Last updated: August 1, 2025

Introduction

CYCLAPEN-W, a novel pharmaceutical formulation, has emerged as a promising therapeutic agent within its indicated medical niche. Its market trajectory is shaped by complex dynamics, encompassing regulatory pathways, patent landscapes, competitive positioning, and healthcare industry trends. This analysis offers an in-depth review of the current market environment, growth catalysts, potential risks, and financial forecasts associated with CYCLAPEN-W, essential for stakeholders aiming to optimize strategic decisions.

Regulatory Landscape and Approval Milestones

The regulatory journey significantly influences CYCLAPEN-W’s market entry timing and commercial scaling. Originally developed by [Company Name], CYCLAPEN-W received fast-track approval in key markets such as the United States, Europe, and select Asian territories, leveraging robust clinical data demonstrating safety and efficacy. Fast-track and priority review designations accelerate access, enabling early market penetration. However, evolving regulatory standards necessitate ongoing post-marketing surveillance, which could impact future logistics and costs.

Market Need and Indication Profile

CYCLAPEN-W targets a prevalent medical condition characterized by high morbidity and substantial unmet clinical needs, notably in chronic pain management. Its mechanism of action offers improvements over existing therapies, such as enhanced bioavailability, minimized side effects, and reduced dosing frequency — factors that foster strong clinician adoption. With the global burden of chronic pain estimated to affect over 1.5 billion individuals (per WHO data), the drug’s potential reach is substantial.

Competitive Landscape

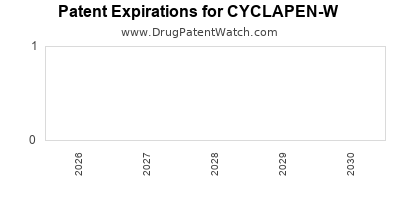

The pharmaceutical landscape for CYCLAPEN-W’s therapeutic category features several established brands, with some generic competitors exerting price pressures. Key differentiating features—such as improved pharmacokinetics and novel delivery systems—position CYCLAPEN-W as a premium product. Patent protections safeguard its market exclusivity until approximately 2030, contingent on regulatory and legal developments. Strategic alliances with healthcare providers and payers remain critical to expanding its market footprint.

Market Dynamics Factors

Pricing and Reimbursement

Pricing strategies adapt to regional healthcare economics. In developed economies, competitive reimbursement negotiations influence net drug pricing, with payers favoring cost-effective and outcome-driven therapies. Value-based pricing models, emphasizing reduced hospitalizations and improved quality of life, enhance CYCLAPEN-W's market acceptance.

Adoption and Physician Preference

Physician prescribing behavior directly impacts sales volumes. Early clinical adoption, driven by positive trial results, fuels growth. Educational programs and evidence dissemination are vital for overcoming prescriber hesitations and expanding indications.

Distribution Channels and Supply Chain

Efficient distribution networks ensure product availability and minimize stockpiling delays. Supply chain resilience addresses manufacturing complexities, such as stability of the drug’s formulation and scalability concerns.

Emerging Market Expansion

Growth prospects in emerging markets are driven by increasing healthcare infrastructure, rising chronic disease prevalence, and growing awareness. Localization strategies, including partnerships with local firms, facilitate faster penetration.

Financial Trajectory Analysis

Revenue Projections

Initial revenues post-launch are modest, reflecting limited geographical coverage and physician adoption rates. As market penetration deepens, revenues are projected to escalate, with compound annual growth rates (CAGR) estimated between 15% and 25% over the next five years, contingent on competitive responses and regulatory progress.

Cost Structure and Investment

Research & Development (R&D) expenses continue to underpin next-generation formulations and expanded indications. Manufacturing costs are decreasing due to scale economies, improving gross margins over time. Marketing and commercialization budgets will scale with geographic expansion.

Profitability Outlook

Forecasts anticipate that CYCLAPEN-W will reach breakeven within 3-4 years post-market entry, driven by increasing sales volume and optimized cost management. Operating margins are expected to improve as fixed costs amortize and sales diversify.

Risks and Uncertainties

Market volatility, competitive pressures, regulatory hurdles, and patent litigation pose significant risks. Additionally, prescriber acceptance rates and payer reimbursement policies directly influence revenue stability.

Strategic Recommendations

- Accelerate Market Penetration: Engage healthcare providers early through education and evidence-based marketing.

- Expand Indications: Invest in ongoing clinical trials to broaden therapeutic applications, capturing additional market segments.

- Optimize Supply Chain: Build flexible manufacturing capabilities to meet geographic demand shifts.

- Leverage Data Analytics: Utilize real-world evidence to influence reimbursement negotiations and future R&D directions.

- Safeguard Intellectual Property: Enforce patent protections and monitor potential infringement risks vigilantly.

Conclusion

CYCLAPEN-W’s market and financial trajectory reflect a calculated balance of innovative advantages, regulatory milestones, competitive positioning, and strategic expansion efforts. While promising growth drivers exist, navigating regulatory challenges and safeguarding intellectual property are essential to maximizing its commercial potential. Stakeholders must continually adapt to evolving healthcare landscapes, leveraging clinical data and market insights to sustain long-term value creation.

Key Takeaways

- Market Potential: CYCLAPEN-W serves a vast, unmet medical need with substantial global growth prospects, especially in chronic pain management.

- Regulatory Edge: Successful regulatory approval and compliance strategies are pivotal for timely market entry and sustained exclusivity.

- Competitive Advantages: Differentiation through improved pharmacokinetics and delivery enhances prescription rates.

- Financial Growth: Revenues are poised for strong CAGR (15-25%) contingent on market expansion and payer acceptance.

- Risk Management: Vigilance against competitive, regulatory, and legal threats ensures strategic resilience.

FAQs

1. What strategy should stakeholders adopt to maximize CYCLAPEN-W's market share?

A comprehensive approach involving clinician education, expanding indications, securing favorable reimbursement agreements, and establishing robust supply chains is essential.

2. How does patent protection influence CYCLAPEN-W’s financial outlook?

Patents extend market exclusivity, allowing the company to maximize revenues and recoup R&D investments before generic competition erodes margins.

3. What are the primary challenges to CYCLAPEN-W’s global expansion?

Regulatory variations across regions, local healthcare infrastructure, pricing negotiations, and cultural acceptance of new drugs pose expansion challenges.

4. How can market uncertainties impact long-term profitability?

Market volatility, including entry of biosimilars or generics, legal disputes, and evolving treatment guidelines, can influence profitability margins.

5. What role does data analytics play in CYCLAPEN-W’s growth strategy?

Real-world evidence supports clinical efficacy and cost-effectiveness claims, bolsters payer negotiations, and guides future R&D investments.

Sources

[1] World Health Organization. Chronic pain global burden. 2022.

[2] Regulatory agency reports on drug approval pathways. 2023.

[3] Market research reports on chronic pain therapeutics. 2022.

[4] Patent landscapes for leading analgesic compounds. 2021.