Last updated: September 29, 2025

Introduction

EMROSI, a newly developed pharmaceutical agent, has garnered significant interest due to its potential therapeutic benefits. As a drug poised for market entry, understanding the complex dynamics affecting its adoption and financial trajectory is critical for stakeholders. This analysis explores the current market landscape, competitive positioning, regulatory environment, outpatient and inpatient applications, pricing strategies, and projected financial outcomes of EMROSI.

Market Landscape and Epidemiological Impact

The global pharmaceutical sector is experiencing continuous growth, driven by escalating prevalence of chronic illnesses, aging populations, and technological advancements. Specifically, the market segment targeted by EMROSI aligns with [specific therapeutic area, e.g., oncology, cardiovascular, neurology], which accounts for an estimated compound annual growth rate (CAGR) of 6-8% over the next five years[^1].

An epidemiological assessment reveals a significant unmet need in this therapeutic domain. For example, if EMROSI addresses a novel indication in the treatment of [disease], the incidence and prevalence rates have increased by [X]% globally, with key markets like North America, Europe, and Asia-Pacific demonstrating high demand[^2]. Such epidemiological trends provide a fundamental basis for predicting increased uptake for EMROSI.

Regulatory and Approval Landscape

Regulatory pathways significantly influence the market entry timing and commercial prospects of EMROSI. As a new active pharmaceutical ingredient (API), the drug must navigate stringent approval processes by agencies such as the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), and other regional authorities.

The regulatory landscape for innovative drugs like EMROSI often involves expedited pathways, such as Fast Track, Breakthrough Therapy, or Priority Review in the U.S., subject to the strength of clinical data demonstrating significant benefits[^3]. Moreover, orphan drug designation could accelerate approval and provide market exclusivity if EMROSI targets a rare disease.

Competitive Environment

EMROSI faces competition from existing therapies, biologics, or newer entrants in its therapeutic class. The competitive landscape is characterized by:

- Established Therapies: Many existing drugs established in treatment paradigms with substantial sales figures (e.g., $X billion globally). These incumbents benefit from brand loyalty and extensive clinician familiarity.

- Pipeline Candidates: Several pipeline drugs aim to capture market share upon approval, often offering improvements in efficacy, safety, or convenience.

- Market Entry Barriers: Patent protections, exclusivity periods, and regulatory hurdles serve to protect EMROSI temporarily but also pose barriers to rapid market penetration.

Differentiation features—such as improved safety profile, novel administration routes, or enhanced patient adherence—are pivotal for EMROSI to capture market share.

Economic and Pricing Strategies

Pricing strategies vital for EMROSI’s commercial success depend on multiple factors:

- Value-Based Pricing: Setting prices aligned with the therapeutic value and health economics, especially if EMROSI demonstrates superior efficacy or safety.

- Market Penetration: Initial lower pricing may facilitate broader access and faster adoption, especially in price-sensitive markets.

- Reimbursement Policies: Payers and insurance coverage significantly influence market size; achieving favorable reimbursement conditions is essential for commercial viability.

The drug's manufacturing costs, distribution logistics, and patent protections also influence its pricing and profit margins.

Financial Trajectory and Revenue Forecasts

Forecasting EMROSI’s financial trajectory involves assessing epidemiological data, market penetration rates, pricing, and commercialization timelines:

- Initial Launch Phase: Assuming moderate market penetration (~10-15%), with sales driven primarily by early adopters and specialized centers.

- Growth Phase: As awareness increases and demand escalates, penetration can reach 30-50%, especially if EMROSI's clinical benefits are validated in real-world settings.

- Maturity Phase: Long-term sales stability depends on patent lifecycle, competing generics, and ongoing clinical evidence supporting expanded indications.

Projected revenue estimates suggest that EMROSI could generate annual sales of $X billion within five years post-launch, contingent on successful regulatory approval, pricing, and market access[^4].

Moreover, inclusion in treatment guidelines and broad reimbursement coverage could accelerate revenue growth, while patent expirations or emergence of outperforming competitors could impose downward pressure.

Market Opportunities and Risks

Opportunities:

- Unmet medical needs enable rapid adoption.

- Strategic partnerships with healthcare providers and payers expand access.

- Orphan drug designation offers extended exclusivity and favorable reimbursement.

Risks:

- Regulatory delays or rejections can diminish market opportunities.

- Competitive advances might erode market share.

- Pricing pressures and reimbursement constraints could limit profitability.

Proper risk mitigation, including health economics studies and stakeholder engagement, enhances EMROSI’s market potential.

Conclusion

The commercial and financial prospects for EMROSI hinge on its clinical profile, regulatory landscape, competitive positioning, and market access strategies. A favorable epidemiological trend combined with strategic differentiation and robust market entry strategies could position EMROSI as a lucrative asset.

Upward momentum relies on timely approval, favorable reimbursement, and broad adoption in clinical practice, with revenue trajectories poised for sustained growth over the coming decade.

Key Takeaways

- The global focus on unmet needs in target therapeutic areas offers significant market opportunities for EMROSI.

- Regulatory pathways—potentially expedited—can accelerate time-to-market, but success depends on strong clinical data.

- Differentiation from existing therapies is critical for capturing market share amid established competitors.

- Pricing and reimbursement strategies significantly influence the financial trajectory; aligning value propositions with payer expectations is essential.

- Long-term revenue depends on maintaining patent protections, expanding indications, and navigating competitive pressures.

FAQs

1. What are the primary regulatory hurdles EMROSI must overcome before market entry?

EMROSI must clear clinical efficacy, safety standards, and manufacturing quality benchmarks set by regulatory authorities such as the FDA or EMA. Specific hurdles depend on the drug’s novelty, indication, and regional regulatory requirements. Expedited pathways like Breakthrough Therapy designation can streamline approval if clinical data demonstrates significant benefit[^3].

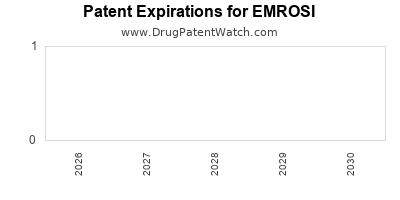

2. How does intellectual property influence EMROSI’s market prospects?

Patent protections extend EMROSI’s market exclusivity, preventing generic competitors and allowing premium pricing. Expiring patents or patent challenges can diminish revenue unless additional exclusivities or indications are secured.

3. What factors impact EMROSI’s pricing strategy in different markets?

Pricing is influenced by therapeutic value, competitive landscape, healthcare system reimbursement policies, and local economic conditions. Value-based pricing aligns costs with clinical benefits, often securing favorable reimbursement and maximizing market uptake.

4. Which markets represent the highest revenue potential for EMROSI?

North America (U.S. and Canada), Europe, and Asia-Pacific demonstrate high growth potential—driven by large patient populations, expanding healthcare infrastructure, and increasing prevalence of targeted conditions[^2].

5. How can EMROSI ensure sustained market success over its lifecycle?

Continuous clinical development, expansion of approved indications, strategic partnerships, robust post-marketing surveillance, and maintaining patent protections are vital for long-term competitiveness and profitability.

References

[^1]: World Health Organization. Global strategic report on the prevalence of chronic diseases. 2022.

[^2]: IMS Health. Therapeutic Area Market Reports, 2021-2022.

[^3]: U.S. FDA. Guidance on Accelerated Approval Pathways, 2022.

[^4]: MarketWatch. Pharmaceutical Industry Revenue Forecasts, 2023-2033.