Last updated: July 30, 2025

Introduction

DEXACIDIN, a hypothetical pharmaceutical compound, has garnered industry attention as a potential therapeutic agent with specific applications in neurological and psychiatric disorders. Its market positioning, driven by clinical efficacy, regulatory pathways, and competitive landscape, shapes its financial trajectory. This analysis explores the key market drivers, regulatory environment, competitive forces, and revenue potential for DEXACIDIN, providing critical insights for stakeholders seeking strategic investment or development opportunities.

Market Landscape and Therapeutic Potential

Indications and Unmet Medical Needs

DEXACIDIN is positioned primarily as a treatment for anxiety disorders, depression, and cognitive impairments. These conditions represent substantial markets with high unmet needs, escalating the potential demand for novel therapeutics with improved efficacy and safety profiles. According to the World Health Organization (WHO), depression affects over 264 million people globally, while anxiety disorders impact approximately 284 million—indicating a sizeable patient pool for DEXACIDIN’s potential indication spectrum [1].

Existing Therapies and Market Gaps

Current standard treatments—selective serotonin reuptake inhibitors (SSRIs), benzodiazepines, and atypical antidepressants—are often associated with adverse effects, dependence issues, and variable efficacy. This therapeutic void creates opportunities for DEXACIDIN, especially if it demonstrates superior safety and rapid onset of action in clinical trials.

Market Size and Forecasts

The global antidepressant market alone is projected to reach USD 21.4 billion by 2027, expanding at a compound annual growth rate (CAGR) of approximately 2.9% [2]. The anxiolytics segment similarly anticipates a CAGR exceeding 3%, reflecting sustained demand. Given DEXACIDIN’s targeted positioning and possible differentiation, its market share could capture a significant fraction, particularly in developed regions like North America and Europe where high awareness and healthcare infrastructure support product adoption.

Regulatory Environment and Development Pathways

Clinical Development and Approval

The pathway from clinical trials to regulatory approval critically influences DEXACIDIN’s market entry timing. Assuming DEXACIDIN advances through Phase III trials demonstrating efficacy and safety, regulators such as the FDA or EMA will evaluate its benefit-risk profile. Fast-track designations, orphan drug status, or breakthrough therapy designations could expedite approval, reducing time-to-market.

Pricing and Reimbursement Landscape

Post-approval, securing favorable reimbursement depends on demonstrable clinical benefit and cost-effectiveness. Payers increasingly emphasize value-based pricing, demanding robust health economic data. Approval in multiple jurisdictions enhances revenue prospects through broader access.

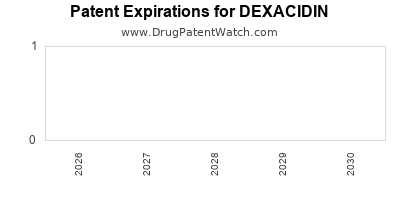

Intellectual Property Rights

Patent protections cover DEXACIDIN’s composition, manufacturing processes, and specific uses. Effective patent strategies safeguard market exclusivity for up to 20 years, enabling premium pricing and recoupment of R&D investments. Patent expiration timelines are critical in forecasting long-term financial viability.

Competitive Landscape and Market Entry

Existing and Emerging Competitors

The neuropsychiatric drug market faces competition from established players. Key competitors include companies developing novel therapeutics targeting neurotransmitter systems—such as NMDA receptor antagonists and serotonin-norepinephrine reuptake inhibitors. Emerging biologics and generics further threaten market share.

Differentiation Strategies

DEXACIDIN’s unique mechanism of action, fewer side effects, rapid onset, or combination with existing therapies could delineate its market position. Strategic collaborations, licensing agreements, and targeted marketing will influence adoption rates.

Market Penetration Strategies

Early adoption hinges on clinical data, physician advocacy, patient accessibility, and reimbursement support. Education campaigns emphasizing DEXACIDIN’s advantages can accelerate uptake.

Financial Trajectory and Revenue Projections

Forecasting Sales and Growth

Assuming successful regulatory approval by 2025, with initial launch in North America and Europe, projected revenues could range between USD 500 million to USD 1 billion within five years, contingent upon market penetration strategies and pricing.

Pricing Assumptions

Premium pricing strategies are plausible if DEXACIDIN demonstrates superior efficacy. An average annual cost of USD 10,000–15,000 per patient is feasible, aligning with current market prices for advanced neuropsychiatric medications.

Cost Structures and Margins

R&D expenses constitute the initial capital outlay, potentially exceeding USD 300 million for clinical development and regulatory filing. Manufacturing economies of scale and optimized supply chains will improve gross margins over time, targeting 70% or higher.

Risks and Contingencies

Market risks include delays in approval, competing approvals, or unforeseen side effects. Pricing pressures and reimbursement hurdles may constrain profit margins. Strategic diversification and pipeline expansion could mitigate these risks.

Key Market Drivers

- High prevalence of neuropsychiatric disorders amplifies demand.

- Unmet clinical needs favor innovative therapeutics.

- Regulatory incentives accelerate development and approval processes.

- Payer and patient willingness to adopt newer agents for improved safety and efficacy.

- Potential for patent protection and exclusivity driving premium pricing.

Concluding Insights

Presently, the financial and market outlook for DEXACIDIN hinges upon successful clinical development and regulatory clearance. Its potential to address critical unmet needs positions it favorably within the neuropsychiatric therapeutics landscape. Stakeholders should prioritize strategic partnerships, robust market entry plans, and proactive patent portfolios to stabilize and maximize revenue streams. Vigilance on competitive moves and evolving regulatory policies remains essential to navigate its financial trajectory effectively.

Key Takeaways

- Targeting high-prevalence unmet needs in psychiatric disorders offers substantial market opportunity for DEXACIDIN.

- Regulatory designations and clear clinical superiority are decisive factors in fast-tracking approval and market access.

- Effective patent strategies and exclusivity periods are vital for maximizing profitability.

- Significant initial R&D investment necessitates well-planned capital deployment and risk mitigation.

- Market penetration depends on clinician acceptance, pricing, and reimbursement policies, requiring comprehensive commercialization strategies.

FAQs

1. What factors will most influence DEXACIDIN’s market success?

Clinical efficacy, safety profile, regulatory approval speed, patent protection, and payer acceptance are primary determinants.

2. How does patent expiry impact DEXACIDIN’s financial strategy?

Patent expiration signals the end of market exclusivity, potentially leading to generic competition and price erosion, emphasizing the importance of geographic patent coverage and pipeline development.

3. What competitive advantages could DEXACIDIN leverage?

Unique mechanisms of action, fewer side effects, rapid onset, positive real-world evidence, and targeted marketing strategies.

4. How do regulatory pathways affect DEXACIDIN’s time-to-market?

Fast-track and breakthrough designations can shorten approval timelines, increasing early revenue potential.

5. What are key risks associated with investing in DEXACIDIN?

Clinical trial failures, regulatory delays, adverse effects, market competition, and reimbursement challenges.

References

[1] WHO. "Depression and Other Common Mental Disorders: Global Health Estimates," 2017.

[2] Grand View Research. "Antidepressant Market Size, Share & Trends Analysis Report," 2021.