CALQUENCE Drug Patent Profile

✉ Email this page to a colleague

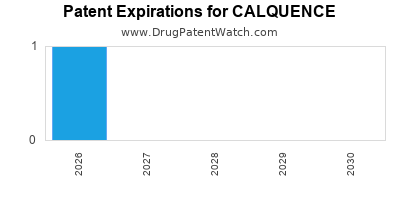

Which patents cover Calquence, and when can generic versions of Calquence launch?

Calquence is a drug marketed by Astrazeneca and is included in two NDAs. There are nine patents protecting this drug and two Paragraph IV challenges.

This drug has one hundred and ninety-two patent family members in fifty countries.

The generic ingredient in CALQUENCE is acalabrutinib maleate. One supplier is listed for this compound. Additional details are available on the acalabrutinib maleate profile page.

DrugPatentWatch® Generic Entry Outlook for Calquence

Calquence was eligible for patent challenges on October 31, 2021.

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be July 1, 2036. This may change due to patent challenges or generic licensing.

There have been eight patent litigation cases involving the patents protecting this drug, indicating strong interest in generic launch. Recent data indicate that 63% of patent challenges are decided in favor of the generic patent challenger and that 54% of successful patent challengers promptly launch generic drugs.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for CALQUENCE?

- What are the global sales for CALQUENCE?

- What is Average Wholesale Price for CALQUENCE?

Summary for CALQUENCE

| International Patents: | 192 |

| US Patents: | 9 |

| Applicants: | 1 |

| NDAs: | 2 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 68 |

| Clinical Trials: | 44 |

| Patent Applications: | 2,613 |

| Drug Prices: | Drug price information for CALQUENCE |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for CALQUENCE |

| What excipients (inactive ingredients) are in CALQUENCE? | CALQUENCE excipients list |

| DailyMed Link: | CALQUENCE at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for CALQUENCE

Generic Entry Dates for CALQUENCE*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

CAPSULE;ORAL |

Generic Entry Dates for CALQUENCE*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

TABLET;ORAL |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Recent Clinical Trials for CALQUENCE

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Jeremy Abramson, MD | Phase 2 |

| Ohio State University Comprehensive Cancer Center | Phase 2 |

| Jonsson Comprehensive Cancer Center | Phase 1/Phase 2 |

Pharmacology for CALQUENCE

| Drug Class | Kinase Inhibitor |

| Mechanism of Action | Tyrosine Kinase Inhibitors |

Paragraph IV (Patent) Challenges for CALQUENCE

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| CALQUENCE | Tablets | acalabrutinib maleate | 100 mg | 216387 | 1 | 2024-02-13 |

| CALQUENCE | Capsules | acalabrutinib | 100 mg | 210259 | 5 | 2021-11-01 |

US Patents and Regulatory Information for CALQUENCE

CALQUENCE is protected by forty-six US patents and two FDA Regulatory Exclusivities.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of CALQUENCE is ⤷ Get Started Free.

This potential generic entry date is based on patent ⤷ Get Started Free.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Astrazeneca | CALQUENCE | acalabrutinib maleate | TABLET;ORAL | 216387-001 | Aug 3, 2022 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Astrazeneca | CALQUENCE | acalabrutinib | CAPSULE;ORAL | 210259-001 | Oct 31, 2017 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| Astrazeneca | CALQUENCE | acalabrutinib maleate | TABLET;ORAL | 216387-001 | Aug 3, 2022 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Astrazeneca | CALQUENCE | acalabrutinib | CAPSULE;ORAL | 210259-001 | Oct 31, 2017 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

EU/EMA Drug Approvals for CALQUENCE

| Company | Drugname | Inn | Product Number / Indication | Status | Generic | Biosimilar | Orphan | Marketing Authorisation | Marketing Refusal |

|---|---|---|---|---|---|---|---|---|---|

| AstraZeneca AB | Calquence | acalabrutinib | EMEA/H/C/005299Calquence as monotherapy or in combination with obinutuzumab is indicated for the treatment of adult patients with previously untreated chronic lymphocytic leukaemia (CLL).Calquence as monotherapy is indicated for the treatment of adult patients with chronic lymphocytic leukaemia (CLL) who have received at least one prior therapy. | Authorised | no | no | no | 2020-11-05 | |

| >Company | >Drugname | >Inn | >Product Number / Indication | >Status | >Generic | >Biosimilar | >Orphan | >Marketing Authorisation | >Marketing Refusal |

International Patents for CALQUENCE

When does loss-of-exclusivity occur for CALQUENCE?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Australia

Patent: 16286548

Estimated Expiration: ⤷ Get Started Free

Patent: 20277123

Estimated Expiration: ⤷ Get Started Free

Patent: 22291635

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 91096

Estimated Expiration: ⤷ Get Started Free

Chile

Patent: 17003445

Estimated Expiration: ⤷ Get Started Free

China

Patent: 8349978

Estimated Expiration: ⤷ Get Started Free

Patent: 3480542

Estimated Expiration: ⤷ Get Started Free

Croatia

Patent: 0200934

Estimated Expiration: ⤷ Get Started Free

Patent: 0211511

Estimated Expiration: ⤷ Get Started Free

Patent: 0230417

Estimated Expiration: ⤷ Get Started Free

Cyprus

Patent: 24519

Estimated Expiration: ⤷ Get Started Free

Patent: 24815

Estimated Expiration: ⤷ Get Started Free

Patent: 26103

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 17281

Estimated Expiration: ⤷ Get Started Free

Patent: 13745

Estimated Expiration: ⤷ Get Started Free

Patent: 54690

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 17281

Estimated Expiration: ⤷ Get Started Free

Patent: 13745

Estimated Expiration: ⤷ Get Started Free

Patent: 54690

Estimated Expiration: ⤷ Get Started Free

Patent: 09493

Estimated Expiration: ⤷ Get Started Free

Finland

Patent: 54690

Estimated Expiration: ⤷ Get Started Free

Hong Kong

Patent: 50511

Estimated Expiration: ⤷ Get Started Free

Hungary

Patent: 49989

Estimated Expiration: ⤷ Get Started Free

Patent: 56008

Estimated Expiration: ⤷ Get Started Free

Patent: 62258

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 6633

Estimated Expiration: ⤷ Get Started Free

Patent: 4066

Estimated Expiration: ⤷ Get Started Free

Patent: 3821

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 29215

Estimated Expiration: ⤷ Get Started Free

Patent: 91494

Estimated Expiration: ⤷ Get Started Free

Patent: 18522877

Estimated Expiration: ⤷ Get Started Free

Patent: 21073235

Estimated Expiration: ⤷ Get Started Free

Patent: 22120156

Estimated Expiration: ⤷ Get Started Free

Lithuania

Patent: 17281

Estimated Expiration: ⤷ Get Started Free

Patent: 13745

Estimated Expiration: ⤷ Get Started Free

Patent: 54690

Estimated Expiration: ⤷ Get Started Free

Malaysia

Patent: 3514

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 8495

Estimated Expiration: ⤷ Get Started Free

Patent: 18000179

Estimated Expiration: ⤷ Get Started Free

Patent: 20014163

Estimated Expiration: ⤷ Get Started Free

Moldova, Republic of

Patent: 17281

Estimated Expiration: ⤷ Get Started Free

Morocco

Patent: 297

Estimated Expiration: ⤷ Get Started Free

Patent: 817

Estimated Expiration: ⤷ Get Started Free

Patent: 556

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 17281

Estimated Expiration: ⤷ Get Started Free

Patent: 13745

Estimated Expiration: ⤷ Get Started Free

Patent: 54690

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 17281

Estimated Expiration: ⤷ Get Started Free

Patent: 13745

Estimated Expiration: ⤷ Get Started Free

Patent: 54690

Estimated Expiration: ⤷ Get Started Free

Russian Federation

Patent: 18103913

Estimated Expiration: ⤷ Get Started Free

San Marino

Patent: 02000304

Estimated Expiration: ⤷ Get Started Free

Patent: 02100597

Estimated Expiration: ⤷ Get Started Free

Patent: 02300165

Estimated Expiration: ⤷ Get Started Free

Serbia

Patent: 411

Estimated Expiration: ⤷ Get Started Free

Patent: 455

Estimated Expiration: ⤷ Get Started Free

Patent: 195

Estimated Expiration: ⤷ Get Started Free

Singapore

Patent: 201913796U

Estimated Expiration: ⤷ Get Started Free

Slovenia

Patent: 17281

Estimated Expiration: ⤷ Get Started Free

Patent: 13745

Estimated Expiration: ⤷ Get Started Free

Patent: 54690

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 1800329

Estimated Expiration: ⤷ Get Started Free

Patent: 2000300

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 2688052

Estimated Expiration: ⤷ Get Started Free

Patent: 180048593

Estimated Expiration: ⤷ Get Started Free

Patent: 240115937

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 97987

Estimated Expiration: ⤷ Get Started Free

Patent: 95802

Estimated Expiration: ⤷ Get Started Free

Patent: 46489

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering CALQUENCE around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Israel | 293821 | צורות מוצקות ופורמולציות של (אס)-4-(8-אמינו-3-(1-(בוט-2-איינאויל)פירולידין-2-איל)אימידאזו[5,1-איי]פיראזין-1-איל)-אן-(פירידין-2-איל)בנזאמיד (Solid forms and formulations of (s)-4-(8-amino-3-(1 -(but-2-ynoyl)pyrrolidin-2-yl)imidazo[1,5-a]pyrazin-1-yl)-n-(pyridin-2-yl)benzamide) | ⤷ Get Started Free |

| Nicaragua | 201400004 | ⤷ Get Started Free | |

| Israel | 293821 | ⤷ Get Started Free | |

| Canada | 2841886 | 4-IMIDAZOPYRIDAZIN-1-YL-BENZAMIDES ET 4-IMIDAZOTRIAZIN-1-YL-BENZAMIDES EN TANT QU'INHIBITEURS DE BTK (4-IMIDAZOPYRIDAZIN-1-YL-BENZAMIDES AND 4-IMIDAZOTRIAZIN-1-YL-BENZAMIDES AS BTK-INHIBITORS) | ⤷ Get Started Free |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for CALQUENCE

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 2734522 | 2021/011 | Ireland | ⤷ Get Started Free | PRODUCT NAME: ACALABRUTINIB OR A PHARMACEUTICALLY ACCEPTABLE SALT THEREOF; REGISTRATION NO/DATE: EU/1/20/1479 20201106 |

| 2734522 | 132021000000047 | Italy | ⤷ Get Started Free | PRODUCT NAME: ACALABRUTINIB O UN SUO SALE FARMACEUTICAMENTE ACCETTABILE(CALQUENCE); AUTHORISATION NUMBER(S) AND DATE(S): EU/1/20/1479, 20201106 |

| 2734522 | C202130014 | Spain | ⤷ Get Started Free | PRODUCT NAME: ACALABRUTINIB O UNA SAL FARMACEUTICAMENTE ACEPTABLE DEL MISMO; NATIONAL AUTHORISATION NUMBER: EU/1/20/1479; DATE OF AUTHORISATION: 20201105; NUMBER OF FIRST AUTHORISATION IN EUROPEAN ECONOMIC AREA (EEA): EU/1/20/1479; DATE OF FIRST AUTHORISATION IN EEA: 20201105 |

| 2734522 | LUC00202 | Luxembourg | ⤷ Get Started Free | PRODUCT NAME: ACALABRUTINIB OU UN SEL PHARMACEUTIQUEMENT ACCEPTABLE DE CELUI-CI; AUTHORISATION NUMBER AND DATE: EU/1/20/1479 20201106 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for CALQUENCE (Acalabrutinib)

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.