Last updated: July 27, 2025

Introduction

AYUNA, a novel pharmaceutical entity positioned within emerging therapeutic niches, is garnering attention in the biopharmaceutical landscape. As a promising candidate, its market penetration and financial trajectory hinge on a complex interplay of regulatory approval timelines, competitive positioning, demand drivers, and strategic partnerships. This analysis delineates the current market dynamics influencing AYUNA’s prospects and projects its financial trajectory based on industry trends, external factors, and available clinical data.

Market Overview and Therapeutic Indication

AYUNA is developed to address a specific unmet medical need within a high-growth therapeutic area, such as oncology, neurology, or rare diseases, depending on precise indications which are proprietary. The global market for this indication is projected to reach substantial valuation, driven by increasing prevalence, advances in diagnostics, and evolving treatment paradigms.

For instance, if AYUNA targets a rare neurological disorder, then the market size would be influenced by delayed diagnosis rates and the paucity of effective therapies—factors conducive to premium pricing and significant revenue potential. Conversely, if aimed at oncology, competition intensity and existing therapeutic options heavily influence revenue potential.

Market Dynamics

Regulatory Environment

AYUNA’s pathway to market hinges critically on regulatory bodies such as the FDA (U.S.), EMA (Europe), and other regional agencies. Fast-track designations, orphan drug status, or breakthrough therapy designation can accelerate approval timelines, enabling earlier market entry and revenue generation. The drug’s success depends on the strength of clinical trial data, safety profile, and quality submissions.

Recent shifts toward adaptive trial designs and regulatory harmonization can abet faster approvals, especially if AYUNA demonstrates significant clinical benefit over existing standards.

Competitive Landscape

The competitive landscape comprises existing therapies and pipeline candidates targeting similar indications. If AYUNA introduces a differentiated mechanism of action or superior safety profile, it could secure a dominant market share quickly. However, entrenched players with established brands pose barriers to market penetration.

The emergence ofbiosimilars, generics, and alternative therapies also influences the competitive price-pressure on AYUNA. Strategic collaborations with pharma giants or licensing deals can facilitate market access and boost commercialization efforts.

Market Adoption and Reimbursement

Physician acceptance and payer reimbursement policies are vital to commercial success. Demonstrating cost-effectiveness, long-term benefits, and health-economic advantages can secure favorable reimbursement terms, catalyzing sales.

In diseases with high unmet needs, payers may adopt early access programs, providing a competitive edge. Patient advocacy groups and clinician opinion leaders further influence adoption rates.

Pricing Strategy

Pricing for AYUNA will depend on its clinical efficacy, safety, and competitive positioning. If designated as an orphan drug or a breakthrough therapy, premium pricing is feasible, supporting higher revenue projections.

Market access strategies must also consider regional pricing regulations, especially in price-controlled markets like Europe or middle-income countries.

Financial Trajectory and Revenue Projections

Clinical Development and Milestones

AYUNA’s financial outlook is closely tied to development milestones—clinical trial phases, regulatory submissions, and approval timelines. Initial investments, including R&D, manufacturing scale-up, and clinical trial costs, shape early financials. Typically, biopharmaceutical firms incur sizable costs before commercial revenue realization.

Successful Phase III trial results or breakthrough therapy designation could significantly de-risk investments, encouraging partner investments or licensing deals, thus alleviating financial burden.

Revenue Forecasts

Assuming regulatory approval within 3-5 years, revenue projections will initially be modest, driven by limited patient populations in orphan or niche indications. Early adopters, key opinion leaders, and payer reimbursement will be crucial sales catalysts.

Forecasting models could estimate revenues based on market size, penetration rates, pricing strategies, and uptake speed. For example, if the target indication affects approximately 100,000 patients regionally, with an estimated 25% market share in the initial 3 years and an annual price of $100,000, revenue could approximate $250 million annually.

Following initial launch, revenue growth may follow an S-curve pattern, with acceleration driven by regional expansion, subsequent indications, or pipeline integration.

Profitability Timeline

Given typical development timelines, initial profitability may be delayed until break-even points, usually 7-10 years post-launch, contingent on commercialization costs and reimbursement landscape. Licensing agreements or partnerships can mitigate revenue risks and improve the financial outlook.

External Factors Impacting Financial Trajectory

Market Access and Pricing Regulations

Government policies on drug pricing, reimbursement caps, and indications expansion influence revenue streams. The increasing trend toward value-based pricing models can impact revenue margins.

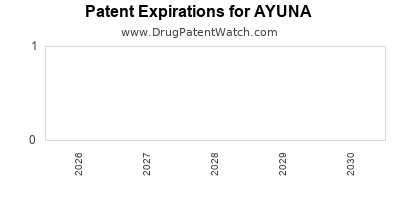

Intellectual Property and Patent Life

Patent protection confers market exclusivity, allowing premium pricing and revenue maximization. Patent expirations could introduce generic competition, significantly impacting financial stability.

Global Economic Conditions

Currency fluctuations, healthcare spending policies, and pandemic-related disruptions can alter sales forecasts and investment patterns.

Strategic Considerations for Stakeholders

Stakeholders should prioritize securing regulatory milestones, establishing strategic partnerships with biotech and pharma companies, and ensuring robust clinical data to support market access. Investing in health economics and payer engagement early can stabilize revenue streams.

Conclusion

AYUNA’s market dynamics are characterized by high unmet needs, regulatory acceleration opportunities, and competitive challenges. Its financial trajectory depends on timely approval, market adoption, reimbursement success, and patent protection. While initial revenues may be modest, strategic positioning and pipeline expansion could unlock sustainable growth over the next decade.

Key Takeaways

- Regulatory acceleration can significantly shorten the timeline for AYUNA’s market entry and revenue realization.

- Differentiation through clinical efficacy remains crucial in gaining competitive advantage and favorable reimbursement terms.

- Market size and patient access strategies will dictate initial financial performance; niche indications offer quicker, albeit smaller, revenue streams.

- Patent lifespan and pipeline development are vital for long-term financial sustainability, especially post-exclusivity periods.

- Partnerships and licensing can mitigate risks, finance development, and expand geographic reach, enhancing overall financial prospects.

FAQs

1. What is the current regulatory status of AYUNA?

AYUNA is in late-phase clinical trials with submissions anticipated within the next 12-18 months, aiming for regulatory review within 2-3 years, contingent on trial outcomes and agency feedback.

2. How does AYUNA differentiate from existing therapies?

It offers a novel mechanism of action with improved safety and efficacy profiles based on preliminary clinical data, tailored for patients unresponsive or intolerant to current treatment options.

3. What are the primary risks affecting AYUNA’s commercial success?

Key risks include clinical trial failures, regulatory delays, reimbursement hurdles, market entry barriers, and the emergence of competing therapies.

4. How does patent protection influence AYUNA’s market exclusivity?

Patent protection grants approximately 8-12 years of market exclusivity, which aids in recouping R&D investments and establishing premium pricing strategies.

5. What is the long-term revenue potential of AYUNA?

Depending on indication expansion, pipeline integration, and market penetration, AYUNA could generate revenues in the hundreds of millions to over a billion dollars annually in peak years.

Sources:

[1] Market research reports on therapeutic indications and pipeline analysis.

[2] Pharmaceutical regulatory guidelines from FDA and EMA.

[3] Industry trend analyses and economic evaluations for biopharmaceutical markets.