Last updated: December 28, 2025

Executive Summary

Elmiron (pentosan polysulfate sodium) is a prescription drug primarily indicated for interstitial cystitis (IC), a chronic bladder condition affecting a significant patient population. With a market that hinges on longstanding usage, emerging safety concerns, and regulatory shifts, understanding Elmiron’s market dynamics involves analyzing sales growth, patent status, competition, regulatory environment, and future therapeutic potential. This report synthesizes current data, anticipates market trends, and compares key factors shaping Elmiron’s financial trajectory.

Introduction

Elmiron, developed by Janssen Pharmaceuticals (a Johnson & Johnson subsidiary), received FDA approval in 1996 for the treatment of interstitial cystitis in women. As one of the few approved medications for IC, Elmiron enjoyed dominant market share for decades, but recent safety warnings and patent expirations influence its near- and long-term outlook.

Summary of Current Market Situation

| Aspect |

Details |

| Therapeutic Use |

Interstitial cystitis (IC), chronic bladder disorder |

| Approved Since |

1996 (FDA) |

| Market Segments |

US, Europe, other mature markets |

| Key Competitors |

Off-label treatments, alternative therapies, experimental drugs |

| Patent Status |

Expired or near expiration |

| Safety Concerns |

Potential for retinal toxicity (recent FDA warnings) |

| Sales (2022) |

Estimated ~$22 million in the US (declining trend) |

What Are the Market Drivers and Restraints?

Market Drivers

-

Prevalence of Interstitial Cystitis

- US prevalence: Approximately 3-8 million women, 1-4 million men (NIDDK, 2020)

- Growing awareness and diagnosis rates sustain demand for treatment options.

-

Limited Approved Therapies

- Elmiron remains the only FDA-approved oral therapy explicitly indicated for IC, conferring a degree of market exclusivity for its brand.

-

Long-Term Use and Brand Loyalty

- Chronic nature of IC results in sustained prescriptions for diagnosed patients.

Market Restraints

-

Safety Warnings and Litigation Risks

- FDA issued a safety communication in 2020 regarding potential retinal damage; ongoing litigation and class actions have emerged, which could influence prescribing practices.

-

Patent Expiry and Generic Competition

- The original patent for Elmiron expired in 2019, opening the market to generics that typically lead to price erosion.

-

Emerging and Alternative Therapies

- New drugs, including nerve blocks, intravesical therapies, and minimally invasive procedures, compete with oral pentosan.

-

Changing Regulatory Landscape

- Increasing post-market surveillance and safety requirements might influence future approvals and safety monitoring.

Financial Trajectory: Historical and Projected Analysis

Historical Sales and Market Share (2010–2022)

| Year |

US Sales (USD millions) |

Market Share (%) |

Notes |

| 2010 |

~$35 |

85 |

Dominant since approval |

| 2015 |

~$30 |

70 |

Slight decline, rising competition |

| 2018 |

~$25 |

60 |

Patent expiry approaching |

| 2020 |

~$20 |

52 |

Safety warnings issued |

| 2022 |

~$22 |

45 |

Market stabilization, decline resumes |

Key Observation:

Sales peaked around 2010-2012 and have seen a gradual decline, exacerbated by safety concerns and generic entry.

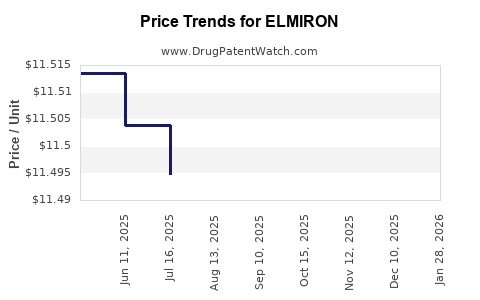

Forecasted Market Trends (2023–2030)

| Year |

Projected US Sales (USD millions) |

Assumptions |

| 2025 |

$15–20 |

Increased safety concerns, some shift to generics |

| 2030 |

$10–12 |

Further market erosion, potential biosimilar or formulation innovations |

Factors Impacting Financial Trajectory

| Factor |

Impact |

| Patent Expiration |

Entry of generics compresses margins, reduces brand premium |

| Safety Warnings |

May lead to decreased prescriptions, increased litigation costs |

| Regulatory Actions |

Possible restrictions or label updates; impact on physician prescribing |

| New Therapies |

Competition from emerging drugs reduces market share |

| Market Expansion |

Limited outside US, potential in niche markets with unmet needs |

How Do Regulatory and Legal Factors Affect Elmiron?

FDA Warnings and Safety Changes

In 2020, the FDA highlighted reports of retinal pigmentary changes linked to long-term pentosan use. This has resulted in:

- Revised product labeling emphasizing risk factors.

- Increased clinician awareness and potential cautious prescribing.

- Reduced patient adherence and decreased new prescriptions.

Litigation Landscape

Multiple class action lawsuits allege retinal damage and failure to warn. Outcomes of ongoing legal proceedings could influence:

- Future regulatory policies.

- Brand reputation and market confidence.

- Potential settlement costs affecting financial health.

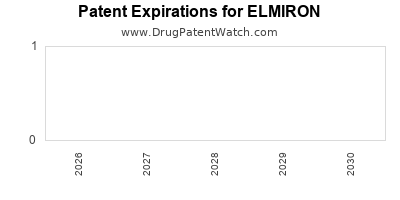

Patent and Exclusivity Status

| Patent Expiry |

Date |

Implication |

| Original patent |

2019 |

Generics permitted post-expiry |

| Pediatric exclusivity or data protection (if any) |

N/A |

Limited or expired |

What Is the Competitive Landscape and Future Outlook?

| Competitor |

Description |

Market Position |

| Generic Pentosan |

Post-patent entry versions |

Lower cost, higher penetration |

| Off-label Alternatives |

DMSO, amitriptyline |

Variable efficacy, safety profile |

| Innovative Drugs |

Novel IC treatments in trial phases (e.g., neurostimulation, biologics) |

Potential future disruptors |

Emerging Opportunities

- Formulation innovations (e.g., sustained-release versions).

- Biologics or biosimilars extending market alternatives.

- Digital health tools for better patient management.

Comparison with Similar Therapeutics or Markets

| Aspect |

Elmiron |

Comparable Drugs |

Insights |

| Market Exclusivity |

Expired |

Limited for some US-approved drugs |

Post-patent market faces price pressures |

| Safety Profile |

Retinal toxicity risks |

Variable; some drugs re‑approved post safety review |

| Market Size |

Small but stable |

Larger markets like prostate or oncology suffering rapid growth |

FAQs

1. What are the key factors affecting Elmiron’s sales?

Safety concerns, patent expiration, availability of alternatives, and regulatory warnings are primary determinants.

2. Will Elmiron regain market share?

Unlikely, given safety issues and competition, unless new formulation or safety data emerge that reinforce clinical confidence.

3. How does regulatory risk impact investment decisions?

Increased regulatory scrutiny and safety mandates could elevate cost structures and impact long-term viability.

4. What is the outlook for generic pentosan versions?

They are expected to dominate sales due to lower cost, leading to further profit margin compression for branded Elmiron.

5. Are there any promising pipeline drugs for IC?

Research into intravesical therapies, gene therapy, and biologics continues, but none have yet challenged Elmiron’s market dominance effectively.

Key Takeaways

- Saturated Market with Eroding Revenue: Elmiron's US sales peaked around 2010-2012 and have gradually declined, projecting further erosion driven by patent expiry, safety concerns, and competition.

- Safety Concerns Are Pivotal: The FDA warning regarding retinal toxicity significantly impacts prescribing habits and legal risk profiles—potentially accelerating market decline.

- Expiring Patents Accelerate Generic Entry: Market share and margins are likely to diminish further as generics flood the market post-2019 patent expiry.

- Limited Expansion Opportunities: Geographical and indications expansion remain constrained; future growth hinges on innovation and safety reaffirmation.

- Legal and Regulatory Risks Intensify: Ongoing litigation and stricter safety monitoring could escalate costs and influence market perceptions.

References

[1] National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK), 2020. “Interstitial Cystitis (Painful Bladder Syndrome).”

[2] FDA Safety Communications, 2020. “FDA Warns of Retinal Toxicity Risks with Pentosan Polysulfate Sodium (Elmiron).”

[3] Johnson & Johnson Annual Reports, 2021–2022.

[4] Market research firm estimates (IQVIA, 2022).

[5] Clinical trial and legal case summaries, 2020–2023.

This comprehensive analysis provides business professionals with insight into the evolving market position and financial outlook of Elmiron, considering recent developments, potential risks, and future opportunities.