Last updated: July 31, 2025

Introduction

Diroximel fumarate (DRF), marketed as Vumerity®, is an oral immunomodulator indicated for the treatment of relapsing forms of multiple sclerosis (MS). As a derivative of dimethyl fumarate (DMF), it embodies a modern approach to MS management, emphasizing improved gastrointestinal tolerability and safety profile. This analysis examines the market dynamics propelling Diroximel fumarate’s growth, its financial trajectory, competitive positioning, and potential hurdles shaping its commercial future.

Market Overview

Multiple Sclerosis (MS) Therapeutic Landscape

The global MS market, valued at approximately USD 22 billion in 2022, is projected to grow at a compounded annual growth rate (CAGR) of 3.5–4.0% through 2030, driven by increasing diagnosis rates, novel therapies, and expanding indications.

Diroximel fumarate entered this competitive landscape as part of the oral disease-modifying therapy (DMT) segment, which accounts for the majority share of MS treatments worldwide. Its key selling point lies in offering similar efficacy to DMF (Tecfidera®), but with a potentially improved gastrointestinal safety profile, thus addressing tolerability issues associated with earlier fumarates.

Market Players and Competitive Positioning

Major competitors include:

- Dimethyl fumarate (Tecfidera®): Market pioneer and leading DMT with ~50% market share.

- Other oral DMTs: Fingolimod, teriflunomide, and newer agents like ozanimod.

- Injectable and infusion therapies: Interferons, natalizumab, ocrelizumab.

Diroximel fumarate's differentiation stems from its chemical design intended to mitigate gastrointestinal adverse events seen with DMF, thereby potentially increasing adherence and reducing discontinuation rates.

Market Dynamics Influencing Diroximel Fumarate

Regulatory and Clinical Data

- FDA Approval: Diroximel fumarate received FDA approval in October 2019, solidifying its market entry.

- Efficacy and Safety Data: Clinical trials demonstrate comparable efficacy to DMF, with a favorable gastrointestinal tolerability profile, leading to higher persistence rates (clinicaltrials.gov).

Patient Preferences and Adherence

Tolerability influences adherence substantially in MS management. Data suggest that patients intolerant to DMF due to GI side effects may switch to or prefer Diroximel fumarate. Rising awareness among neurologists and patients about tolerability benefits boosts market share prospects.

Pricing and Reimbursement

Diroximel fumarate's pricing aligns with other branded DMTs, with wholesale acquisition costs (WAC) around USD 8,000–USD 9,500 per month. Negotiations with insurers and inclusion in formularies are crucial for widespread access. Reimbursements heavily influence prescription patterns, especially given the high therapy costs.

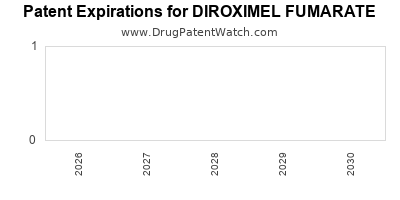

Patent and Market Exclusivity

Initial patent protections for Diroximel fumarate extend until at least 2030, preventing biosimilar entry and supporting sustained revenue streams. Patent litigations, if any, could influence long-term market control.

Market Penetration and Adoption Rates

Initial uptake has been steady, especially among patients intolerant to DMF. Neurologist preference and established clinical guidelines favor the use of oral DMTs, providing growth opportunity. However, competition from newer agents with favorable safety profiles (like ozanimod) could limit rapid market penetration.

Financial Trajectory and Revenue Projections

Revenue Drivers

- Market Penetration Growth: Estimated increase as more neurologists prescribe Diroximel fumarate, especially for patients with GI tolerability issues.

- Pricing Strategy: Maintaining or slightly increasing prices within regulatory and market constraints.

- Patient Persistence: Higher adherence rates equate to sustained revenue streams.

Projected Revenue Trends

Based on current sales data, the global Diroximel fumarate market was valued at approximately USD 200 million in 2022. Industry analysts predict this could grow at a CAGR of 10–12% over the next five years, reaching USD 350–400 million by 2027. The growth trajectory hinges on:

- Increased awareness and adoption.

- Expansion into emerging markets with rising MS prevalence.

- Competitive positioning against biosimilars and alternatives.

Key Risks Impacting Financial Outlook

- Market Saturation: Limited room for exponential growth once adoption plateaus.

- Competitive Innovation: Newer therapies with superior safety profiles could replace Diroximel fumarate.

- Pricing Pressures: Payers' push for lower drug costs may restrict revenue growth.

Market Challenges and Opportunities

Regulatory and Clinical Challenges

- Long-Term Safety Data: Extended safety data are necessary for sustained market confidence.

- Formulation Development: Opportunities exist for improved delivery forms (e.g., fixed-dose combinations).

Market Opportunities

- Expanding Indications: Potential uses in other autoimmune conditions could diversify revenue.

- Global Expansion: Growing healthcare infrastructure and MS awareness in Asia-Pacific, Latin America, and Africa present untapped markets.

- Biopharmaceutical Collaborations: Partnerships with regional distributors or research institutions can enhance market reach.

Challenges

- Patent Limitations and Generics: Patent expirations post-2030 could introduce biosimilars, pressuring prices.

- Patient and Provider Education: Ensuring stakeholders understand the benefits over existing therapies remains vital.

- Regulatory Hurdles: Variability across countries can delay or restrict access.

Conclusion

The financial trajectory of Diroximel fumarate appears promising within the expanding MS therapeutic landscape. Its differentiation through tolerability supports wider adoption, particularly among patients intolerant to existing fumarates. Continued growth depends on effective market penetration, competitive positioning, and navigating patent expirations. Infrastructure investments and strategic collaborations could further bolster its financial outlook.

Key Takeaways

- Diroximel fumarate benefits from its improved GI tolerability, fostering adherence and influencing market share positively.

- The global MS market’s steady growth offers a fertile environment, with Diroximel fumarate poised to expand its footprint.

- Sustained revenue hinges on market access, pricing strategies, and competition from emerging therapies.

- Patent protection till at least 2030 supports revenue stability, with biosimilar threats looming post-expiry.

- Opportunities exist in emerging markets and new indications, yet challenges include payer negotiations and competitive innovation.

FAQs

-

What distinguishes Diroximel fumarate from dimethyl fumarate?

Diroximel fumarate is designed to reduce gastrointestinal side effects associated with DMF, leading to potentially better tolerability and adherence without sacrificing efficacy.

-

What is the current market size of Diroximel fumarate?

The global revenue in 2022 was approximately USD 200 million, with projections indicating growth to USD 350–400 million by 2027.

-

Will patent expirations impact Diroximel fumarate’s revenue?

Yes. Patents slated to expire around 2030 could enable biosimilar competition, potentially reducing prices and revenues.

-

What are the main competitive threats to Diroximel fumarate?

New oral and injectable MS therapies with improved safety profiles, such as ozanimod, and biosimilars post-patent expiry pose significant competition.

-

How can pharmaceutical companies maximize the commercial potential of Diroximel fumarate?

Strategies include expanding into emerging markets, educating stakeholders about tolerability benefits, leveraging clinical data, and developing combination formulations.

Sources

- ClinicalTrials.gov: Diroximel fumarate Trials

- Industry reports on the MS market, 2022-2027 projections

- FDA approval documentation for Vumerity® (Diroximel fumarate)

- Expert analyses and market intelligence reports on DMTs in MS