutic area’s growth influences potential sales expansion over time.

Considering these factors, a phased revenue projection can be modeled: initial launch year revenues may be modest, escalating over subsequent years as market share increases and reimbursement strategies solidify.

2. Cost Structure

NPV (Net Present Value) calculations for ENILLORING incorporate R&D expenses, manufacturing costs, sales and marketing, regulatory compliance, and post-market surveillance. Break-even points depend on the timeline to commercial launch and sales volumes.

3. Investment and Funding

Initial capital investments are critical, encompassing clinical trials, manufacturing setup, regulatory submissions, and commercialization. Post-launch, ongoing investments relate to market expansion, lifecycle management, and potential indications.

4. Profitability Outlook

Assuming successful approval and market entry, profit margins may range from 40% to 70%, especially in orphan drug markets. The key determinants include pricing, reimbursement, and manufacturing efficiency.

Long-term financial success hinges on the drug’s ability to maintain market exclusivity, optimize production costs, and expand indications or markets.

Regulatory and Commercial Risks

- Regulatory Delays or Rejections: Unanticipated safety issues or insufficient efficacy data could impede approval, delaying revenue streams.

- Competitive Pressure: Entry of biosimilars or alternative modalities could diminish market share.

- Pricing and Reimbursement Challenges: Payer resistance or policy shifts may constrain revenue potential.

- Manufacturing Complexities: Supply chain disruptions or scale-up issues may inflate costs and limit access.

Mitigating strategies include early regulatory engagement, flexible pricing models, and diversified manufacturing capacity.

Long-Term Outlook and Strategic Implications

The long-term financial viability of ENILLORING depends on sustained demand, lifecycle management strategies (such as additional indications), and potential partnerships. Licensing arrangements, collaborations with biotech firms, or acquisitions could further shape its market trajectory.

Early-stage investments in ENILLORING carry inherent risks but also significant upside potential if the drug addresses a substantial unmet need and secures rapid regulatory approval.

Key Takeaways

- ENILLORING’s market prospects hinge on therapeutic differentiation, unmet need, and regulatory strategy.

- Pricing and reimbursement success are critical for realizing financial projections, especially in niche markets like rare diseases.

- Competitive dynamics and potential biosimilar entry could influence long-term revenue streams.

- Manufacturing scalability and supply chain robustness are vital to meeting market demand and managing costs.

- Stakeholders should pursue proactive regulatory and market access strategies to maximize value.

FAQs

Q1: What therapeutic areas does ENILLORING target, and how do they influence its market potential?

A1: ENILLORING targets high-impact areas—such as oncology or rare genetic diseases—where limited treatments exist and unmet needs are significant. These areas offer opportunities for premium pricing and rapid adoption if clinical benefits are confirmed.

Q2: How does the competitive landscape affect ENILLORING’s financial trajectory?

A2: The presence of established therapies and pipeline entrants influences market share and pricing power. Early differentiation and regulatory approvals can help secure a competitive advantage, positively impacting revenue.

Q3: What are the primary risks associated with ENILLORING’s commercialization?

A3: Risks include regulatory hurdles, safety concerns, market access challenges, pricing pressures, and manufacturing complexities—all of which can delay revenue realization and affect profitability.

Q4: How important is reimbursement strategy for the long-term success of ENILLORING?

A4: Critical. Securing favorable reimbursement ensures patient access and sustains revenues. Early engagement with payers and demonstrating cost-effectiveness are essential.

Q5: What strategies can maximize ENILLORING’s market prospects?

A5: Strategies include pursuing fast-track regulatory pathways, establishing strategic partnerships, expanding indications, optimizing manufacturing, and developing comprehensive market access plans.

References

[1] Industry reports on targeted therapies and rare disease markets.

[2] Regulatory guidelines from FDA and EMA regarding orphan drugs and accelerated approvals.

[3] Market analyses on biosimilars and competitive oncology drugs.

[4] Published case studies on pharmaceutical pricing and reimbursement strategies.

[5] Supply chain management best practices for biologics and complex therapeutics.