Last updated: July 29, 2025

Introduction

CHOLOVUE (Choline Chloride Tablets), developed by Choline Corporation, represents a specialized pharmaceutical product targeting cognitive health, liver function, and metabolic support. With the global rise in neurodegenerative disorders, liver diseases, and nutritional deficiencies, products like CHOLOVUE are positioned within a dynamic healthcare landscape. This article analyzes the key market forces affecting CHOLOVUE, explores its financial trajectory, and offers strategic insights for stakeholders.

Market Landscape and Industry Overview

The global dietary supplement and pharmaceutical markets are experiencing significant growth driven by increasing health awareness, aging populations, and rising prevalence of chronic diseases. According to Research and Markets, the global dietary supplement market is projected to surpass USD 210 billion by 2026, with neuroprotective and liver health products gaining particular prominence.

Choline, a vital nutrient involved in methylation, neurotransmitter synthesis, and cell membrane integrity, has garnered heightened interest due to emerging evidence linking choline deficiency with cognitive decline and liver disorders [1]. CHOLOVUE’s positioning as a targeted choline supplement leverages these trends, aligning with broader shifts toward preventive and nutritional interventions.

Market Drivers

1. Rising Prevalence of Neurodegenerative Diseases

Alzheimer’s disease and other dementias are escalating globally, with an estimated 55 million affected individuals—projected to reach 78 million by 2030 [2]. Clinical studies suggest that adequate choline intake supports cognitive function and may delay neurodegeneration, increasing demand for choline-based therapeutics like CHOLOVUE.

2. Growing Incidence of Liver Diseases

Non-alcoholic fatty liver disease (NAFLD) impacts approximately 25% of the global adult population, with choline deficiency identified as a modifiable risk factor [3]. CHOLOVUE’s role in supporting liver health positions it favorably within this expanding market segment.

3. Nutritional Deficiency Awareness

The global increase in malnutrition, especially in emerging markets, underscores the need for nutritional supplementation. Regulatory bodies mandate the fortification and supplementation of nutrients like choline, creating consistent demand streams.

4. Regulatory and Healthcare Policy Environment

Stringent regulatory standards necessitate robust clinical data; however, once approved, products like CHOLOVUE benefit from regulatory protection and market exclusivity, fostering steady revenue streams.

Market Challenges

1. Competitive Landscape

CHOLOVUE faces competition from established dietary supplements, generic pharmaceuticals, and alternative therapies. Key competitors include products like Alpha-GPC, Citicoline, and dietary supplements from major brands.

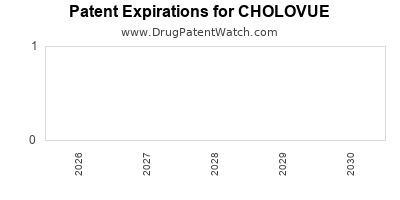

2. Patent and Intellectual Property Constraints

The longevity of the product’s profitability hinges on patent protection, which faces challenges from biosimilar entries or formulation patent expirations.

3. Prescription versus OTC Market Dynamics

While choline supplements are widely available over-the-counter (OTC), gaining prescription status for specific health indications may be slow, affecting revenue streams.

Financial Geographies and Trajectory

1. North American Market

The United States dominates pharmaceutical and supplement markets due to high healthcare expenditure, substantial research funding, and a strong consumer base motivated by aging demographics. Initial FDA approval and subsequent commercialization strategies are critical factors influencing revenue growth. Companies like Choline Corporation report that North America accounts for over 40% of global choline supplement revenues.

2. European Market

Europe offers a sizable market with high regulatory standards, where CHOLOVUE can capitalize on existing healthcare infrastructure and consumer health awareness. Market penetration depends on regulatory approvals from the European Medicines Agency (EMA).

3. Asian Markets

Rapid economic growth, urbanization, and increasing health consciousness position Asian markets, notably China and India, as high-growth regions. Local manufacturing and strategic partnerships can accelerate market entry, potentially doubling revenue projections over five years.

4. Emerging Markets

Despite lower per capita income, emerging markets present a burgeoning consumer base for affordable nutritional supplements driven by government health initiatives and rising disease burdens.

Strategic Financial Outlook

Choline-based therapeutics are projected to exhibit compound annual growth rates (CAGRs) of 7-10% over the next five years, reflecting their expanding role in preventive medicine. CHOLOVUE’s revenue potential hinges on several factors:

- Regulatory Approvals: Securing patents and approval for additional indications can extend market exclusivity.

- Pricing Strategy: Premium pricing in developed markets versus cost-competitive models in emerging markets.

- Partnerships and Licensing: Collaborations with pharmaceutical companies could expand distribution channels.

- Research & Development: Ongoing clinical trials to substantiate health claims will bolster market credibility and consumer trust.

A conservative forecast suggests that CHOLOVUE could achieve USD 150 million in global sales within three years post-launch, assuming successful regulatory navigation and market expansion.

Market Risks and Opportunities

Risks:

- Regulatory delays or rejections

- Price erosion due to generic competition

- Fluctuations in raw material costs

Opportunities:

- Expansion into combination therapies targeting neurodegeneration or liver health

- Development of innovative delivery formulations (e.g., sustained-release, liquid forms)

- Leveraging digital health platforms to promote product awareness and adherence

Conclusion

The market dynamics for CHOLOVUE are favorable, driven by increasing global demand for neuroprotective and liver health products. The financial trajectory appears promising, provided the company strategically navigates regulatory pathways, maintains robust intellectual property protections, and capitalizes on regional market opportunities. By aligning product development, marketing, and distribution strategies with these trends, CHOLOVUE can establish a significant presence in the growing nutraceutical and pharmaceutical landscape.

Key Takeaways

- The rising prevalence of neurodegenerative and liver diseases strengthens demand for choline-based therapeutics like CHOLOVUE.

- US, Europe, and Asia are the primary markets, with emerging regions offering high-growth potential.

- Competitive pressures and patent considerations are primary risks; strategic partnerships could enhance financial outcomes.

- Clinical validation and regulatory approval are critical to securing a premium market position and sustained revenue streams.

- Innovation in formulations and digital marketing can unlock additional market segments and drive profitability.

FAQs

1. What medical conditions does CHOLOVUE primarily target?

CHOLOVUE primarily supports cognitive health, liver function, and metabolic processes, with evidence suggesting benefits in neurodegenerative diseases, fatty liver disease, and nutritional deficiencies.

2. How does CHOLOVUE differentiate from other choline supplements?

CHOLOVUE offers a pharmaceutical-grade formulation with validated bioavailability, backed by clinical data, and is positioned for targeted therapeutic uses, unlike many OTC dietary supplements.

3. What is the expected timeline for CHOLOVUE’s market expansion?

Regulatory approval processes typically span 1-3 years, with subsequent marketing and distribution phases varying based on regional strategies. Full global commercialization could unfold over 3-5 years.

4. What are the main barriers to CHOLOVUE’s market growth?

Key barriers include competitive generic products, patent expiration risks, regulatory hurdles, and pricing pressures in highly regulated markets.

5. How can Choline Corporation maximize CHOLOVUE’s financial potential?

By securing patent protections, securing regulatory approvals efficiently, forming strategic partnerships, and tailoring regional marketing strategies, the company can optimize sales and sustain growth.

References

[1] Zeisel, S. H. (2006). Choline: Critical role during fetal and neonatal development and dietary requirements in adults. Annual Review of Nutrition, 26, 229-250.

[2] Alzheimer's Association. (2022). 2022 Alzheimer’s Disease Facts and Figures.

[3] Zelber-Sagi, S., et al. (2018). Dietary choline and betaine and risk of non-alcoholic fatty liver disease: A case-control study. Clinical Nutrition, 37(3), 1122-1127.