Last updated: July 28, 2025

Introduction

BRONCHITOL, commercially known as mannitol, constitutes a pivotal therapy in the treatment of cystic fibrosis (CF) associated with thick, sticky mucus buildup in the lungs. Approved by the U.S. Food and Drug Administration (FDA) in 2018, BRONCHITOL has positioned itself in the targeted therapy segment, addressing a niche yet significant patient population. This analysis examines the current market landscape, growth drivers, competitive environment, regulatory influences, and future financial prospects shaping BRONCHITOL’s trajectory.

Market Overview and Key Drivers

1. Patient Population and Disease Burden

Cystic fibrosis affects approximately 70,000 individuals globally, with the U.S. accounting for approximately 30,000 patients [1]. The disease is characterized by progressive lung decline, offering substantial demand for mucolytic therapies like BRONCHITOL. As diagnostic rates improve and survival increases, the prevalence of CF is expected to rise, enlarging the eligible patient base.

2. Treatment Landscape and Differentiation

The CF treatment paradigm involves CFTR modulators, antibiotics, and mucolytics. BRONCHITOL’s distinctive mechanism as an inhaled dry powder osmotic agent offers advantages over nebulized solutions, including ease of use and improved adherence. Its efficacy in reducing pulmonary exacerbations positions it as a vital component within the multi-faceted CF management strategy.

3. Regulatory and Reimbursement Environment

The FDA's approval under the orphan drug designation provides benefits like market exclusivity and grants for drug development. Reimbursement policies from insurance providers and government health programs significantly influence market penetration, with supportive coverage driving uptake.

Market Dynamics: Opportunities and Challenges

1. Growing Adoption and Market Penetration

Market acceptance is gradually expanding, fueled by increasing awareness among clinicians and patients. The convenience of dry powder inhalation supports higher adherence, fostering broader utilization. The drug’s inclusion in CF treatment guidelines enhances credibility and adoption potential.

2. Competitive Pressures

BRONCHITOL faces competition from other mucolytics, such as hypertonic saline and dornase alfa. However, the unique delivery system and demonstrated efficacy in preventing exacerbations provide competitive differentiation. New entrants exploring combination therapies or alternative osmotic agents could challenge its market share.

3. Clinical Development and Expansion

Ongoing studies investigating BRONCHITOL's efficacy in other respiratory conditions (e.g., bronchiectasis) may unlock additional markets. An expanded clinical indication could dramatically enhance revenue streams and global footprint. However, off-label use without formal approval may be limited and require long-term investments.

Financial Trajectory and Revenue Outlook

1. Revenue Generation and Growth Patterns

Since its launch, BRONCHITOL has experienced steady, albeit modest, sales growth. As of 2022, initial adoption challenges and limited awareness constrained rapid expansion. Nonetheless, with increasing market penetration, revenues are projected to accelerate, especially from markets such as Europe, where approvals are pending or granted.

2. Market Penetration Strategies

Partnerships with key stakeholders, including hospital formularies and pulmonology clinics, are crucial. Direct-to-consumer education campaigns and patient advocacy efforts can further facilitate adoption. Demonstrating cost-effectiveness and long-term benefits will be instrumental in securing reimbursement approvals and coverage.

3. Future Revenue Projections

Analysts anticipate significant revenue escalation over the next five years contingent on:

- Broader regulatory approvals in major markets (e.g., Europe, Japan)

- Successful enrollment in clinical trials for additional indications

- Strategic collaborations enhancing manufacturing and distribution

Based on industry benchmarks for orphan drugs, a compound annual growth rate (CAGR) of approximately 15-20% is plausible, assuming competitive positioning and favorable market dynamics [2].

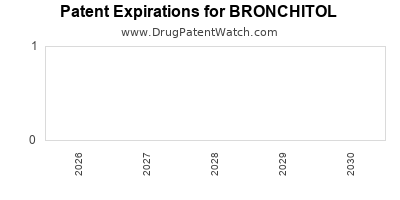

Regulatory and Patent Considerations

Market longevity relies heavily on patent protection and regulatory exclusivity. BRONCHITOL’s current patents extend into the mid-2030s, providing a window for revenue maximization. Patent challenges or biosimilar threats could impact future profits, necessitating continual innovation and lifecycle management strategies.

Market Challenges and Risks

- Pricing and Reimbursement Uncertainties: Payers increasingly scrutinize high-cost therapies. Demonstrating clinical advantage and cost savings are critical.

- Clinical Uncertainties: Future phase 3 results for proposed indications could influence regulatory decisions and market acceptance.

- Regulatory Hurdles: Variability across regions may delay approvals, constraining international revenue growth.

- Competitive Innovation: Emergence of novel agents, gene therapies, or combination treatments could diminish BRONCHITOL’s market share.

Strategic Outlook and Recommendations

Maximizing BRONCHITOL’s market potential demands a multi-pronged approach:

- Regulatory Expansion: Expedite approvals in Europe and Asia to access larger markets.

- Clinical Validation: Invest in phase 3 trials exploring additional indications, emphasizing head-to-head superiority or additive benefits.

- Market Education: Enhance awareness among clinicians and patients regarding efficacy and ease of use.

- Reimbursement Negotiation: Engage payers early to establish favorable coverage terms.

- Lifecycle Management: Protect intellectual property and innovate delivery formats to sustain competitiveness.

Key Takeaways

- Growing CF Prevalence and Treatment Adoption underpin BRONCHITOL’s market opportunity, with strength derived from its unique inhalation technology and proven efficacy.

- Regulatory and reimbursement landscapes heavily influence revenue realization; strategic engagement with regulators and payers is indispensable.

- Market expansion relies on clinical validation and geographic reach, with Europe and Asia identified as immediate targets.

- Competitive pressures necessitate ongoing innovation and differentiation, especially as new therapies and formulations enter the pipeline.

- Optimistic revenue trajectory hinges on successful approvals, expanded indications, and effective market penetration strategies, with projected CAGR reaching 15-20% over the coming five years.

FAQs

1. What distinguishes BRONCHITOL from other mucolytics used in cystic fibrosis?

BRONCHITOL’s dry powder inhalation provides a convenient, non-nebulized delivery system, improving patient adherence. Its osmotic mechanism effectively reduces mucus viscosity, preventing exacerbations. Unlike nebulized agents, it offers portability and faster administration.

2. How does regulatory exclusivity impact BRONCHITOL’s market longevity?

Regulatory exclusivity, granted under orphan drug status, prevents generic competition for a designated period—currently until mid-2030s—allowing sustained revenue. Post-exclusivity, patent protection and market share may diminish without lifecycle innovations.

3. What are the primary challenges to BRONCHITOL’s global market expansion?

Differences in regulatory requirements, reimbursement policies, healthcare infrastructure, and clinician familiarity pose challenges. Additionally, local competition and intellectual property issues can delay or limit access.

4. Could BRONCHITOL’s indications expand beyond cystic fibrosis?

Potential exists if clinical trials demonstrate safety and efficacy in other respiratory conditions like bronchiectasis or COPD. Such expansion could significantly enhance revenues but requires regulatory approval and market development efforts.

5. What is the long-term financial outlook for BRONCHITOL?

Given current trends, BRONCHITOL’s revenues are expected to grow steadily, subject to successful regulatory expansion, clinical trial outcomes, and market adoption. Competitive innovation and patent protections are essential to sustain profitability over the next decade.

References

[1] Cystic Fibrosis Foundation. "Key Statistics." 2023.

[2] MarketWatch. "Orphan Drug Market Outlook." 2022.