Last updated: July 27, 2025

Introduction

Candesartan cilexetil, marketed primarily under the brand name Atacand among others, is a widely prescribed angiotensin II receptor blocker (ARB) indicated for hypertension and heart failure management. As a successor to earlier ARBs like losartan, candesartan has carved out a significant market segment driven by its efficacy, safety profile, and expanding indications. This analysis explores the core market dynamics and the financial trajectory of candesartan cilexetil, considering factors such as patent status, competitive landscape, regulatory environment, and global demand patterns.

Market Overview

The global antihypertensive drug market, valued at approximately USD 32 billion in 2022, encompasses several classes, including ARBs, ACE inhibitors, beta-blockers, and diuretics. ARBs constitute an increasingly important segment owing to their favorable side effect profile compared to ACE inhibitors, with fewer incidences of cough and angioedema. Candesartan cilexetil, as a leading ARB, accounts for a notable share within this segment, with revenues primarily generated in North America, Europe, and parts of Asia-Pacific.

Market Drivers

Efficacy and Safety Profile

Candesartan demonstrates comparable efficacy to other ARBs but benefits from higher receptor affinity and longer duration of action, improving patient adherence and clinical outcomes [1]. Its tolerability has contributed to its widespread adoption, especially in patients intolerant to other antihypertensive agents.

Expanding Therapeutic Indications

Originally approved for hypertension, candesartan’s indications now extend to heart failure with reduced ejection fraction (HFrEF). Such expanded uses increase the overall market potential.

Growing Prevalence of Hypertension and Heart Failure

Global epidemiological data indicates a steady rise in hypertension prevalence, projected to reach 1.5 billion affected individuals by 2025 [2]. The aging population further compounds this trend, amplifying demand for effective antihypert Silytics and heart failure medications.

Healthcare Infrastructure and Access

Increased healthcare access in emerging economies facilitates greater prescribing of ARBs, including candesartan, driven by broader screening programs and cardio-vascular health initiatives.

Market Challenges

Patent Landscape and Generic Competition

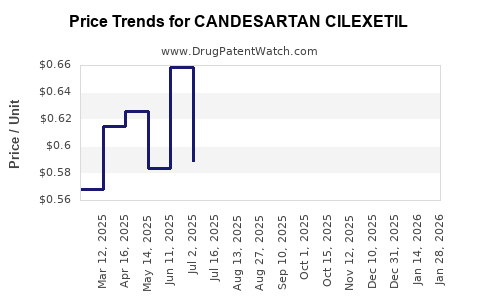

Candesartan was initially marketed under proprietary patent protections, which have largely expired in many jurisdictions. This has led to the proliferation of generic versions, exerting downward pressure on pricing. While innovator sales remain vital in regions with patent protections, generics dominate in key markets, eroding profit margins.

Pricing and Reimbursement Policies

Reimbursement constraints, especially in cost-sensitive markets, influence prescribing patterns. Payers often favor generics, limiting revenue opportunities for branded formulations.

Competitive Landscape

The ARB class comprises several blockbuster drugs, including losartan, valsartan, irbesartan, and telmisartan. Among these, losartan’s patent expiry predates that of candesartan, affecting market share dynamics. Recently, newer ARBs with novel formulations or combined therapies challenge candesartan’s market position.

Regulatory Hurdles

Approval of new indications or formulations involves rigorous clinical trials and regulatory review, potentially delaying revenue growth. Additionally, emerging pharmacovigilance data demands continuous safety evaluation.

Financial Trajectory

Historical Performance

Originator companies like AstraZeneca (which marketed Atacand until 2010) have seen initial high revenues from candesartan, peaking in the early 2010s. Post-patent expiry, revenues shifted predominantly toward generic manufacturers, leading to significant price erosion.

Current Revenue Streams

In mature markets, branded sales constitute a smaller fraction, with generics capturing the majority. However, geographic markets with robust healthcare infrastructure, such as the US, Europe, and some Asian nations, still report consistent prescriptions of branded candesartan at premium pricing.

Future Projections

Analysts forecast a compound annual growth rate (CAGR) of approximately 3-4% for the global candesartan market from 2023 to 2028, driven by increasing hypertension prevalence, the aging population, and clinical guideline updates favoring ARB use over ACE inhibitors in specific patient subsets [3].

Generics are expected to dominate revenue shares, but branded formulations could sustain niche markets, especially where physician preferences and brand loyalty influence prescribing behavior.

Emerging Markets and Licensing Opportunities

Market expansion in China, India, and Latin America offers lucrative prospects due to rising healthcare expenditure and urbanization. Strategic licensing agreements and partnerships could bolster revenue streams for patent holders or generic manufacturers.

Innovation and Formulation Developments

While no major patent expiries are anticipated soon, incremental innovations such as fixed-dose combinations (FDCs) with other antihypertensive classes, extended-release formulations, or biosimilar introductions could diversify the product portfolio and bolster revenue.

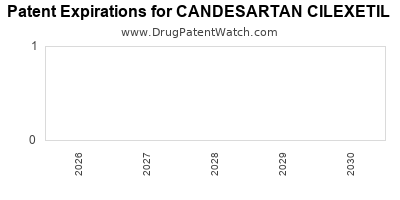

Regulatory and Patent Outlook

Patent exclusivity for candesartan cilexetil has largely concluded by 2013 in developed markets, opening the fiercely competitive generic arena. Future patent filings, if any, are likely related to formulations or methods of manufacturing rather than the active molecule itself.

Regulatory agencies, including the FDA and EMA, continue to review safety data, with post-marketing commitments ensuring sustained availability. Any potential regulatory hurdles can influence sales trajectories but are unlikely to impact the core market significantly.

Key Market Trends and Future Outlook

- Shift toward Personalized Medicine: Increasing recognition of pharmacogenomic factors influencing response may shape future prescribing patterns.

- Growth in Cardiovascular Disease Management: Rising awareness and preventive measures support sustained demand.

- Price Competition: The proliferation of generics is expected to continue exerting downward pressure on prices in mature markets.

- Pipeline Developments: While newer ARBs and combination therapies emerge, candesartan’s established safety profile assures its continued presence in treatment algorithms.

Conclusion and Strategic Considerations

Candesartan cilexetil's market dynamics hinge on a confluence of patent expiries, generic competition, and evolving clinical guidelines. While branded sales may decline, the overall market for candesartan remains resilient, backed by global hypertension and heart failure prevalence. Companies should focus on leveraging manufacturing efficiencies, expanding into emerging markets, and innovating through fixed-dose combinations or novel formulations.

Key Takeaways

- The global candesartan market is stabilized by its efficacy, safety, and expanding clinical indications, despite intense generic competition.

- Patent expiries have shifted revenue emphasis from branded to generic markets, impacting profit margins.

- Rising hypertension prevalence and aging populations collectively sustain demand, particularly in emerging markets.

- Strategic licensing, formulations, and new combination therapies offer growth avenues amid competitive pressures.

- Continuous regulatory vigilance and post-marketing safety data influence market stability and future prospects.

FAQs

1. What are the main factors influencing the decline of branded candesartan sales?

Patent expirations have introduced widespread generic competition, substantially reducing prices and market shares for branded formulations. This shift is compounded by healthcare payers favoring low-cost generics and prescribing guidelines promoting cost-effective therapies.

2. How does the competitive landscape impact the profitability of candesartan?

Generic competition exerts significant pressure on pricing, squeezing profit margins for both original innovators and generic manufacturers. Strategic differentiation through formulations or combination therapies becomes essential to maintain profitability.

3. Which markets present the highest growth opportunities for candesartan?

Emerging markets like China, India, and Latin America exhibit high growth potential due to increasing hypertension prevalence, expanding healthcare access, and favorable economic trends, provided regulatory and reimbursement barriers are addressed.

4. Are there any promising pipeline developments for candesartan?

While no major patent protections are anticipated soon, incremental innovations such as fixed-dose combinations, extended-release formulations, or biosimilars may enhance market share and therapeutic efficacy.

5. How might future regulatory changes impact candesartan’s market?

Stringent safety monitoring, labeling updates, or new approval pathways could influence prescribing practices. However, the established clinical profile of candesartan and regulatory trends favoring ARBs suggest limited adverse impact.

References

[1] Mancia G, et al. (2017). "The role of candesartan in hypertension management." Current Hypertension Reports.

[2] World Health Organization. (2020). "Global Brief on Hypertension."

[3] MarketWatch. (2022). "Antihypertensive Drugs Market Outlook and Forecast."