Last updated: August 3, 2025

Introduction

CYSTARAN (mitomycin C) is an established chemotherapeutic agent predominantly utilized for its antineoplastic properties, notably in treating superficial bladder cancer. Its market trajectory, driven by evolving clinical practices, regulatory landscapes, and healthcare economics, presents a complex landscape. Analyzing current market dynamics and projecting future financial trajectories requires a detailed understanding of its therapeutic profile, competitive environment, manufacturing factors, and potential innovation pathways.

Overview of CYSTARAN

CYSTARAN’s active ingredient, mitomycin C, is an antitumor antibiotic derived from Streptomyces caespitosus. It functions by crosslinking DNA, thereby inhibiting DNA synthesis and inducing apoptosis in rapidly dividing cells. Originally approved in the 1970s, CYSTARAN remains integral in intravesical therapy for non-muscle invasive bladder cancer (NMIBC), particularly in patients unresponsive to Bacillus Calmette-Guérin (BCG) therapy.

Despite its age, CYSTARAN has maintained clinical relevance due to its efficacy, low systemic toxicity in localized applications, and established administration protocols. Nonetheless, newer agents and delivery systems are gradually gaining ground, influencing its market dynamics.

Market Drivers

Clinical Efficacy and Therapeutic Positioning

CYSTARAN’s primary indication, intravesical therapy for bladder cancer, seeps into markets characterized by high recurrence rates; approximately 70% of NMIBC patients experience recurrences within five years, necessitating ongoing treatment options [1].

Clinical data affirm mitomycin C's effectiveness in reducing recurrence rates, particularly when employed as an adjunct or alternative to BCG. Its minimal systemic toxicity makes it appealing in patients with contraindications to immunotherapy.

Regulatory and Reimbursement Frameworks

Regulatory approval remains stable in various regions, with FDA approval for intravesical use. However, in some countries, CYSTARAN’s commercialization depends on local regulatory pathways, impacting market access.

Reimbursement policies influence adoption rates. In regions with comprehensive reimbursement strategies for intravesical therapies, CYSTARAN's utilization is sustained, especially in public healthcare systems.

Manufacturing and Supply Chain Factors

The manufacturing of mitomycin C involves complex fermentation and purification processes. Numerous generic manufacturers produce it, fostering competitive pricing and supply stability. However, supply chain disruptions, especially during global events like the COVID-19 pandemic, could temporarily impact availability.

Competitive Landscape

While CYSTARAN remains a frontline agent, emerging therapies—including BCG variants, chemohyperthermia techniques, and novel immunotherapies—are reshaping the bladder cancer treatment paradigm [2].

Agents such as pembrolizumab (immune checkpoint inhibitors) are being evaluated for NMIBC, potentially challenging mitomycin C’s market share. Nonetheless, CYSTARAN benefits from cost-effectiveness and long-term clinical data, bolstering its continued relevance.

Market Challenges

- Evolving Treatment Guidelines: International guidelines increasingly incorporate newer immunotherapeutics, positioning mitomycin C as a second-line or adjunct agent.

- Side Effect Profile: While often well-tolerated, local side effects such as chemical cystitis may deter some clinicians.

- Alternatives in Adjunctive Applications: Research into combination therapies may influence future use patterns.

Financial Trajectory and Market Size

Current Market Valuation

Estimates place the global intravesical therapy market—dominated by agents like mitomycin C—at approximately $400-$500 million, with CYSTARAN constituting a significant share due to its longstanding clinical adoption [3].

North America accounts for a substantial portion, driven by high bladder cancer prevalence and established treatment protocols. Europe follows, with emerging markets in Asia-Pacific contributing incremental growth.

Market Growth Projections

Projection models suggest moderate growth rates (~2-4%) over the next five years, primarily driven by:

- Increasing Incidence of Bladder Cancer: Globally, bladder cancer ranks among the top ten most common cancers, with rising prevalence linked to aging populations and smoking rates [4].

- Expanding Treatment Cohorts: Greater awareness and early detection expand eligible patient pools.

- Optimized Usage Patterns: Adoption of intravesical therapies as standard care in various geographic regions enhances market stability.

However, this growth may be tempered by:

- Emergence of Novel Agents: Potential displacement by immune checkpoint inhibitors or hyperthermic treatments.

- Pricing Pressures: Healthcare systems’ focus on cost containment incentivizes price reductions and favors generics.

- Regulatory Changes: Potentially limiting indications or imposing new safety standards.

Future Financial Pathways

While current data support steady revenues, a possible shift toward a plateauing market stems from competition and innovation. In the long term, revenues could stabilize or decline unless new formulations (e.g., sustained-release intravesical products) or new therapeutic indications emerge.

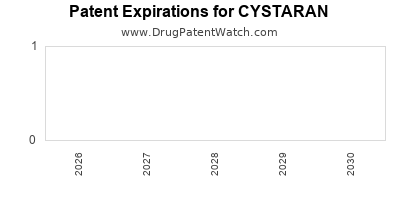

Conversely, niche markets—such as treatment of specific recurrent cases or combination therapies—may present additional revenue avenues. Strategic collaborations, patent extensions, or new formulations could bolster profitability.

Regulatory and Innovation Opportunities

- Novel Formulations: Development of controlled-release mitomycin C formulations aims to improve efficacy and reduce toxicity.

- Indications Expansion: Research into systemic uses or combination regimens could open new markets.

- Biomarker-Driven Therapies: Precision medicine approaches may improve patient selection, optimizing outcomes and market penetration.

- Regulatory Pathways: Fast-track approvals for reformulated products or new indications could accelerate revenue growth.

Conclusion

CYSTARAN’s market landscape is characterized by a mature but stable position, with gradual growth driven by persistent clinical demand for intravesical bladder cancer therapy. Its financial trajectory is influenced primarily by global bladder cancer incidence, clinical practice evolution, competitive innovations, and healthcare economic policies. While near-term prospects suggest modest growth, strategic innovation and expanding indications could sustain or enhance its market position.

Key Takeaways

-

Market Stability: CYSTARAN remains a cornerstone in bladder cancer intravesical therapy, supported by decades of clinical data and broad acceptance.

-

Growth Drivers: Increasing bladder cancer incidence, expanded treatment protocols, and emerging formulations underpin steady demand.

-

Competitive Landscape: Innovations in immunotherapy and hyperthermic treatments pose long-term competitive challenges but also opportunities for combination strategies.

-

Pricing and Reimbursement: Generics and healthcare policy influence revenues; cost-effective positioning sustains relevance.

-

Innovation Potential: Formulation improvements, new indications, and biomarker-guided therapies provide pathways for future expansion.

FAQs

1. What are the main clinical indications for CYSTARAN?

CYSTARAN (mitomycin C) is primarily indicated for the intravesical treatment of superficial bladder cancer (non-muscle invasive bladder cancer), especially in patients unresponsive to or intolerant of BCG therapy.

2. How does CYSTARAN compete with newer bladder cancer therapies?

While newer immunotherapies like pembrolizumab are emerging, CYSTARAN benefits from established efficacy, low cost, and widespread familiarity. Its competition centers around new agents offering potentially higher efficacy or reduced recurrence, but cost and clinical experience favor CYSTARAN’s continued use.

3. What factors influence the future growth of CYSTARAN’s market?

Key factors include bladder cancer incidence rates, adoption of new treatments, regulatory changes, pricing strategies, and innovations such as extended-release formulations or combination therapies.

4. Are there ongoing developments to improve CYSTARAN?

Yes. Researchers are exploring sustained-release formulations, combination regimens with immunotherapies, and expanded indications that could extend CYSTARAN’s utility and commercial appeal.

5. How do manufacturing and supply chain considerations impact CYSTARAN’s market?

Manufacturing complexity and reliance on generic producers ensure competitive pricing but also pose risks of supply disruptions, influencing market stability and pricing.

References

[1] Babjuk, M., et al. (2019). EAU Guidelines on Non-Muscle-Invasive Bladder Cancer. European Association of Urology.

[2] Sylvester, R. J., et al. (2021). Intravesical BCG and alternative therapies for bladder cancer. Nature Reviews Urology.

[3] MarketWatch. (2022). Global Intravesical Therapy Market Size, Share & Trends Analysis.

[4] Burger, M., et al. (2020). World bladder cancer epidemiology. European Urology.