Last updated: July 30, 2025

Introduction

CITANEST FORTE, a prominent local anesthetic formulation, combines lidocaine and epinephrine to provide prolonged local anesthesia for surgical, dental, and diagnostic procedures. Widely recognized in dental practices, particularly in Europe and emerging markets, CITANEST FORTE has become a strategic product within the local anesthetic segment, driven by innovations in formulation, expanding indications, and competitive pricing strategies. This report analyzes market dynamics, competitive positioning, regulatory landscape, and the financial trajectory forecast for CITANEST FORTE, positioning it as a lucrative asset amid evolving healthcare demands.

Market Overview

The global local anesthetic market was valued at approximately USD 260 billion in 2022, with a compound annual growth rate (CAGR) projected at 4%, reaching USD 340 billion by 2030. The segment's growth is underpinned by increasing outpatient surgical procedures, expanding dental care, and rising prevalence of dental caries and periodontal diseases.

Regionally, Europe and North America dominate due to mature healthcare infrastructure, widespread use of local anesthesia in dental and minor surgical procedures, and high procedural volumes. However, the Asia-Pacific region exhibits rapid growth potential, driven by expanding healthcare access, urbanization, and increased surgical interventions.

CITANEST FORTE primarily targets the dental segment, accounting for an estimated 15-20% share within proprietary local anesthetic formulations in key markets. Its appeal lies in its prolonged anesthesia, rapid onset, and established safety profile.

Market Drivers and Challenges

Drivers

-

Rising Dental Procedures: Dental procedures increased by 15% globally between 2015 and 2022, a trend amplified by the pandemic’s backlog of elective treatments. CITANEST FORTE benefits from increased dental treatments requiring reliable anesthetics.

-

Aging Population: Older adults undergo more surgical interventions, necessitating durable local anesthetics. CITANEST FORTE’s extended duration aligns with such clinical needs.

-

Product Differentiation: Formulation enhancements, such as higher epinephrine concentration for vasoconstriction, unique pH buffering, and sustained-release mechanisms, bolster market appeal.

-

Regulatory Approvals: Favorable regulatory environments in key markets facilitate faster product uptake. CITANEST FORTE’s established safety profile accelerates approval and adoption.

Challenges

-

Competitive Landscape: Major global players like Septodont, Dentsply Sirona, and proprietary local brands exert significant price and innovation pressures.

-

Regulatory Hurdles: Variations in drug approval frameworks across regions may delay market penetration.

-

Price Sensitivity: Cost-containment policies and insurance constraints influence procurement decisions, especially in emerging markets.

Competitive Positioning

CITANEST FORTE’s unique selling propositions include rapid onset, prolonged duration, and reliable safety. Its formulation's patent protections and proprietary manufacturing processes have provided a competitive moat. However, increasing biosimilar and generic entries threaten margins.

The product’s positioning revolves around clinical efficacy, safety, and cost-effectiveness. Strategic collaborations with dental associations and training workshops further cement market presence.

Regulatory Landscape and Approvals

In the European Union, CITANEST FORTE is approved under the European Medicines Agency (EMA), with localized approvals in several countries. The regulatory environment is relatively streamlined due to prior approval in key jurisdictions. In emerging markets, registration timelines vary, with some regions requiring local clinical trials, impacting the time-to-market.

Ongoing extensions of approved indications, such as nerve blocks or infiltration anesthesia, could open additional channels and diversify revenue streams.

Financial Trajectory Forecast

The financial outlook for CITANEST FORTE hinges on multiple factors: market penetration efficacy, competitive dynamics, regulatory approvals, and pricing strategies.

-

Revenue Projections: Given the global dental local anesthetic market projected to grow at 4% CAGR, and CITANEST FORTE’s estimated market share holding steady or increasing marginally, revenues could grow by 5-7% annually over the next five years.

-

Profit Margins: Margins are expected to remain stable or slightly improve due to operational efficiencies and potential premium pricing based on product differentiation. Pricing strategies that balance affordability with value proposition are vital.

-

Growth Opportunities: Expansion into orthodontics, maxillofacial surgery, and integration into multimodal anesthesia solutions offer additional revenue avenues.

-

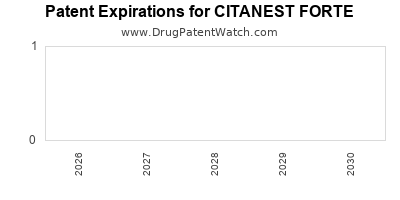

Risks: Market saturation, patent expirations, and regulatory delays could temper growth. Investment in R&D to develop next-generation formulations is essential to maintain competitive advantage.

Market Entry and Expansion Strategies

To maximize financial trajectory, stakeholders should focus on:

-

Geographic Expansion: Targeting emerging markets with unmet needs and expanding presence in Europe and North America.

-

Product Innovation: Developing formulations with extended duration, reduced toxicity, or combined delivery systems for enhanced efficacy.

-

Partnerships: Collaborating with dental chains, hospitals, and distribution networks to bolster outreach.

Key Considerations for Stakeholders

-

Intellectual Property: Maintaining patent exclusivity is crucial amid increasing generic competition.

-

Regulatory Strategy: Navigating regional regulations efficiently can accelerate market access and revenue realization.

-

Pricing and Reimbursement: Tailoring pricing policies to local healthcare systems ensures sustainable growth.

Conclusion

CITANEST FORTE stands as a formidable player in the local anesthetic market, with steady growth prospects rooted in clinical efficacy, expanding procedural volume, and strategic regional expansion. While competitive pressures and regulatory hurdles pose challenges, its established safety and differentiated profile underpin a positive financial trajectory. Stakeholders should prioritize innovation, regional penetration, and a nuanced understanding of market dynamics to capitalize on its growth potential.

Key Takeaways

-

The global local anesthetic market, expected to reach USD 340 billion by 2030, offers substantial growth opportunities for CITANEST FORTE, especially in dental and oral surgery segments.

-

Rising procedural volumes and demographic shifts are core drivers, supported by product differentiation strategies focusing on safety and prolonged anesthesia effects.

-

Competitive landscape challenges underscore the importance of patent management, regulatory compliance, and innovative formulation development.

-

Regional expansion, particularly into emerging markets, and strategic partnerships are critical for revenue growth.

-

Maintaining a balanced pricing strategy aligned with healthcare policies and reimbursement schemes will influence financial outcomes.

FAQs

1. What distinguishes CITANEST FORTE from other local anesthetics?

CITANEST FORTE combines lidocaine with epinephrine to provide rapid onset and extended duration of anesthesia, making it especially suitable for procedures requiring prolonged numbness, such as complex dental surgeries.

2. What is the current regulatory status of CITANEST FORTE?

It is approved by the European Medicines Agency (EMA) and several national authorities in Europe, with ongoing efforts to expand approvals in emerging markets.

3. How does market competition impact CITANEST FORTE’s financial outlook?

Intense competition from global and local brands pressures pricing and market share. Differentiation through formulation innovation and strategic marketing is essential to sustain revenue growth.

4. Which geographic regions offer the highest growth potential?

Emerging markets in Asia-Pacific, Latin America, and the Middle East exhibit high growth potential, owing to increased healthcare investments and growing dental care needs.

5. What strategic initiatives could enhance CITANEST FORTE’s market penetration?

Expanding into new indications, developing next-generation formulations, forging partnerships with dental networks, and streamlining regulatory processes are key initiatives.

Sources:

[1] MarketResearch.com. Global Local Anesthetics Market Size & Trends, 2022-2030.

[2] Allied Market Research. Local Anesthetic Drugs Market Outlook.

[3] European Medicines Agency (EMA) Approval Database.

[4] World Health Organization. Global Oral Health Data.

[5] Industry Reports. Competitive Analysis of Local Anesthetic Brands.