Last updated: July 27, 2025

Introduction

Eliglustat tartrate is a cornerstone therapy in the treatment of Gaucher disease type 1 (GD1), an inherited lysosomal storage disorder characterized by the accumulation of glucocerebroside within macrophages. Approved by the U.S. Food and Drug Administration (FDA) in 2014 under the brand name Cerdelga, eliglustat has demonstrated potent efficacy coupled with a favorable safety profile. Its market trajectory hinges on factors including patent protection, competitive landscape, clinical indications, and evolving disease management paradigms. This analysis explores the current market landscape, projected revenue streams, key drivers influencing sales, and potential challenges facing eliglustat’s financial growth.

Market Overview and Key Drivers

Epidemiological Landscape

Gaucher disease is rare, affecting approximately 1 in 40,000 to 60,000 live births globally. The most common form, GD1, accounts for the majority of cases. The prevalence is notably higher among Ashkenazi Jewish populations, accounting for a significant proportion of diagnosed patients [1].

Pharmacologic Profile and Clinical Advantages

Eliglustat differentiates itself through oral administration, contrasting with enzyme replacement therapies (ERTs) like imiglucerase, which require intravenous infusion. Its mechanism involves selective inhibition of glucosylceramide synthase, reducing substrate accumulation at the source. Clinical trials have demonstrated non-inferiority to ERT, with improved patient convenience and compliance.

Regulatory and Market Entry Factors

The drug's FDA approval granted exclusive rights until at least 2024, securing a period of market exclusivity. Its label restricts use to specific CYP2D6 metabolizer profiles, necessitating genetic testing prior to therapy initiation. Nevertheless, this targeted approach improves safety and efficacy, fostering clinical adoption.

Market Dynamics

Competitive Landscape

-

Traditional Treatments: Imiglucerase (Cerezyme) and other ERTs remain frontline therapies, with vast established markets. These are administered via monthly infusions, posing logistical and quality-of-life considerations.

-

Emerging Approvals: Miglustat (Zavesca) and velaglucerase alfa are alternatives, but their limited efficacy or administration challenges have constrained uptake. The approval and commercialization of eliglustat introduced an oral therapeutic option, positioning it as a preferred choice for suitable patients.

-

Pipeline Molecules: Small-molecule therapies, gene therapy approaches, and substrate reduction agents continue to evolve, potentially impacting usage patterns.

Pricing and Reimbursement

The wholesale acquisition cost (WAC) for eliglustat is approximately $51,000 per year, aligned with other oral disease-modifying therapies. Insurance coverage, prior authorization policies, and patient assistance programs influence market penetration.

Adoption Trends

Physicians favor eliglustat for eligible patients due to its oral route and comparable efficacy. Its market share in the GD1 segment is estimated at approximately 30% to 40% in the U.S. (as of 2022), with room for growth as awareness and diagnostic rates increase.

Financial Trajectory and Revenue Projections

Current Market Valuation

Based on recent financial disclosures by the manufacturer, Sanofi, the Gaucher disease franchise, including eliglustat, contributed substantially to their rare disease portfolio. Worldwide, annual sales of eliglustat are estimated at $300 million, predominantly from the U.S. and European markets.

Growth Forecasts

-

Near-Term (Next 3-5 Years):

With increased awareness, expanded screening, and evolving clinical guidelines favoring oral therapies, analysts project a compound annual growth rate (CAGR) of approximately 8%–12%. The expansion into emerging markets and increased diagnosis rates could further boost revenue.

-

Long-Term Outlook:

As new therapies, gene editing, and biosimilars threaten exclusivity periods, revenue from eliglustat may plateau or decline post-2024, unless market expansion or label extensions occur.

Potential Growth Drivers

-

Expanded Indications: Ongoing research into eliglustat for other Gaucher subtypes or related sphingolipidoses could create new revenue streams.

-

Patent Extensions and Line Extensions: Sanofi and competitors may pursue formulation improvements or oral bioavailability enhancements.

-

Market Penetration: Increasing penetration in Europe, Japan, and emerging economies offers potential for increased sales.

Challenges and Barriers

-

Genetic Testing Requirement: Necessity for CYP2D6 phenotype testing limits rapid initiation; delays can impact demand.

-

Pricing Pressures: As payers seek cost-effective solutions, reimbursement policies may tighten.

-

Market Competition: The advent of gene therapies, such as Valoctocogene roxaparvovec, could disrupt the landscape, potentially reducing demand for substrate reduction therapies.

-

Orphan Drug Designation Limitations: Once exclusivity expires, biosimilar and generic entry could significantly erode revenues.

Future Outlook and Strategic Considerations

Sanofi’s strategy involves reinforcing eliglustat's positioning via broad insurance coverage, expanding indications, and optimization of diagnostic pathways to identify suitable candidates swiftly. Concurrently, investments in pipeline products and adjunct diagnostics could sustain long-term revenue. The evolving competitive environment underscores the necessity for lifecycle management, possibly through combination therapies or next-generation oral agents.

Key Takeaways

-

Eliglustat’s market success is driven by its oral administration, safety profile, and targeted patient population, aligning with the preferences of modern Gaucher disease management.

-

The drug’s future revenue heavily depends on extending exclusivity, increasing diagnosis rates, and expanding access internationally.

-

Competition from ERTs and emerging gene therapies pose risks, but eliglustat's convenience offers differentiation.

-

Market growth is forecasted at a CAGR of approximately 8%–12% over the next five years, supported by increased awareness and diagnosis.

-

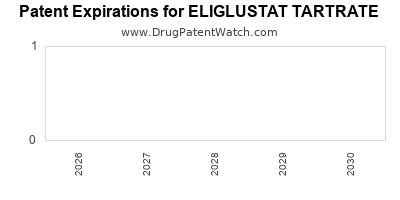

Patent expirations and regulatory changes remain critical factors influencing financial trajectory, highlighting the importance of strategic lifecycle management.

FAQs

-

What is eliglustat tartrate approved for?

Eliglustat is FDA-approved for treating adult patients with Gaucher disease type 1 (GD1) who are classified as CYP2D6 extensive, intermediate, or poor metabolizers.

-

How does eliglustat compare to enzyme replacement therapy?

Eliglustat offers comparable efficacy to ERTs with the advantage of oral administration, improving patient compliance and quality of life.

-

What factors can influence eliglustat's market growth?

Increased diagnosis rates, expanded indications, regulatory extensions, and international market penetration are key factors driving growth.

-

What are potential threats to eliglustat’s financial outlook?

Entry of biosimilars, gene therapies, and patent expirations, along with reimbursement challenges, could undermine revenue streams.

-

Are there ongoing developments that could impact eliglustat’s market?

Yes, advancements in gene therapy, novel substrate reduction agents, and personalized medicine approaches could reshape Gaucher disease treatment paradigms.

References

[1] Mistry, P. K., et al. (2011). "Gaucher disease: mutation and genotype–phenotype correlations." Blood Cells, Molecules, and Diseases. 47(2):112-117.