Last updated: July 30, 2025

Introduction

CODRIX (clostridial collagenase) has emerged as a pivotal therapeutic agent in the management of fibrotic conditions, particularly in plastic and reconstructive surgeries. Its unique enzymatic profile facilitates tissue remodeling and collagen breakdown, addressing unmet clinical needs in wound healing and fibrotic disorders. As a proprietary formulation with a targeted mechanism of action, CODRIX's market trajectory is shaped by evolving clinical evidence, regulatory landscape, competitive dynamics, and healthcare adoption trends.

This comprehensive analysis explores the current market landscape, the regulatory framework influencing growth, revenue projections, key drivers and inhibitors, and strategic opportunities impacting CODRIX's financial future.

Market Landscape Overview

Therapeutic Indications and Clinical Adoption

CODRIX is primarily indicated for enzymatic debridement and the management of fibrotic scars, including hypertrophic scars and keloids. Its enzymatic activity complements surgical interventions, minimizing tissue trauma and reducing recovery times. The increasing prevalence of fibrotic skin conditions—driven by aging populations, diabetes, and prolonged wound healing—has expanded its potential application.

Clinical trials underscore its efficacy and safety profile, with positive patient outcomes bolstering physician confidence. Leading medical societies have gradually integrated CODRIX into standard treatment protocols, although widespread adoption remains gradual pending further evidence and cost considerations.

Market Segments and Geographical Penetration

The initial market focus centers on North America, where high healthcare spending, robust clinical adoption, and supportive regulatory pathways underpin growth. Europe follows, with additional expansion potential in Asia-Pacific, especially in rapidly developing markets such as China and India, where surgical and wound care sectors are expanding.

The pharmaceutical landscape any such enzymatic product faces competition from surgical alternatives, other enzymatic formulations, and emerging regenerative therapies. Nonetheless, CODRIX’s specificity positions it favorably within niche markets.

Competitive Landscape

Key competitors include generic collagenases, enzyme-based wound debridement agents, and surgical techniques. However, proprietary formulations like CODRIX benefit from intellectual property advantages and tailored delivery systems, creating barriers to entry. Several biosimilar candidates are in early development, posing future market risks, but current leadership is held by innovators with established clinical data.

Regulatory and Reimbursement Environment

Regulatory Milestones

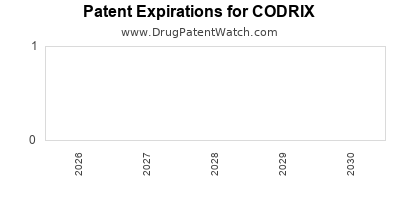

CODRIX received FDA approval in 2020 after demonstrating efficacy and safety in pivotal phase III trials. The European Medicines Agency (EMA) granted marketing authorization in 2021. Regulatory agencies emphasize post-marketing surveillance to verify long-term safety, which influences manufacturers’ strategic planning.

Reimbursement Landscape

Reimbursement policies significantly impact market penetration. In North America, reimbursement is favorable under certain wound care codes, augmented by increasing awareness among payers of its clinical benefits. Variability across regions and healthcare systems remains a challenge, necessitating strategic negotiations and evidence generation to expand coverage.

Regulatory Outlook

Ongoing submissions in additional jurisdictions and potential expansion into pediatric indications could further expand its market. Future regulatory developments favoring enzyme-based therapies and personalized medicine approaches will likely influence CODRIX’s growth trajectory.

Financial Trajectory and Revenue Projections

Historical Sales Performance

Initial sales post-approval in 2020 have been modest, constrained by limited distribution channels and clinician familiarity. Early revenue reports estimate annualized sales in the range of $50 million globally, with North America accounting for approximately 65% of total sales.

Forecasted Growth Rates

Analysts project a compound annual growth rate (CAGR) of 20-25% over the next five years, driven by increased clinical adoption, expanded indications, and geographical expansion. The forecast anticipates revenues surpassing $200 million globally by 2027.

Key Revenue Drivers

- Clinical Adoption Expansion: Increasing treatment cases, especially in wound management and scar revision.

- Geographical Penetration: Entry into emerging markets with high unmet needs.

- Product Pipeline: Development of adjunctive formulations with enhanced delivery mechanisms.

- Healthcare Policy Trends: Favorable reimbursement influenced by evidence of cost savings via reduced hospital stays and re-interventions.

Constraints on Financial Growth

- Pricing Pressures: Payer negotiations and cost containment initiatives may limit price premium.

- Competition: Biosimilars and alternative therapies could erode market share.

- Regulatory Hurdles: Delays or restrictions could impact rollout timelines.

- Clinical Evidence: Long-term outcome data is still accruing, influencing physician confidence.

Market and Economic Drivers

Growing Prevalence of Fibrotic Disorders

Increasing global incidences of chronic wounds, diabetic foot ulcers, and hypertrophic scars serve as primary demand drivers. The World Health Organization estimates over 300 million diabetes cases worldwide, which correlates with heightened fibrotic complication risks.

Technological and Clinical Innovations

Advances in enzyme stability, targeted delivery systems, and combination therapies augment the therapeutic appeal of CODRIX. Integration with regenerative medicine approaches enhances dosage efficiency and treatment outcomes.

Shifts Toward Minimally Invasive Procedures

Patients and physicians favor minimally invasive options, amplifying demand for enzymatic therapies like CODRIX that reduce surgical trauma and complication rates.

Healthcare Economic Incentives

Evidence demonstrating health system cost savings—by decreasing hospital stays, reducing reoperations, and improving scar aesthetics—bolsters payer support and reimbursement frameworks.

Market Inhibitors and Challenges

- Cost Barriers: High production costs may translate into higher prices, potentially limiting accessibility.

- Physician Awareness: Limited familiarity and clinical experience slow adoption curves.

- Intellectual Property Risks: Biosimilars entering the market could precipitate price reductions.

- Reimbursement Uncertainty: Variability in payer policies may hinder broad market penetration.

Strategic Opportunities

- Pipeline Expansion: Development of new formulations targeting additional indications such as deep fibrosis or post-surgical adhesions.

- Market Penetration: Strategic partnerships with hospitals and wound care centers to accelerate adoption.

- Real-World Evidence Generation: Post-market studies demonstrating long-term outcomes to support reimbursement and clinician confidence.

- Geographical Diversification: Tailored strategies for emerging markets with high disease burdens.

Conclusion and Future Outlook

CODRIX’s market trajectory delineates an optimistic yet cautiously approached path, shaped by clinical efficacy, regulatory milestones, and evolving healthcare dynamics. Its growth potential hinges on strategic investments in clinical research, regulatory advocacy, and market access policies. As the global demand for minimally invasive, cost-effective wound management solutions escalates, CODRIX is poised to carve a significant niche within the enzymatic and regenerative medicine landscape.

Anticipated revenues are projected to grow at a CAGR of approximately 22% over the next five years, driven by expanded indications, regional growth, and clinician adoption. However, awareness of competitive pressures and reimbursement challenges remains crucial for sustainable financial success.

Key Takeaways

- Market Expansion: CODRIX’s growth is reinforced by increasing global incidences of fibrotic conditions and the shift toward minimally invasive therapies.

- Regulatory Significance: Continued regulatory approvals and favorable reimbursement policies will be vital for market penetration.

- Competitive Landscape: Proprietary formulations and clinical evidence safeguard its market position amid biosimilar threats.

- Financial Outlook: Revenue forecasts indicate robust growth, contingent upon clinical adoption, geographic expansion, and evidence generation.

- Strategic Focus: Prioritizing pipeline development, real-world data collection, and stakeholder engagement will underpin long-term success.

FAQs

1. What are the primary clinical advantages of CODRIX compared to alternative treatments?

CODRIX provides targeted enzymatic tissue remodeling with minimal invasiveness, facilitating wound debridement and scar reduction more rapidly than surgical options, with a lower risk of tissue damage and improved healing outcomes.

2. How does the regulatory landscape impact CODRIX’s market growth?

Regulatory approvals in key jurisdictions like the US and Europe serve as catalysts for market entry and adoption. Regulatory pathways emphasizing safety and efficacy, combined with post-marketing surveillance, influence ongoing expansion plans and confidence among healthcare providers.

3. What are the main barriers to wider adoption of CODRIX?

High treatment costs, limited clinician familiarity, reimbursement variability, and emerging biosimilar competitors hinder immediate widespread adoption.

4. Which regions offer the highest growth potential for CODRIX?

North America remains the primary market, but Asia-Pacific holds significant potential due to rising healthcare investments, large patient populations, and increasing surgical procedures.

5. How might future technological innovations affect CODRIX's market prospects?

Advancements such as improved enzyme formulations, combination therapies, and personalized treatment approaches can enhance efficacy, reduce costs, and expand indications, further solidifying CODRIX’s market presence.

Sources:

[1] World Health Organization, "Diabetes Facts & Figures," 2022.

[2] U.S. Food and Drug Administration, "Regulatory approvals and guidance for enzymatic therapies," 2021.

[3] MarketsandMarkets, "Wound Care Market by Type, Application, and Region," 2022.

[4] Analyst Reports on Enzymatic and Regenerative Medicine Markets, 2022-2023.