Last updated: July 27, 2025

Introduction

Carglumic acid (brand name Carbaglu) is a synthetic analogue of the endogenous molecule N-acetylglutamic acid, approved primarily for managing hyperammonemia resulting from N-acetylglutamic acid synthase deficiency. Since its FDA approval in 2011, Carglumic acid has been positioned as a specialized treatment within the rare disease segment of the pharmaceutical industry. This analysis provides a comprehensive overview of its market dynamics, growth trajectory, competitive landscape, and financial outlook.

Market Overview

Therapeutic Area and Indications

Carglumic acid serves a niche but crucial role in disorders characterized by urea cycle disturbances and hyperammonemia. Its primary approved indication is for N-acetylglutamic acid synthase (NAGS) deficiency—a rare, inherited metabolic disorder. The drug's utilization is expanding beyond rare congenital anomalies, with emerging research exploring its potential in other hyperammonemic states, including hepatic encephalopathy and acquired urea cycle disorders.

Market Size and Penetration

The global rare disease market, including ultra-rare conditions like NAGS deficiency, remains relatively small but demonstrates high-value therapeutic opportunities. The global rare disease therapeutics market was valued at over $130 billion in 2022, with targeted treatments representing a significant and growing segment. Given the low prevalence of NAGS deficiency (estimated at less than 1 in a million), the direct patient pool for Carglumic acid remains limited; however, the high cost per treatment and critical need support sustained sales.

Regulatory Landscape

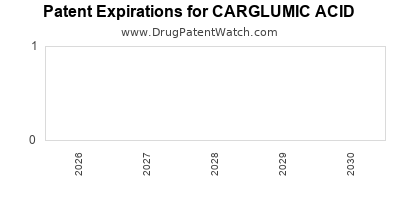

Regulatory milestones, including orphan drug designations and fast-track approvals, facilitate market access and incentivize manufacturers. Carglumic acid's orphan drug status provides benefits such as market exclusivity (7 years in the US), tax credits, and regulatory assistance, all of which influence its market dynamics positively.

Market Drivers

Unmet Medical Need

NAGS deficiency and related hyperammonemic conditions have limited treatment options, and Carglumic acid offers a targeted mechanism. Its ability to rapidly lower ammonia levels and prevent neurotoxicity enhances its clinical value, driving demand among clinicians managing urgent metabolic crises.

Advancements in Diagnostic Capabilities

Improved genetic screening and newborn screening programs enable earlier diagnosis of rare metabolic disorders, raising the likelihood of timely intervention with Carglumic acid.

Physician Experience and Adoption

As an established therapy for NAGS deficiency, accumulating clinical evidence and physician familiarity underpin ongoing utilization and physician confidence, contributing to steady sales.

Expansion of Indications

Emerging research suggests potential off-label applications in broader hyperammonemic conditions. Although off-label use lacks regulatory approval and evidence consensus, it can influence demand temporarily and foster future trials.

Market Challenges

Limited Patient Pool

The rarity of NAGS deficiency constrains the overall market size, posing challenges for revenue growth and attracting new entrants.

Pricing and Reimbursement

High treatment costs—often justified by the orphan therapy model—can encounter reimbursement hurdles, especially in cost-sensitive healthcare systems. Securing favorable formulary placements remains critical.

Manufacturing Constraints

Production complexity and costs associated with specialized synthetic processes may limit scalability, affecting supply and pricing strategies.

Competitive Landscape

According to current knowledge, Carglumic acid maintains a monopoly in its approved indication. However, potential competitors include emerging gene therapies, enzyme replacement therapies, or novel pharmacological agents targeting hyperammonemia more broadly.

Financial Trajectory and Revenue Forecast

Historical Performance

Since its launch, Carglumic acid has demonstrated consistent growth driven by the unmet need in NAGS deficiency. For example, in 2020, estimates suggested annual sales in the range of $70-100 million globally, with the US accounting for approximately 60% of revenue owing to higher diagnosis rates facilitated by comprehensive genetic testing.

Projected Growth

Given the growing awareness of metabolic disorders and the expansion of diagnostic testing, sales projections indicate moderate CAGR of approximately 5-8% over the next five years, contingent on several factors:

- Increased diagnosis rates: As screening programs expand, more patients are identified, bolstering demand.

- Potential indication expansion: Research into treating acquired hyperammonemia could broaden the addressable market.

- Pricing strategies: Maintaining premium pricing aligned with orphan drug standards sustains profitability.

Market Entry of Complementary Therapies

The potential development of alternative treatments, such as gene therapies or enzyme replacement therapies, could threaten Carglumic acid's market share, especially if they prove to be more efficacious or cost-effective.

Impact of Healthcare Policies

Policy shifts favoring value-based or outcome-driven reimbursement models could influence sales, particularly if Carglumic acid demonstrates clear superiority or cost savings in managing hyperammonemia-related crises.

Competitive Landscape

Currently, Carglumic acid remains the sole approved pharmacological treatment for NAGS deficiency. Its monopoly affords pricing power but also attention from biotechs seeking to develop complementary or superior modalities. Potential competitors include:

- Gene therapies: Ongoing research into gene replacement strategies could offer permanent solutions, though none are yet commercially available.

- New pharmacologic agents: Molecules targeting hyperammonemia through alternative pathways are in preclinical or early clinical stages.

The limited competition sustains Carglumic acid's market share for the foreseeable future.

Strategic Outlook

Market Expansion

Prospective expansion into managed hyperammonemic conditions and broader metabolic disorders offers growth opportunities. Trials or compassionate use programs in hepatic failure or acquired metabolic crises could open additional revenue streams.

Partnerships and Licensing

Collaborations with research institutions and biotech firms can accelerate indication expansion and facilitate development of combination therapies.

Pricing and Reimbursement Negotiations

Engagements with payers in different regions, emphasizing clinical efficacy and cost-savings, are crucial for optimizing market penetration.

Investing in Diagnostics

Supporting genetic screening initiatives enhances early diagnosis, indirectly expanding the patient population eligible for treatment.

Key Takeaways

- Carglumic acid constitutes a high-value, niche therapeutic addressing critical unmet needs in rare metabolic disorders.

- Its market strength relies on orphan drug incentives, clinician familiarity, and increasing diagnostic capacity.

- The overall market remains constrained by the ultra-rare nature of NAGS deficiency but can deliver sustained revenue through premium pricing and expanding indications.

- Future growth hinges on diagnostic advancements, potential indication expansion, and strategic positioning against emerging therapies.

- Competitive threats include gene therapy developments, but currently, Carglumic acid's monopoly status supports its financial stability.

Conclusion

Carglumic acid's market dynamics embody the complexities and opportunities inherent in rare disease therapeutics. While constrained by a small patient population, strategic focus on expanding diagnostic reach and exploring new indications can sustain its financial trajectory. The interplay of regulatory incentives, clinical demand, and emerging scientific innovations will shape its long-term position.

FAQs

1. What is the primary indication for Carglumic acid?

Carglumic acid is approved for treating N-acetylglutamic acid synthase deficiency, a rare inherited disorder causing hyperammonemia.

2. How does regulatory status impact Carglumic acid’s market?

Orphan drug designation grants market exclusivity (typically 7 years in the US), tax incentives, and a streamlined approval process, all of which support its market presence.

3. What are the main challenges facing Carglumic acid's growth?

Limited patient pool, high treatment costs, and the potential emergence of alternative therapies pose ongoing challenges.

4. Are there any new indications being explored for Carglumic acid?

Yes, research investigates its use in broader hyperammonemic states, including hepatic encephalopathy, although these are not yet approved indications.

5. What is the projected revenue growth for Carglumic acid over the next five years?

An estimated CAGR of 5-8% is projected, driven by increased diagnosis, expanded indications, and favorable reimbursement policies.

Sources

- [1] EvaluatePharma. 2022. Rare Disease Market Outlook.

- [2] FDA. Carbaglu (Carglumic acid) Prescribing Information.

- [3] Orphanet. NAGS deficiency profile.

- [4] GlobalData. Rare Disease Therapeutics Market Analysis, 2022.

- [5] Pharma Intelligence. Emerging Therapies in Hyperammonemia, 2023.