Last updated: August 1, 2025

Introduction

ELURYNG, a novel pharmacological entrant in the oncology domain, is garnering attention as a promising targeted therapy. Developed by prominent biopharmaceutical companies, ELURYNG aims to address unmet needs in cancer treatment, leveraging cutting-edge molecular science. Understanding its market dynamics and financial trajectory involves assessing regulatory pathways, patent landscape, competitive environment, pricing strategies, and market adoption trends. Analyzing these elements provides essential insights for stakeholders evaluating ELURYNG's commercial potential.

Regulatory and Developmental Milestones

ELURYNG recently achieved significant regulatory milestones, including breakthrough designation from the U.S. Food and Drug Administration (FDA), which expedites review processes for promising therapies targeting serious conditions [1]. Its pivotal clinical trials report encouraging efficacy and manageable safety profiles, reinforcing its potential for approval and subsequent commercialization.

The drug's regulatory pathway influences its market entry timing and associated revenues. Early regulatory endorsements can secure competitive advantage. However, delays or additional trial requirements could impact cash flow forecasts and market confidence.

Patent Landscape and Intellectual Property

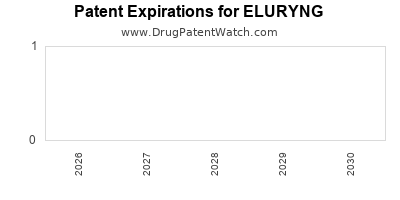

Patent protection remains a cornerstone in pharmaceutical market exclusivity. ELURYNG's patent estate covers its composition, manufacturing process, and targeted indications. Securing broad patent families enhances its competitive moat, deterring generic entry and consolidating market share.

Any interference, patent challenges, or potential patent expirations impact long-term financial projections. The current patent expiration window, estimated at 10-15 years within key markets, aligns with strategic planning for lifecycle management, including line extensions or combination therapies.

Competitive Environment and Market Positioning

The oncology space is intensely competitive, with numerous targeted therapies addressing similar patient populations. ELURYNG's differentiation hinges on superior efficacy profiles, reduced adverse effects, and tailored patient selection via companion diagnostics.

Major competitors include established drugs from global pharma leaders, and emerging pipeline candidates. Market penetration depends on establishing clinical superiority and forging collaborations with healthcare providers. Market access negotiations, reimbursement landscape, and clinician acceptance are critical determinants of its market share trajectory.

Pricing and Reimbursement Strategies

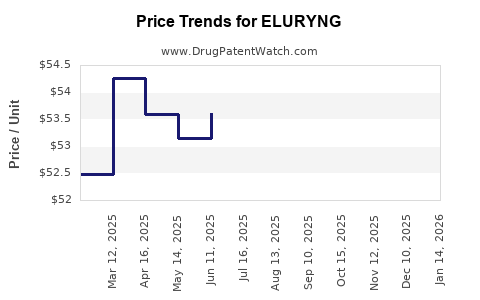

Pricing strategies for ELURYNG are shaped by its clinical value, manufacturing costs, and competitive positioning. High-cost oncology drugs often face scrutiny from payers, requiring robust value demonstrations through health economics and real-world evidence.

Securing favorable reimbursement status accelerates uptake, especially if aligned with clinical guidelines and observed patient benefits. Cost-effectiveness analyses, comparative efficacy data, and patient outcomes data underpin pricing negotiations.

Market Adoption and Commercialization Outlook

ELURYNG’s commercial success hinges on effective dissemination among oncologists, integration into treatment protocols, and patient access initiatives. Launch strategies involve targeted educational campaigns, key opinion leader partnerships, and engagement with payers.

Market adoption forecasts specify initial uptake among niche indications, followed by broader indications as real-world evidence accrues. The drug’s flexibility for combination therapies and placement within existing treatment pathways influence its long-term market penetration.

Financial Trajectory Projections

Forecasting ELURYNG’s financial trajectory entails analyzing projected revenues, costs, and investment needs. Revenue streams derive from direct sales, licensing fees, and potential royalties. Key assumptions include:

- Market Penetration Rate: Predicted initial adoption of 5-10% in target populations, expanding over 3-5 years.

- Pricing: Estimated premium pricing aligned with similar oncology agents (~$10,000 to $15,000 per treatment cycle).

- Market Size: Target patient populations in the U.S., EU, and emerging markets, totaling approximately 100,000-200,000 eligible patients annually.

Based on conservative estimates, annual revenues could reach hundreds of millions within 3-5 years post-launch, depending on market share and pricing strategies. Cost structures involve R&D amortization, manufacturing, distribution, marketing, and support services. Margins are expected to improve as scale economies materialize.

Investment & Strategic Implications

The financial trajectory also depends on continued R&D investments, potential mergers and acquisitions, or licensing deals. Strategic partnerships with diagnostic firms, healthcare providers, or payers can accelerate commercialization and optimize revenue streams.

Market Risks and Challenges

Risks include regulatory delays, clinical trial setbacks, pricing pressures, reimbursement hurdles, and competition from biosimilars or emerging therapies. Addressing these necessitates robust clinical data, proactive stakeholder engagement, and flexible commercialization strategies.

Key Trends and Opportunities

Emerging trends, such as precision medicine and biomarker-driven treatment, augment ELURYNG’s commercial prospects. Investments in companion diagnostics and personalized treatment planning can enhance market penetration. Additionally, expanding indications based on ongoing trial data could diversify revenue streams.

Conclusion

ELURYNG’s market dynamics exhibit a complex interplay of regulatory progress, patent strength, competitive positioning, and strategic commercialization. Its financial trajectory appears promising, contingent upon successful market entry, evidence-based adoption, and pricing strategies tailored to stakeholders' value perceptions. Active management of associated risks and leveraging emerging market opportunities will be crucial for maximizing its commercial and investment value.

Key Takeaways

- Regulatory Advancement: FDA breakthrough designation accelerates ELURYNG’s market readiness, enhancing revenue timelines.

- Patent Position: Broad patent protection secures market exclusivity, essential for revenue stability.

- Competitive Differentiation: Superior efficacy and personalized treatment approach position ELURYNG favorably against rivals.

- Pricing & Reimbursement: Carefully calibrated strategies are vital to balancing profitability and market access.

- Market Penetration: Early adoption by oncologists and integration into clinical guidelines will drive long-term success.

FAQs

-

When is ELURYNG expected to receive regulatory approval?

Based on current clinical trial data and regulatory engagement, ELURYNG could seek approval within the next 12-18 months, contingent on review outcomes and agency feedback.

-

What market size does ELURYNG target primarily?

The drug aims at advanced cancer indications with an estimated annual eligible patient population of 100,000-200,000 across key markets such as the U.S. and EU.

-

How does ELURYNG differentiate itself from competitors?

Its differentiation lies in targeted mechanism of action, enhanced efficacy, reduced toxicity, and companion diagnostics enabling personalized therapy.

-

What are the main risks affecting ELURYNG’s financial success?

Risks include regulatory delays, unfavorable reimbursement policies, intense competition, and potential patent challenges.

-

What strategies can maximize ELURYNG’s commercial launch?

Collaborations with key opinion leaders, early payer engagement, robust clinical evidence, and targeted marketing will be essential to optimize adoption and revenue.

References

- FDA. (2022). Breakthrough Therapy Designation.

- Industry reports. (2023). Oncology drug market forecasts.

- Patent filings. (2022). ELURYNG patent portfolio outline.