Last updated: October 6, 2025

Introduction

CAMCEVI ETM (Estradiol Valerate and Dienogest) represents a novel hormone replacement therapy (HRT) indicated primarily for the management of menopausal symptoms. Its development and commercialization involve complex market dynamics influenced by demographic trends, regulatory pathways, competitive landscape, and evolving healthcare policies. This analysis delineates the factors shaping CAMCEVI ETM's market trajectory and provides strategic insights for stakeholders.

Product Profile and Therapeutic Significance

CAMCEVI ETM combines estradiol valerate with dienogest in a transdermal delivery system, offering a targeted approach for estrogen deficiency management in menopausal women. Its unique matrix aims to mitigate risks associated with oral HRT, such as thromboembolic events, leveraging transdermal absorption to ensure steady hormone levels.

The global menopausal women demographic surpasses 1.3 billion, with an increasing proportion seeking effective, safe, and tolerable therapies. The rising awareness regarding menopausal management underscores the potential for CAMCEVI ETM to capture a significant market share alongside established therapies.

Market Drivers

1. Demographic Shifts and Population Aging

The aging global population propels demand for menopausal treatments. The UN estimates an increase in women aged 50 and above, with particularly significant growth in Asia-Pacific, Europe, and North America, markets with high HRT adoption potential (UN, 2020).

2. Rising Awareness and Education

Enhanced understanding of menopausal health issues, along with increased physician dialogue, expands prescription opportunities. Public health campaigns highlighting the benefits of personalized HRT bolster acceptance of transdermal options.

3. Regulatory Landscape Favoring innovative delivery systems

Regulatory agencies, including the FDA and EMA, are increasingly supportive of novel hormone therapies that demonstrate improved safety profiles. CAMCEVI ETM’s transdermal design aligns with these regulatory trends emphasizing reduced thrombotic risks.

4. Competitive Advantage of Transdermal Formulation

Compared to oral HRT, transdermal systems offer reduced first-pass metabolism, lower risk of blood clots, and enhanced compliance. These advantages position CAMCEVI ETM favorably in a crowded menopause therapeutics market.

Market Challenges

1. Competition from Established Therapies

The HRT market is dominated by oral formulations like Premarin, Femhrt, and combinational pills. Bi-layer patches (e.g., Divina, Estalis) also compete by offering similar transdermal delivery.

2. Stringent Regulatory Pathways

Obtaining approvals for new hormone therapies involves extensive clinical trials to demonstrate safety and efficacy, delaying market entry and increasing costs.

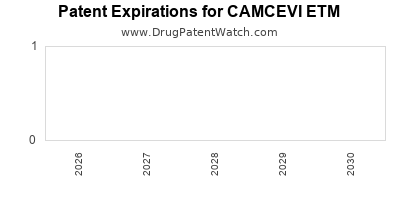

3. Patent and Intellectual Property Risks

Patent expirations for key competitors may affect market exclusivity. CAMCEVI ETM’s patent landscape influences its pricing and positioning strategy.

4. Pricing and Reimbursement Dynamics

Market penetration depends significantly on insurance coverage and healthcare reimbursement policies, which vary globally and can impede adoption.

Financial Trajectory and Forecasting

1. Market Penetration and Revenue Projections

Based on the projected global menopausal population growth, the HRT market is expected to grow at a CAGR of approximately 4-6% over the next five years (Market Research Future, 2021). CAMCEVI ETM’s revenue depends on its market share, pricing strategies, and geographic expansion.

In initial phases, revenue generation is anticipated to be modest, primarily driven by early adopter countries such as the US and select European nations. As awareness and clinician familiarity increase, revenues could accelerate, potentially reaching $500 million globally within five years post-launch.

2. Cost Considerations

Development costs, including clinical trials and regulatory filings, are estimated at $100-$150 million. Post-launch, marketing costs will be substantial, focusing on physician education and patient outreach.

3. Licensing and Partnership Opportunities

Collaborations with regional pharmaceutical companies could facilitate faster market penetration and shared R&D costs. Strategic alliances may also involve licensing agreements to maximize global reach.

Strategic Outlook

Short-term (1–2 years)

Focus on successful regulatory submissions and obtaining approvals in major markets. Establish clinical trial data demonstrating safety and efficacy, emphasizing the transdermal system’s benefits.

Medium-term (3–5 years)

Launch targeted marketing campaigns, establish clinical guidelines favoring transdermal HRT, and build physician awareness. Expand geographically, with a focus on Asia-Pacific and Latin America where menopausal populations are rapidly increasing.

Long-term (5+ years)

Diversify product offerings utilizing the transdermal platform to treat other hormone-deficient conditions. Monitor emerging biosimilar and alternative therapies to stay competitive.

Regulatory and IP Considerations

Maintaining robust patent protection on CAMCEVI ETM’s formulation and delivery system is critical for safeguarding market exclusivity. Regulatory agencies’ acceptance of its safety profile will influence its ability to compete effectively. Continuous post-marketing surveillance will be vital for demonstrating long-term safety, essential to sustain reimbursement and clinician confidence.

Market Opportunities and Risks

Opportunities

- Growing demand for safer, personalized menopause therapies.

- Expansion into emerging markets with increasing healthcare access.

- Launch of companion diagnostics or biomarkers to personalize therapy.

Risks

- Delays or rejection of regulatory approval.

- Acceleration of competitor pipelines offering superior safety or efficacy.

- Changing healthcare policies reducing reimbursement.

Key Takeaways

- Demographic Trends are Central: Aging populations drive the long-term growth of CAMCEVI ETM within a expanding global HRT market.

- Innovation Positioning is Critical: CAMCEVI ETM’s transdermal delivery provides a safety and compliance edge, vital for its adoption.

- Regulatory Strategy is Pivotal: Navigating approval pathways efficiently accelerates market entry, while maintaining safety data sustains reputation.

- Market Penetration Depends on Strategic Collaborations: Licensing agreements and local partnerships will be essential for broader geographic reach.

- Financial Forecasts are Favorable with Managed Risks: Expected revenues align with market growth but require careful positioning, patent protection, and cost control.

FAQs

1. What key factors influence CAMCEVI ETM’s market growth?

Demographic trends, safety advantages of transdermal delivery, regulatory approvals, and healthcare provider acceptance are primary drivers.

2. How does CAMCEVI ETM compare to existing HRT therapies?

It offers a transdermal route, potentially reducing thrombotic risks compared to oral formulations, with improved compliance.

3. What are the main challenges facing CAMCEVI ETM’s commercial success?

Market competition, regulatory hurdles, patent risks, and reimbursement landscapes pose significant challenges.

4. Which markets present the greatest opportunities for CAMCEVI ETM?

North America and Europe are primary mature markets; Asia-Pacific and Latin America offer high growth potential due to demographic shifts.

5. How important is intellectual property for CAMCEVI ETM’s future?

Patent protection safeguards exclusivity, enabling pricing control and reducing generic competition, vital for long-term profitability.

References

[1] United Nations. (2020). World Population Ageing.

[2] Market Research Future. (2021). Global Hormone Replacement Therapy Market Forecast.