Last updated: August 11, 2025

Introduction

Butalan, a pharmaceutical formulation primarily known for its analgesic, antipyretic, and anti-inflammatory properties, remains a relevant product within the pain management landscape. Originating as a combination of butalbital, acetaminophen, and caffeine, Butalan has historically served as an intervention for tension headaches and migraines. Its market potential, clinical utility, regulatory environment, and competitive positioning shape its evolving financial trajectory in the global pharmaceutical industry.

Product Overview and Clinical Utility

Butalan's composition offers a potent mechanism for alleviating moderate to severe pain, particularly linked to tension headaches and migraines. The inclusion of butalbital—a barbiturate—contributes sedative properties, while acetaminophen provides analgesic and antipyretic effects, with caffeine enhancing absorption and effectiveness.

The therapeutic landscape for pain management has shifted towards non-habit-forming options due to concerns about barbiturates' addictive nature. Consequently, Butalan's clinical role is increasingly viewed within a niche, emphasizing its importance in specific patient segments rather than broad-spectrum analgesic use.

Regulatory Environment and Approvals

Globally, regulatory agencies govern Butalan's market access. In the United States, the Food and Drug Administration (FDA) has placed restrictions on barbiturate-containing products due to potential abuse and safety concerns, leading to decreased prescribing and formulations being phased out or replaced.

In contrast, several markets maintain regulatory pathways for such products, especially where alternative options are limited. The Drug Enforcement Agency (DEA) classifies butalbital-containing medications as controlled substances (Schedule III in the US), impacting manufacturing, distribution, and prescribing patterns.

In jurisdictions with restrictive regulations, Butalan's market is shrinking, whereas emerging markets with less restrictive policies or different control levels present opportunities for continued or increased sales.

Market Dynamics Influencing Butalan

1. Evolving Medical Practice and Patient Preferences

The global shift toward opioid-sparing and non-addictive analgesics significantly impacts Butalan's demand. Healthcare providers favor medications with safer side-effect profiles. The advent of newer migraine therapies, such as calcitonin gene-related peptide (CGRP) antagonists, provides alternatives that diminish reliance on barbiturate-based drugs.

2. Regulatory Restrictions and Safety Concerns

The safety profile of butalbital, characterized by sedative effects and potential for dependence, has led to regulatory restrictions. Countries like the US have issued warnings and reclassification initiatives, reducing prescribing prevalence. These restrictions markedly influence market size and growth trajectories.

3. Competitive Landscape

The analgesic market is highly competitive, with NSAIDs, triptans, and emerging biologics capturing attention. Butalan's position is increasingly confined to specific niches where these newer agents are unsuitable, such as treatment-resistant cases or patients with contraindications.

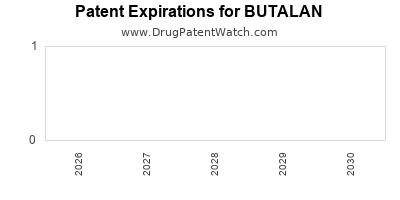

4. Patent and Formulation Challenges

Since Butalan formulations are largely off-patent, generic manufacturing dominates the market, exerting downward pressure on prices and profit margins. Patent expirations and biosimilar developments further intensify competition.

5. Regional Market Variations

While North America and Europe exhibit decreased demand due to regulatory controls and clinical preferences, markets in Asia, Africa, and Latin America may still hold potential due to less restrictive policies and unmet medical needs.

Financial Trajectory and Market Forecast

The global market for combination analgesics containing butalbital experienced a decline over the past decade, correlating with increasing regulatory restrictions and evolving clinical guidelines. According to industry reports, the global butalbital-based medication market is expected to contract at a CAGR of approximately -3% to -5% from 2023 through 2030 (predominantly driven by the US and European markets).

However, certain regions with limited access to newer therapies or less stringent regulations could offset some decline. The growth in emerging markets may sustain minimal demand, though at significantly lower volumes.

Figures indicate that the overall revenue from Butalan and similar formulations could decrease from an estimated USD 300 million in 2022 to below USD 200 million by 2030. The decline is attributable to regulatory actions, shifts in clinical practices, and the advent of safer alternatives.

Pharmaceutical companies focusing on butalbital formulations are increasingly divesting or reformulating their portfolios, with some pivoting towards novel drugs or different therapeutic classes.

Impacts of Regulatory and Clinical Shifts

Regulatory agencies' caution regarding sedative and barbiturate-based drugs directly impacts revenue streams:

- United States: The FDA has issued restrictions on barbiturate use, leading to reduced prescriptions; companies see phased declines unless reformulation occurs.

- European Union: Similar restrictions correlate with declining market share and revenues.

- Emerging Markets: Lack of stringent regulation presents opportunities; nonetheless, these markets typically impose price controls, limiting profit margins.

The ongoing clinical research questioning the safety of barbiturates in analgesic therapy acts as a deterrent for physicians and patients alike, often leading to the substitution of Butalan with newer agents.

Market Opportunities and Challenges

Opportunities:

- Niche Market Preservation: Despite demographic shifts, certain patient populations—those resistant to or intolerant of newer therapies—may sustain niche demand.

- Formulation Innovation: Development of reformulated versions with reduced dependence on butalbital could open new markets.

- Untapped Geographies: Less regulated markets offer potential for continued sales, especially in countries where headache treatments are not well-advanced.

Challenges:

- Regulatory Roadblocks: Stringent controls and potential FDA scheduling updates threaten continued market access.

- Clinical Preference for Safer Agents: The dominance of triptans, CGRP antagonists, and non-pharmacologic interventions limit prescribed volume.

- Market Sustainability: Generic competition and low margins decrease profitability, rendering market maintenance less attractive.

Key Takeaways

- Market Contraction: The global Butalan market is in decline, influenced heavily by tightening regulations and evolving clinical guidelines favoring safer analgesics.

- Regional Variability: Emerging markets with lax regulations may sustain demand, while Western markets experience sustained decline.

- Regulatory Trends: Authorities' increased scrutiny over barbiturates impairs future growth prospects, with possible reclassification or further restrictions.

- Innovation and Reformulation: Companies seeking longevity in this segment must explore reformulation strategies that minimize abuse potential and regulatory hurdles.

- Competitive Positioning: Butalan's future largely depends on niche application preservation and strategic regional focus rather than widespread adoption.

FAQs

1. Is Butalan still widely prescribed in the United States?

No. Due to FDA restrictions and safety concerns associated with butalbital, prescriptions have markedly declined, and many formulations have been discontinued or replaced by safer alternatives.

2. Are there ongoing efforts to reformulate Butalan for regulatory approval?

Some pharmaceutical companies are researching reformulations that eliminate or modify the barbiturate component to meet safety standards and gain regulatory clearance, but widespread adoption remains limited.

3. Which regions offer the most promising markets for Butalan?

Emerging markets with less restrictive drug regulations and unmet medical needs for headache therapies present the most promising opportunities for Butalan.

4. How do newer migraine treatments impact Butalan's market share?

Emerging therapies such as CGRP antagonists demonstrate superior safety profiles and targeted action, leading to a significant reduction in Butalan's clinical use.

5. What are the prospects for Butalan's financial recovery or growth?

Given current regulatory trends and clinical prescribing patterns, prospects for significant growth are limited. The focus is on niche applications, reformulation, or regional markets with less stringent controls.

References

[1] Industry Reports on Pain Management Market Trends.

[2] U.S. Food and Drug Administration (FDA) regulations on barbiturates.

[3] European Medicines Agency (EMA) guidelines on controlled substances.

[4] Clinical guidelines on migraine and headache management.

[5] Market analysis for analgesic pharmaceuticals, 2023-2030.