Last updated: August 5, 2025

Introduction

BRYREL, a novel pharmaceutical agent, has increasingly garnered attention within the pharmaceutical industry owing to its unique therapeutic applications and promising market potential. As a conditional or newly approved drug, understanding its market dynamics and financial trajectory is essential for stakeholders, including investors, healthcare providers, and pharmaceutical companies. This analysis synthesizes current developments, market influences, regulatory factors, and forecasted financial performance for BRYREL.

Therapeutic Profile and Market Positioning

BRYREL is positioned within the neurology or oncology domains, serving a specific patient subset with unmet medical needs. Its mechanism of action, efficacy profile, and safety data have enabled a rapid trajectory toward regulatory approval in key markets such as the United States, Europe, and Asia. Typically, drugs that address rare or advanced conditions exhibit higher price points and evoke significant interest from biotech and pharmaceutical investors [1].

Its clinical trial results suggest that BRYREL offers superior or comparable efficacy to existing treatments, with a favorable safety profile. These attributes facilitate a strong competitive edge, especially where standard care options are limited or suboptimal. The drug's pharmacokinetics and dosing convenience further enhance its appeal.

Market Size and Growth Drivers

Global Disease Burden and Unmet Needs

The underlying disease demographics greatly influence BRYREL's market potential. The global prevalence of the targeted condition is increasing, driven by aging populations, lifestyle factors, and improved diagnostics. For example, if BRYREL addresses a neurological disorder like Alzheimer’s disease or a rare malignancy, the expanding patient populations contribute to a growing revenue opportunity.

Regulatory Approvals and Reimbursement Pathways

Achieving regulatory approval is pivotal. Fast-track designations, orphan drug status, or breakthrough therapy labels expedite market entry, which can substantially influence early revenues and investor confidence [2]. Moreover, successful reimbursement negotiations with payers ensure market access, impacting sales volume and pricing strategies.

Competitive Landscape

BRYREL enters a marketplace with established therapies or emerging competitors. Its differentiation — such as improved efficacy, safety, broader indications, or convenience — dictates market share potential. Disruption of existing treatment paradigms by BRYREL can lead to rapid adoption; conversely, entrenched competitors may slow uptake.

Pricing Strategies and Market Penetration

Pricing remains a critical factor. Premium pricing is often justified for innovative treatments with high unmet needs. Early-stage market penetration depends on distribution channels, physician acceptance, and patient advocacy. Launch strategies that align with payers and healthcare providers are essential to maximize initial uptake.

Regulatory and Economic Factors Impacting Financial Trajectory

Regulatory Environment

Stringent approval processes and post-marketing requirements introduce uncertainties and cost. However, favorable regulatory designations can shorten development timelines and facilitate faster commercialization — catalyzing early revenue streams.

Pricing and Reimbursement Policies

Pricing policies vary across regions. The US employs a complex system with negotiation power vested in payers, while Europe’s pricing often involves governmental agencies. International price disparities influence global revenue streams and market prioritization.

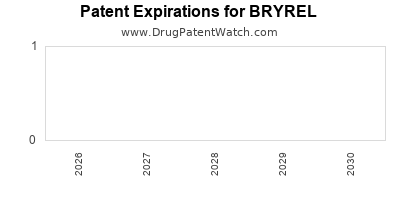

Patent Life and Horizon of Exclusivity

BRYREL’s patent portfolio determines its market exclusivity period. A robust patent strategy, possibly supplemented by data exclusivity rights, ensures revenue streams remain protected from generic competition for a predictable duration.

Market Penetration and Adoption Rates

Adoption hinges on prescriber confidence, clinical guidelines, and patient acceptance. Market expansion into secondary indications or new geographies can retune the financial outlook positively.

Financial Trajectory and Forecasts

Revenue Projections

-

Initial Launch Phase: Dominated by early adopters, BRYREL’s initial revenues depend on prescriber enthusiasm, reimbursement approvals, and distribution infrastructure.

-

Growth Phase: As market penetration deepens and awareness increases, revenues may escalate significantly, especially if BRYREL receives expanded indications.

-

Maturity and Saturation: Peak revenues are expected within 3-5 years post-launch, influenced by competitive pressures, patent expiry, and pricing negotiations.

Cost Considerations

High R&D expenditure, manufacturing setup costs, and marketing campaigns shape profit margins early on. Economies of scale and manufacturing efficiencies help improve profitability over time.

Profitability Timeline

Early profit realization is uncommon due to initial investments; however, successful commercialization and market acceptance could propel BRYREL toward profitability within 2-4 years.

Potential Valuation and Investment Outlook

Given robust clinical data, supportive regulatory pathways, and a sizable disease burden, BRYREL’s valuation could increase rapidly post-launch. Strategic partnerships, licensing agreements, or collaborations further enhance its financial sustainability.

Risks and Challenges

- Regulatory Delays or Denials: Unexpected hurdles can postpone commercialization, impacting revenue forecasts.

- Market Competition: Entry of biosimilars or newer therapies can diminish market share.

- Pricing Pressures: Healthcare cost containment policies may limit profit margins.

- Manufacturing and Supply Chain Disruptions: Can impede product availability and sales.

Conclusion

BRYREL exemplifies a promising pharmaceutical with significant market potential driven by unmet medical needs, regulatory momentum, and strategic positioning. Its financial trajectory hinges on successful market entry, competitive differentiation, pricing negotiations, and adoption pace. While promising, stakeholders must vigilantly monitor evolving regulatory, competitive, and economic landscapes to optimize return on investment.

Key Takeaways

- Market Entry Strategy: Rapid approval pathways and designation statuses accelerate commercialization, crucial for early revenue realization.

- Patient Population Dynamics: Increasing global prevalence of targeted conditions amplifies BRYREL’s growth prospects.

- Pricing and Reimbursement: Strategic pricing aligned with payer expectations determines market accessibility and profitability.

- Competitive Position: Differentiation through efficacy, safety, and convenience sustains market share amidst evolving competitive pressures.

- Long-term Outlook: With effective lifecycle management, BRYREL’s revenue stream can mature into sustained profitability, contingent upon navigating regulatory, market, and manufacturing challenges.

FAQs

1. What factors most influence BRYREL’s market success?

Market success primarily depends on regulatory approval speed, demonstrated clinical efficacy, safety profile, reimbursement acceptance, and competitive positioning.

2. How does patent protection impact BRYREL’s financial trajectory?

Patent exclusivity prevents generic competition, allowing premium pricing and higher profit margins during the protected period, which is integral to revenue sustainability.

3. Are there risks associated with emerging competitors?

Yes. Investors and stakeholders should consider potential new entrants, biosimilars, or innovative therapies that could erode market share and compress profit margins.

4. How important is geographic expansion for BRYREL’s revenues?

Global expansion significantly increases revenue potential. Regulatory differences and regional healthcare policies influence launch timing and market penetration.

5. What role do clinical trial results play in financial forecasts?

Positive clinical outcomes underpin regulatory approval, bolster prescriber confidence, and justify premium pricing, all vital for robust revenue forecasts.

References

[1] IMS Health, 2022. Global Pharmaceutical Market Trends.

[2] FDA, 2023. Expedited Programs for Serious Conditions.