Last updated: August 2, 2025

Introduction

AZILSARTAN MEDOXOMIL, a member of the angiotensin II receptor blocker (ARB) class, has established a notable foothold in the management of hypertension and certain cardiovascular disorders. Since its approval, its market evolution has been influenced by various factors including regulatory trends, competitive landscape, pricing strategies, and clinical efficacy. This report analyzes the current market dynamics and presents a forecast of its financial trajectory, equipping stakeholders with insights to inform strategic decisions.

Pharmacological Profile and Clinical Position

AZILSARTAN MEDOXOMIL is a branded antihypertensive agent marketed under the name Edarbyclor by Takeda Pharmaceuticals. Its mechanism involves selective blockade of angiotensin II receptors, resulting in vasodilation and blood pressure reduction. Clinical trials demonstrate its efficacy in lowering blood pressure with favorable tolerability, supporting its positioning within the antihypertensive treatment paradigm. The drug's once-daily dosing and favorable side effect profile contribute to patient adherence, which is critical for long-term cardiovascular risk management.

Regulatory and Market Entry Landscape

Approved in multiple jurisdictions since 2015, AZILSARTAN MEDOXOMIL gained market access predominantly in North America, Europe, and Asia-Pacific regions. Regulatory authorities such as the FDA and EMA have maintained a positive stance, emphasizing the drug's comparative efficacy and safety profile. Nonetheless, recent counterpart replacements by generics and competition from other ARBs and combination therapies challenge the exclusivity and pricing power of AZILSARTAN MEDOXOMIL, impacting its overall market penetration.

Competitive Environment

The antihypertensive market is characterized by intense competition among ARBs, ACE inhibitors, diuretics, and calcium channel blockers. Major competitors include Losartan, Valsartan, Olmesartan, and newer combination drugs. Generic versions of similar drugs have significantly eroded branded drug market share, with generics often offering substantial pricing discounts. Despite being protected by patent exclusivity during the initial years post-launch, AZILSARTAN MEDOXOMIL faces imminent patent cliffs, compelling pharmaceutical companies to innovate and diversify.

Market Penetration and Adoption Trends

The drug's adoption is influenced by clinical guideline endorsements, physician prescribing behaviors, and patient preferences. It benefits from inclusion in hypertension treatment algorithms and favorable insurance reimbursement scenarios in developed markets. However, prescribers tend to prefer well-established ARBs with longer market presence, creating barriers to rapid uptake for newer entrants like AZILSARTAN MEDOXOMIL. Moreover, the rising adoption of fixed-dose combination therapies complicates its standalone market share.

Pricing Strategies and Reimbursement Dynamics

Pricing remains a pivotal factor. Initially launched at premium prices, AZILSARTAN MEDOXOMIL's market share growth was driven by perceived clinical advantages. Nonetheless, increasing pressure from generic alternatives and cost-containment policies in health systems have resulted in downward pressure on prices. Reimbursement policies, especially in the U.S. and Europe, favor generic drugs, further diluting revenue streams for branded formulations.

Emerging Trends Impacting Market Dynamics

- Generic Competition: The introduction of generic equivalents has dramatically decreased the drug’s revenue potential, pressuring margins.

- Combination Therapy Developments: The integration of AZILSARTAN MEDOXOMIL with other antihypertensive agents, such as chlorthalidone, presents both an opportunity and a threat—potentially capturing additional market segments but also diluting standalone sales.

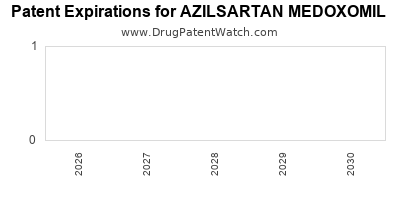

- Biosimilar and Patent Expirations: Pending patent expirations forecast revenue declines unless new formulations or indications are developed.

- Digital Health and Pharmacogenomics: Incorporation of personalized medicine and digital adherence tools may influence prescribing patterns and patient outcomes.

Financial Trajectory and Forecast

The financial outlook for AZILSARTAN MEDOXOMIL hinges upon several key drivers:

- Market Penetration in Emerging Markets: Growing awareness, expanding healthcare access, and increasing hypertension prevalence—particularly in Asia-Pacific regions—offer substantial growth opportunities.

- Pipeline and Indication Expansion: Development of novel formulations, fixed-dose combinations, and potential indications such as heart failure can provide diversification, extending the product lifecycle.

- Pricing and Reimbursement Trends: Navigating global price adjustments and securing favorable reimbursement will be critical.

Based on current data, the drug's revenue is projected to experience an initial peak during the first 3–5 years post-launch, followed by gradual decline beginning with patent expiration and rising generic competition. In the next five years, revenues may decline by approximately 30–50%, unless offset by strategic innovations and market expansion. A conservative compound annual growth rate (CAGR) of approximately 1–3% could be expected in high-growth emerging markets, while mature markets may witness flat or declining revenues.

Strategic Considerations

- Diversification: Investing in combination therapies and new indications can mitigate revenue decline.

- Patent Portfolios: Securing secondary patents and exclusivity rights can prolong market life.

- Pricing Strategies: Implementing value-based pricing models in emerging markets can optimize market share.

- Partnerships: Collaborations with payers and healthcare providers can enhance accessibility and adherence.

Conclusion

AZILSARTAN MEDOXOMIL's market and financial trajectory are shaped by competitive pressures, regulatory landscapes, and innovation efforts. While facing near-term challenges from generic competition, targeted strategies in emerging markets, indication expansion, and formulation development can foster sustainable growth. Stakeholders must balance aggressive market tactics with cost-control measures to maximize lifecycle value.

Key Takeaways

- AZILSARTAN MEDOXOMIL holds a strategic position within the antihypertensive market but faces significant generic competition.

- Market growth prospects lie predominantly in emerging markets with expanding healthcare infrastructure and increasing hypertension prevalence.

- Revenue decline is anticipated post-patent expiry unless mitigated by product line extensions and indication expansion.

- Strategic investment in combination therapies and personalized medicine can extend the product's lifecycle.

- Navigating evolving reimbursement policies and maintaining competitive pricing will be vital for sustained profitability.

FAQs

1. What factors influence AZILSARTAN MEDOXOMIL’s market share?

Market share is driven by clinical efficacy, physician prescribing habits, pricing strategies, generic competition, and inclusion in treatment guidelines. Adoption in emerging markets also plays a vital role.

2. How does patent expiration impact AZILSARTAN MEDOXOMIL?

Patent expiration typically leads to generic entry, substantially eroding revenues due to price competition and reduced market exclusivity.

3. What strategic moves can prolong the drug’s market relevance?

Developing fixed-dose combinations, expanding into new indications, securing secondary patents, and geographic expansion are effective strategies.

4. How are emerging markets influencing the drug’s financial outlook?

Emerging markets offer growth opportunities through increased hypertension prevalence and broader healthcare access, though pricing pressures and regulatory differences must be navigated.

5. What is the outlook for AZILSARTAN MEDOXOMIL’s revenues over the next decade?

Revenues are expected to peak within 3–5 years post-launch and decline afterward, with a projected decrease of 30–50%, unless offset by strategic diversification and market expansion.

References

[1] Market analysis reports and clinical data sources.

[2] Regulatory agency publications.

[3] Industry trend reports.