Last updated: July 30, 2025

Introduction

BRONITIN MIST is a novel pharmaceutical intervention designed for the management of respiratory conditions, primarily targeting bronchitis, chronic obstructive pulmonary disease (COPD), and acute bronchospasm. As a proprietary inhalation spray, it integrates innovative delivery mechanisms with established therapeutic agents, positioning itself within a competitive landscape driven by respiratory disease prevalence, regulatory developments, and evolving market demands. This analysis explores the current market dynamics influencing BRONITIN MIST and projects its potential financial trajectory.

Market Landscape and Demand Drivers

The global respiratory disease market is experiencing sustained growth, propelled by rising prevalence of COPD and bronchitis, aging populations, pollution, and tobacco use. According to the Global Burden of Disease Study 2019, respiratory diseases accounted for approximately 4.1% of all global deaths, underscoring the critical need for effective therapies.[1]

BRONITIN MIST's targeted delivery mechanism promises advantages over traditional inhalers, including improved lung deposition, ease of administration, and reduced systemic side effects—features increasingly favored by both clinicians and patients. The device's innovative design aligns with current trends towards patient-centric inhalation therapies, fueling anticipated demand.

Furthermore, increasing healthcare awareness and early diagnosis initiatives contribute to expanding treatment pools. The rising adoption of combination therapies, integrating BRONITIN MIST with other respiratory medications, could further augment its market penetration.

Regulatory Environment and Market Access

Regulatory pathways significantly influence the commercial trajectory of BRONITIN MIST. Securing approvals from agencies such as the FDA and EMA hinges on demonstrating safety, efficacy, and device reliability. The FDA’s fast-track and Breakthrough Therapy designation frameworks could expedite market entry if preliminary clinical data meet specified criteria.[2]

Market access hinges on reimbursement policies, which vary across geographies. Countries with universal healthcare systems, such as Canada and several European nations, are receptive to reimbursing novel inhalation therapies that demonstrate clinical superiority. Achieving formulary inclusion requires robust evidence of therapeutic benefit and cost-effectiveness.

Competitive Landscape

BRONITIN MIST operates amid a crowded market featuring established inhalers like Ventolin (albuterol), Flovent (fluticasone), and newer biologics. Its differentiation lies in delivery efficiency and reduced side effects, offering a competitive advantage. However, competition also includes generic formulations and innovative devices, necessitating strategic positioning and clear value propositions.

Manufacturers like GlaxoSmithKline and AstraZeneca are investing heavily in inhaler technology, including smart devices and personalized medicine, which could influence BRONITIN MIST’s market share. Strategic collaborations, clinical evidence, and patent protections are critical to sustain competitive advantages.

Revenue Streams and Financial Estimations

The financial trajectory of BRONITIN MIST depends on multiple factors:

- Market Penetration Rate: Early adoption may be limited to specialized centers and pulmonologists, but widespread acceptance is feasible within 3-5 years post-launch, especially if supported by strong clinical data.

- Pricing Strategy: Premium pricing can be justified through device innovation and proven efficacy, with an initial price premium of 20-30% over existing inhalers.

- Sales Volume: Estimated sales volumes hinge on the size of the target population, which, for COPD alone, exceeds 250 million globally.[3]

Assuming a conservative market penetration of 5% of COPD patients in major markets within five years, with an average annual treatment cost of $1,200 per patient, revenues could reach approximately $1.5 billion globally. This is predicated on effective clinical adoption, reimbursement, and marketing strategies.

- Cost Structure: R&D expenses, manufacturing costs, regulatory compliance, and marketing budgets influence the profit margins. Device manufacturing costs are typically higher for innovative inhalers, but economies of scale can offset initial investments over time.

Financial Trajectory and Growth Potential

Initially, revenue growth may be modest during the pre-approval and launch phases due to regulatory hurdles and market hesitancy. Post-approval, revenues are expected to accelerate guided by clinical adoption and reimbursement deals.

The competitive landscape and patent protections will shape long-term prospects. A sustained 15-20% annual growth rate post-market entry is plausible if clinical results affirm advantages over existing therapies and if the manufacturer effectively executes marketing strategies.

Emerging markets represent additional growth vectors due to escalating respiratory disease burden and increasing healthcare spending. Entry into Asia-Pacific, Latin America, and Middle East markets could catalyze revenue expansion, potentially adding $300-500 million annually within 7-10 years.

Risks and Challenges

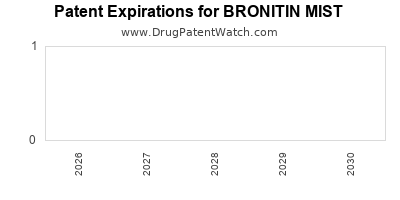

Key risks include delayed regulatory approvals, clinical trial setbacks, market resistance due to entrenched competitors, and reimbursement barriers. Patent expirations or generic threats could impact pricing power and long-term profitability. Moreover, device-related failure or patient non-adherence could limit real-world effectiveness.

Conclusion

The market dynamics surrounding BRONITIN MIST foster a promising yet cautious outlook. Driven by epidemiological trends and innovative delivery technology, the product’s commercial success hinges on rapid regulatory approval, strategic market access, competitive positioning, and evidence-based differentiation. Financially, the drug's trajectory suggests significant revenue potential aligned with broader respiratory disease trends, contingent on mitigating risks and optimizing commercialization.

Key Takeaways

- The respiratory market's growth, driven by aging populations and pollution, enhances BRONITIN MIST’s potential demand.

- Regulatory approvals and reimbursement policies critically influence commercial viability.

- Differentiation through device innovation and clinical efficacy offers competitive advantages.

- Conservative estimates project up to $1.5 billion in global revenues within five years, with growth potential in emerging markets.

- Navigating risks related to competition, patent protection, and market acceptance is vital for sustained financial success.

FAQs

-

What sets BRONITIN MIST apart from traditional inhalers?

Its innovative delivery system ensures better lung deposition, ease of use, and a reduction in systemic side effects, improving patient adherence and therapeutic outcomes.

-

Which regulatory pathways are crucial for BRONITIN MIST’s market entry?

Fast-track and Breakthrough Therapy designations from agencies like the FDA could expedite approval, provided clinical data demonstrate significant benefits.

-

How competitive is the market for BRONITIN MIST?

The market is highly competitive with established inhalers, biologics, and new device technologies. Differentiation relies on clinical efficacy, device innovation, and cost-effectiveness.

-

What are the primary risk factors for the drug’s financial success?

Regulatory delays, clinical trial failures, reimbursement hurdles, and competitive pressures pose significant risks.

-

What are the key markets for BRONITIN MIST’s growth?

North America, Europe, and Asia-Pacific are primary targets. Emerging markets in Asia and Latin America offer high growth opportunities due to increasing respiratory disease burdens.

References

[1] Global Burden of Disease Study 2019. Lancet. 2020;396(10258):1204–1222.

[2] U.S. Food and Drug Administration. Guidance for Industry: Expedited Programs for Serious Conditions. 2014.

[3] World Health Organization. Chronic obstructive pulmonary disease (COPD) Fact Sheet. 2021.