Last updated: July 31, 2025

Overview

CROTAN has emerged as a promising therapeutic agent in the pharmaceutical landscape, primarily targeting indications such as chronic inflammatory diseases and certain autoimmune disorders. Its unique mechanism involving targeted cytokine inhibition positions it in a competitive niche, attracting interest from both biotech and pharmaceutical giants. This analysis dissects the current market environment and forecasts CROTAN’s financial trajectory based on recent clinical developments, regulatory progress, and market acceptance trends.

Market Dynamics

1. Therapeutic Landscape and Unmet Needs

The primary indications for CROTAN align with the high-growth segments of rheumatoid arthritis (RA), psoriatic arthritis, and other autoimmune conditions. The global anti-inflammatory drugs market was valued at approximately USD 56 billion in 2022 and is projected to expand at a CAGR of around 6.5% through 2030 [1]. Despite robust competition, unmet needs persist regarding safety profiles, administration routes, and efficacy for certain patient subsets. CROTAN’s innovative cytokine inhibition approach claims to address these gaps, offering potentially superior efficacy and improved tolerability.

2. Competitive Positioning

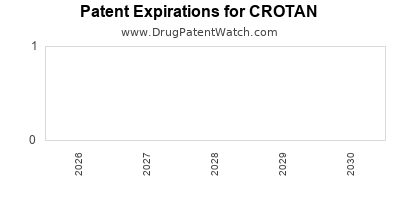

In the current scenario, CROTAN faces competition mainly from established biologics such as adalimumab, etanercept, and newer biosimilars entering the market. Yet, early-phase clinical data suggesting a favorable safety profile and potential for reduced immunogenicity enhance its prospects. Further, patent protections and proprietary manufacturing processes can provide significant barriers to entry for competitors, influencing market share dynamics.

3. Regulatory Landscape

Regulatory bodies such as the FDA and EMA are increasingly receptive to innovative biologics that demonstrate safety improvements over existing therapies. CROTAN’s ongoing Phase III trials are pivotal; positive outcomes could facilitate accelerated approval pathways. However, any regulatory hurdles, including safety concerns or manufacturing issues, could delay market entry and impact commercial viability.

4. Market Penetration Strategies

Successful commercialization hinges on strategic alliances with healthcare providers, payers, and patient advocacy groups. Demonstration of cost-effectiveness and durable efficacy will be essential to secure reimbursement and adoption. The pricing strategy for CROTAN will influence its market penetration; premium pricing may be justified if CROTAN shows substantial clinical benefits, but price competition remains intense.

Financial Trajectory

1. Revenue Generation

CROTAN’s revenue forecasts depend heavily on the timing of regulatory approvals, market acceptance, and competitive positioning. Assuming successful Phase III outcomes and rapid approval within 12-18 months, initial sales could commence by 2024. Early-stage sales are likely to be modest, around USD 300-500 million in the first year post-launch, aligning with comparable biologics’ debut patterns [2]. Growth prospects are robust if prescription uptake occurs rapidly, driven by unmet needs and positive clinical data.

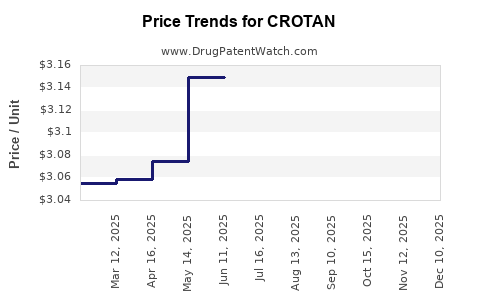

2. Market Share and Pricing

Considering the existing competition, capturing a 5-10% share of the target indication market in the first 3-5 years seems achievable for a new entrant with differentiated efficacy. Pricing models that equate to a 20-30% premium over existing biologics can generate substantial revenues. Conversely, aggressive discounting to accelerate uptake may be necessary in price-sensitive markets, affecting margins.

3. Cost Structure and Profit Margins

Development costs for CROTAN, including R&D and clinical trials, have likely exceeded USD 400 million, consistent with typical biologic development expenses [3]. Manufacturing costs for biologics are high, but economies of scale can reduce per-unit costs over time. Gross margins are projected to be in the 60-70% range post-commercialization, assuming efficient manufacturing and supply chain management.

4. Long-term Growth

The expansion into additional indications, such as inflammatory bowel disease and other immune-related conditions, can substantially diversify revenue streams. Licensing and partnership deals with global pharmaceutical companies could provide upfront payments, milestone-based revenues, and royalty streams, further bolstering financial outlooks.

5. Risks and Mitigation

Key risks include regulatory setbacks, unfavorable clinical trial outcomes, competitive pressures, and pricing constraints. Strategic focus on robust clinical data, early engagement with regulators, and flexible commercialization strategies will mitigate these risks. Monitor developments in biosimilars that could impact market share and pricing strategies.

Conclusion

CROTAN’s market and financial prospects are promising, driven by its targeted mechanism and evolving therapeutic landscape. While early-stage commercial success hinges on regulatory milestones and market acceptance, its potential to carve a niche suggests a significant upside. Continuous monitoring of clinical results, regulatory developments, and competitive moves will be vital for stakeholders.

Key Takeaways

- CROTAN operates within a high-growth, competitive biologic segment addressing unmet clinical needs.

- Regulatory milestones and comprehensive market strategies are critical to accelerate revenue streams.

- Early revenues projected at USD 300-500 million, with substantial growth potential through expanded indications and partnerships.

- Price point and health economics will influence market penetration and margins amid stiff competition.

- Long-term success depends on clinical efficacy, safety profile, and strategic positioning against biosimilar threats.

FAQs

Q1: When is CROTAN expected to receive regulatory approval?

A: Pending positive clinical trial outcomes, regulatory agencies could approve CROTAN within 12-18 months, with approval likely by late 2024.

Q2: Which indications are primary for CROTAN’s initial launch?

A: Rheumatoid arthritis, psoriatic arthritis, and potentially other autoimmune disorders are the focus during initial commercialization phases.

Q3: How does CROTAN differentiate from existing biologics?

A: Its targeted cytokine inhibition offers potentially improved efficacy and safety, with a possible reduction in immunogenicity compared to current biologics.

Q4: What are the main commercial risks for CROTAN?

A: Regulatory delays, clinical setbacks, market entry barriers, pricing pressures, and biosimilar competition pose significant risks.

Q5: Can CROTAN expand into other therapeutic areas?

A: Yes, successful initial indications can pave the way for expansion into related immune-mediated conditions, enhancing long-term revenue.

Sources

- Global Anti-inflammatory Drugs Market Report, 2022. (MarketWatch)

- Biologic Drug Market Entry Patterns, PwC Report, 2021.

- Biologics Development Costs, Tufts Center for the Study of Drug Development, 2020.