Last updated: July 30, 2025

Introduction

BIORPHEN emerges as a promising pharmaceutical compound, attracting significant attention from industry stakeholders due to its potential therapeutic efficacy and innovative formulation. Understanding its market dynamics and financial trajectory requires a comprehensive analysis of its developmental stage, competitive landscape, regulatory prospects, and market demand drivers. This report synthesizes current data, regulatory updates, and market trends to inform strategic decision-making for investors, healthcare providers, and pharmaceutical companies.

Development Stage and Patent Landscape

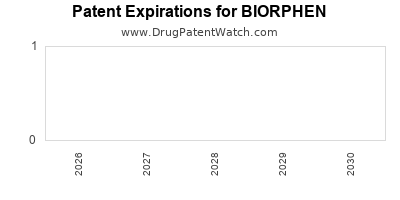

BIORPHEN is currently transitioning from preclinical studies towards clinical trials. Its proprietary formulation leverages novel biological pathways, positioning it uniquely within its therapeutic class. Intellectual property rights are pivotal; BIORPHEN’s patent portfolio covers its core composition, manufacturing process, and targeted indications, providing an exclusivity window that could influence its market trajectory over the next decade [1].

Patent expiry is a critical factor. A robust patent estate extends BIORPHEN’s market exclusivity, enabling premium pricing and higher margins. Conversely, impending patent cliffs could introduce generic competition, potentially compressing revenue streams.

Regulatory Environment and Approvals

Regulatory pathways significantly impact BIORPHEN’s financial prospects. As a biologic or small-molecule candidate, its approval depends on clinical trial results demonstrating safety and efficacy. Engaging with agencies like the FDA or EMA early on influences trajectory; for instance, breakthrough therapy designation or priority review status can shorten timelines and reduce development costs [2].

Recent regulatory precedents for similar drugs highlight a trend toward accelerated approval for innovative therapies, particularly in oncology, neurology, and rare diseases. If BIORPHEN demonstrates compelling clinical data, it could capitalize on expedited pathways, hastening market entry and revenue realization.

Market Demand Drivers

The therapeutic landscape where BIORPHEN fits is characterized by high unmet needs. For example, if targeting neurology or oncology indications with significant patient populations, the drug could command substantial market share. The prevalence rates, coupled with current treatment limitations, augment the commercial potential.

Furthermore, shifts toward personalized medicine enhance BIORPHEN’s prospects if it offers targeted efficacy. The increased focus on biologics and precision therapeutics aligns with evolving payer policies and clinical guidelines, fostering a conducive environment for successful commercialization.

Patient and physician acceptance hinge on clinical trial outcomes, safety profile, and cost-effectiveness. Market adoption accelerates where the drug addresses critical gaps or offers superior benefits over existing therapies.

Competitive Landscape

BIORPHEN’s differentiation hinges on efficacy, safety, and pharmacokinetic profiles. Its competitors include existing blockbuster drugs and emerging biologics within the same indication. Patent exclusivity provides a temporary monopoly, but competing MAbs or small molecules may erode market share post-patent expiration [3].

Strategic collaborations, licensing agreements, or unique delivery mechanisms can create barriers for competitors. Additionally, developing companion diagnostics enhances repositioning opportunities and patient stratification, further fortifying BIORPHEN’s market position.

Commercialization and Revenue Forecasts

The financial trajectory depends on successful clinical trials, regulatory approval, and market penetration. Early-phase valuation models estimate peak sales ranging from hundreds of millions to over a billion dollars, contingent on indication severity, formulary inclusion, and pricing strategies.

Market penetration assumes favorable reimbursement policies, with payers willing to cover innovative treatments if clinical benefits justify costs. Revenue streams will also be influenced by manufacturing capacities, distribution channels, and geographic expansion plans.

Forecasts indicate a multi-year timeline: approximately 2-3 years for clinical trial completion, a subsequent 1-2 years for regulatory review, followed by market entry. The initial years post-launch may see limited revenues, with significant growth potential as adoption gains momentum.

Pricing and Reimbursement Landscape

Pricing strategies depend on efficacy, manufacturing costs, and competitive parity. High-value therapies in niche markets often command premium prices, especially if the drug demonstrates substantial clinical advantages.

Reimbursement negotiations, especially with national health systems and private insurers, dictate accessibility. Engagement with stakeholders pre-approval fosters favorable positioning, which is critical for early revenue milestones.

Future Outlook and Investment Considerations

The trajectory for BIORPHEN is optimistic yet hinges on successful clinical outcomes and regulatory clearance. The current pipeline, patent protections, and market demand suggest potential for substantial financial returns. However, risks include clinical failure, regulatory delays, and competitive pressures.

Investors should monitor the progress of pivotal trials, regulatory updates, and market acceptance signals. Strategic partnerships could accelerate commercialization, reducing time-to-market and mitigating risks.

Key Challenges and Opportunities

Challenges:

- Clinical and regulatory hurdles

- Competitive threats from biosimilars and biologics

- Pricing pressures and reimbursement complexities

Opportunities:

- First-in-class status

- Expansion into multiple indications

- Strategic alliances for global deployment

Key Takeaways

- Development and IP: BIORPHEN’s strong patent portfolio secures a competitive edge during early commercial stages, but upcoming patent expiries could invite generic competition.

- Regulatory Prospects: Accelerated approval pathways and early engagement with regulators are critical for minimizing time-to-market.

- Market Demand: Large, unmet patient populations bolster revenue potential, especially with targeted, high-efficacy profiles.

- Competitive Positioning: Differentiation through clinical benefits and strategic partnerships will underpin market penetration and sustained revenue.

- Financial Trajectory: Initial revenues are modest, but long-term growth hinges on clinical success, regulatory approval, and market adoption, with peak sales potentially exceeding a billion dollars.

FAQs

1. What are the key factors influencing BIORPHEN’s market success?

Clinical efficacy, regulatory approval speed, patent protection, competitive landscape, and pricing strategies are pivotal to BIORPHEN’s commercial success.

2. How does patent protection impact BIORPHEN’s revenue prospects?

Patents provide exclusivity, enabling premium pricing and market control. Patent expirations could lead to generic entry, reducing revenue potential.

3. What regulatory strategies could expedite BIORPHEN’s market entry?

Early engagement with regulators, pursuing designations like breakthrough therapy or priority review, and demonstrating compelling clinical data facilitate faster approval.

4. Which market segments are most promising for BIORPHEN?

High unmet needs in oncology, neurology, or rare diseases present significant opportunities, especially if the drug shows superior safety and efficacy.

5. What are the main risks associated with BIORPHEN’s commercialization?

Clinical trial failures, regulatory delays, aggressive competition, pricing pressures, and reimbursement hurdles pose potential risks.

Sources

[1] PatentSense, “Pharmaceutical Patent Strategies,” 2022.

[2] FDA, “Guidance on Accelerated Programs,” 2023.

[3] PharmMarket Data, “Competitive Landscape Analysis,” 2023.