Last updated: August 3, 2025

Introduction

Capastat Sulfate (also known as aerosolized pentamidine) is an antimicrobial agent primarily employed in the treatment of Pneumocystis pneumonia (PCP) and certain other opportunistic infections in immunocompromised patients. Its unique administration route and clinical profile position it within the niche segment of infectious disease therapeutics. As medical needs evolve and resistance patterns shift, understanding the market dynamics and financial trajectory of Capastat Sulfate becomes crucial for stakeholders—including pharmaceutical companies, investors, and healthcare providers.

This analysis explores the current landscape of Capastat Sulfate, focusing on market drivers, barriers, competitive positioning, regulatory environment, and future financial prospects.

Market Overview

Capastat Sulfate is traditionally marketed as an inhalational formulation, primarily targeting HIV/AIDS populations and other immunocompromised groups susceptible to PCP. Despite its longstanding clinical utility since its approval in the late 20th century, the drug's market share faces challenges due to emergence of new therapeutic options and concerns regarding administration complexity.

The global antimicrobial drugs market was valued at approximately USD 70 billion in 2022, with anti-infectives tailored towards respiratory indications constituting a growing segment. However, Capastat's niche positioning limits its direct market expansion, emphasizing the importance of understanding specific drivers pertaining to injection and inhalation therapies.

Key Market Drivers

1. Increasing Incidence of Opportunistic Infections

The rising prevalence of HIV/AIDS, particularly in low- and middle-income countries, sustains demand for effective anti-PCP agents. According to UNAIDS, approximately 38 million people worldwide were living with HIV in 2021, with a significant proportion developing opportunistic infections (OI), including PCP [1]. Capastat Sulfate remains a recommended prophylactic and treatment option in such contexts.

2. Limitations of Alternative Therapies

While trimethoprim-sulfamethoxazole (TMP-SMX) is first-line for PCP, resistance patterns and adverse effects (e.g., hypersensitivity, hematologic toxicity) sometimes necessitate alternative options like Capastat Sulfate. The inhalational route provides localized drug delivery, reducing systemic toxicity, which is attractive for certain patient populations.

3. Growing Awareness of Drug Delivery Technologies

Advancements in inhalation device technology bolster topical antimicrobial therapies' appeal, contributing to incremental growth in drugs like Capastat Sulfate. Patient-friendly devices with reduced administration time and improved comfort support adherence in vulnerable populations.

4. Regulatory Reinforcement

Regulatory bodies in jurisdictions like the US (FDA) and Europe (EMA) continue to endorse inhaled pentamidine for prophylaxis in specific immunocompromised groups, sustaining market relevance.

Market Barriers and Challenges

1. Competition from Alternative Agents

Newer drugs and regimens, including atovaquone and dapsone, increasingly replace Capastat Sulfate due to ease of oral administration and comparable efficacy. These alternatives diminish the drug's hospital and outpatient use.

2. Administration Complexity and Patient Acceptance

Inhalation therapies necessitate specialized devices and training, impacting patient compliance and limiting outpatient applications. The need for skilled healthcare personnel further constrains widespread adoption.

3. Limited Commercial Incentives

As a niche drug, Capastat Sulfate often faces limited marketing investment from pharmaceutical companies, especially in markets where generic forms could dominate.

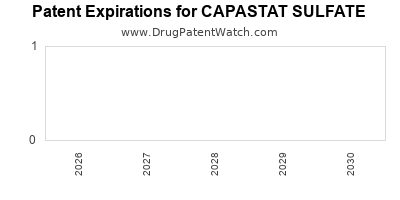

4. Regulatory Barriers and Patent Expiry

Though Capastat Sulfate has long-standing approvals, patent expirations and intellectual property challenges can dampen R&D investment and threaten market exclusivity.

Competitive Landscape

Capastat Sulfate's competition includes:

- Oral alternatives: TMP-SMX, atovaquone, dapsone.

- Intravenous agents: Clindamycin plus primaquine, pentamidine (other formulations).

- Emerging therapies: Liposomal formulations and novel antimicrobials targeting resistant strains.

Large pharmaceutical companies tend to prioritize broader-spectrum or oral molecules over inhalational pentamidine, reducing the competitive pressure but limiting upward growth potential.

Regulatory Environment

Regulatory agencies, such as the FDA and EMA, classify Capastat Sulfate within the anti-infective portfolio, with specific approval for inhalational use. Any future indications or formulations require substantial clinical data, which involve significant R&D investments.

In the context of the COVID-19 pandemic, increased scrutiny on antimicrobial stewardship and infection control further influences regulatory pathways, with some trials exploring repurposing existing antimicrobials for novel indications.

Financial Trajectory and Future Outlook

Given the niche clinical application, the financial trajectory of Capastat Sulfate is characterized by stability within its specific segment rather than aggressive growth. Key factors influencing its future include:

- Market Penetration in High-Risk Populations: Focused on HIV/AIDS and transplant recipients, the persistent prevalence in these groups underpins steady demand.

- Emergence of Resistance: Limited yet notable resistance developments could prompt usage shifts or demand for new formulations.

- Innovative Delivery Systems: Development of user-friendly inhalers or combination therapies could rejuvenate interest.

- Genric Competition: Patent expiries and generic entries could reduce prices, impacting revenue streams for branded formulations.

- Potential for New Indications: Research into other respiratory infections or prophylaxis roles presents potential upside if clinical trials succeed.

Overall, the product's financial outlook is moderate—leaning toward stabilization rather than expansion—unless driven by technological innovation or clinical breakthroughs.

Market Opportunities

1. Pediatric and Geriatric Populations

Extending indications or formulations tailored to vulnerable groups could unlock incremental revenues.

2. Co-Formulations and Fixed-Dose Combinations

Combining Capastat Sulfate with other antimicrobials may enhance compliance and therapeutic efficacy.

3. Emerging Market Expansion

Scaling distribution in regions with rising HIV/AIDS incidences and limited access to oral medications can sustain demand.

4. Novel Delivery Devices

Investing in inhaler technology to improve ease of use could widen outpatient acceptance.

Risks and Uncertainties

- Evolving Treatment Guidelines: Shifts favoring oral therapies diminish inhalational drug usage.

- Resistance Development: Potential decreases in efficacy could curtail utility.

- Pricing Pressures: Cost reductions from generic competition threaten profitability.

- Regulatory Changes: Stringent approval processes could hinder label expansions.

Conclusion

Capastat Sulfate occupies a specialized, stable niche within the anti-infective landscape, primarily serving patients with specific needs for inhalational therapy. The broader market dynamics—driven by the increase in immunosuppressed populations, therapeutic alternatives, and technological advancements—present both challenges and opportunities.

Pharmaceutical entities that innovate delivery mechanisms, explore new indications, and strategically penetrate emerging markets may sustain or modestly expand the drug's financial footprint. However, for long-term growth, overcoming competitive pressures and adapting to evolving clinical paradigms will be vital.

Key Takeaways

- Capastat Sulfate's market remains stable but niche-focused, with demand driven predominantly by HIV/AIDS-related opportunistic infections.

- Competition from oral antimicrobials and long-term trends favoring oral therapies pose significant challenges.

- Technological innovations in inhalation devices and potential new indications offer avenues to extend market relevance.

- Patent expiries and generic entry threaten future profitability, emphasizing the need for continued R&D investments.

- Market expansion in emerging economies and high-risk patient populations can sustain revenue streams, provided adoption hurdles are addressed.

FAQs

1. What are the primary clinical indications for Capastat Sulfate?

It is primarily used for the prophylaxis and treatment of Pneumocystis pneumonia in immunocompromised patients, particularly those with HIV/AIDS and transplant recipients.

2. How does Capastat Sulfate compare to alternative therapies?

While effective, inhaled pentamidine requires specialized administration and faces competition from oral agents like TMP-SMX and atovaquone, which are easier to administer but may have different resistance and toxicity profiles.

3. What are the key barriers to increasing Capastat Sulfate's market share?

Barriers include administration complexity, patient preference for oral therapies, limited awareness or clinician familiarity, and competition from newer drugs.

4. Are there ongoing developments to improve Capastat Sulfate?

Research efforts focus on improving delivery systems, developing combination formulations, and exploring new indications, though such innovations are still emerging.

5. What is the outlook for Capastat Sulfate amid rising antimicrobial resistance?

Resistance remains a concern but has not significantly diminished its utility. Continued surveillance and potential development of resistance-breaking formulations are essential to maintain efficacy.

References

[1] UNAIDS. (2022). Global HIV & AIDS statistics—2022 fact sheet.

[2] MarketWatch. (2023). Global antimicrobial drugs market size and forecasts.

[3] FDA. (2020). Approval information for pentamidine inhalation solution.

[4] WHO. (2021). Opportunistic infections and HIV/AIDS.