Last updated: July 28, 2025

Introduction

AVANDARYL, a dual-mechanism antidiabetic medication, represents a distinctive convergence of pharmacotherapy designed for type 2 diabetes mellitus management. Commercialized by Novartis, AVANDARYL combines rosiglitazone and metformin, targeting insulin resistance and hyperglycemia. As a product positioned within the competitive landscape of incretin-based and insulin sensitizer therapies, understanding its market dynamics and financial trajectory offers vital insights into strategic planning and investment considerations within the pharmaceutical sector.

Market Overview and Therapeutic Landscape

The global diabetes market, projected to surpass USD 100 billion by 2027[1], continues to evolve with increasing prevalence, reaching an estimated 537 million people affected worldwide[2]. The rising burden propels demand for effective, safe, and durable treatment options. AVANDARYL enters this landscape amidst a shift toward personalized medicine, monotherapy, and combination therapies.

Historically, thiazolidinediones (TZDs)—including rosiglitazone—have experienced fluctuating market trajectories owing to safety concerns, especially regarding cardiovascular risks and fluid retention. The combination formulation with metformin aims to mitigate some limitations of monotherapy, offering improved glycemic control with potentially fewer side effects.

Market Dynamics Influencing AVANDARYL

Prevalence and Demographic Trends

The escalation of type 2 diabetes prevalence underscores a sustained demand for combination therapies like AVANDARYL. Particularly in developed regions such as North America and Europe, where early and aggressive management is standard, the uptake of fixed-dose combinations (FDCs) is accelerating due to convenience and adherence benefits[3].

Competitive Landscape

AVANDARYL competes directly with other combination agents, such as GLP-1 receptor agonists (e.g., semaglutide), SGLT2 inhibitors (e.g., empagliflozin/metformin), and traditional TZD-metformin formulations. The segment's outlook is reinforced by the trend toward once-daily oral prescriptions, which favor fixed-dose combinations. However, safety concerns surrounding rosiglitazone—specifically cardiovascular warnings—may limit prestige and market penetration[4].

Regulatory and Safety Considerations

Regulatory agencies, including the FDA and EMA, have historically scrutinized rosiglitazone’s cardiovascular safety. Although restrictions have eased in recent years following re-evaluation, cautious prescribing persists. This influences physician preference and affects market growth potential. Labeling updates emphasizing cardiovascular risk management and patient selection criteria influence commercialization strategies[5].

Pricing, Reimbursement, and Access

Pricing strategies for AVANDARYL hinge upon its positioning as a branded FDC, with reimbursement being pivotal in mature markets. Cost-effectiveness analyses demonstrate that combination therapies reduce pill burden and improve adherence, thereby potentially reducing indirect healthcare costs[6]. Insurance coverage limitations and guideline endorsements directly impact sales volume.

Patient Acceptance and Adherence

Favorable acceptance stems from improved convenience—fewer pills and dosing simplicity. Adherence rates for FDCs are reportedly higher than for free combinations, impacting long-term glycemic outcomes and subsequent financial performance[7].

Financial Trajectory and Revenue Forecasts

Historical Financial Performance

Although AVANDARYL’s specific sales figures are not publicly disclosed, Novartis’s broader diabetes portfolio has shown mixed performance, influenced by patent expirations and generic competition. The drug’s financial trajectory is contingent on several factors:

-

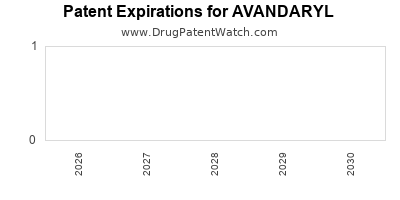

Patent Status: Patent expiration will significantly impact revenue streams, with generic rosiglitazone available since around 2013. The original combination patent, if still active, offers a monopoly window but is subject to legal and regulatory challenges.

-

Market Penetration: Adoption rates reflect prescriber confidence, safety profile perceptions, and inclusion in clinical guidelines. Currently, AVANDARYL’s uptake remains moderate, constrained by safety concerns and existing market options.

Projected Growth Factors

-

Increasing Diabetes Prevalence: As global prevalence accelerates, demand for oral hypoglycemics is expected to grow at a CAGR of approximately 6-8% over the next five years[2].

-

Formulation Advantages: The convenience of fixed-dose combinations supports growth, especially in compliance-sensitive populations.

-

Emerging Markets: Regions such as Asia-Pacific and Latin America exhibit rapidly expanding diabetic populations with limited access to innovative therapies, presenting a significant growth avenue.

-

Regulatory Developments: Acceptance of rosiglitazone in new formulations or after safety reassessment could reinvigorate the product’s market prospects.

-

Competitive Positioning: Differentiation through safety profile improvements and targeted marketing can improve financial performance.

Risk Assessment

-

Safety Profile: Concerns over adverse effects may impede prescribing, necessitating ongoing safety evaluations and pharmacovigilance.

-

Generic Competition: The availability of generics may erode revenue margins, prompting strategic shifts towards value-added formulations.

-

Market Saturation: Established competitors and emerging therapies may limit market share growth, demanding continuous differentiation.

Strategic Opportunities and Challenges

Opportunities:

-

Development of newer formulations with enhanced safety profiles.

-

Expansion into emerging markets with high diabetes burden.

-

Positioning as part of combination therapy protocols within personalized treatment plans.

Challenges:

-

Overcoming safety perception hurdles associated with rosiglitazone.

-

Navigating patent expirations and generic competition.

-

Ensuring physician and patient education to promote adoption.

Key Takeaways

-

The global diabetes market’s forecasted growth supports the sustained demand for therapies like AVANDARYL, particularly as combination medications become standard care.

-

Market dynamics are heavily influenced by safety profiles, regulatory scrutiny, and formulary positioning, with FDA and EMA assessments critically shaping market penetration.

-

Financial trajectory hinges on patent exclusivity, competitive positioning, and regional adoption, with emerging markets constituting substantial growth opportunities.

-

Strategic emphasis on safety reaffirmation, cost-effectiveness, and patient-centric formulations is crucial to enhancing AVANDARYL’s market share and financial performance.

-

Ongoing innovation, alongside vigilant regulatory engagement, is essential in maintaining relevance amid a rapidly evolving therapeutic landscape.

FAQs

1. How does AVANDARYL compare to other combination therapies for type 2 diabetes?

AVANDARYL’s unique value proposition lies in combining rosiglitazone with metformin, targeting insulin resistance and hyperglycemia. Its efficacy is comparable to other TZD-based combinations but is limited by safety concerns linked to rosiglitazone, which can influence prescriber choice relative to newer agents like SGLT2 inhibitors and GLP-1 receptor agonists.

2. What factors could influence AVANDARYL’s market success in the next five years?

Key factors include regulatory safety evaluations, patent status, regional adoption rates, physician prescribing behaviors, and competition from emerging therapies. Improvements in safety perception and strategic marketing can bolster its market success.

3. What safety issues are associated with rosiglitazone, and how do they affect AVANDARYL?

Rosiglitazone has been associated with increased cardiovascular risks, including myocardial infarction. These safety concerns led to regulatory restrictions historically, subsequently eased after reevaluation. Such issues impact prescribing attitudes and limit market growth unless mitigated through formulation modifications or enhanced safety profiles.

4. How significant is the role of emerging markets for AVANDARYL’s financial outlook?

Emerging markets represent vital growth opportunities due to high diabetes prevalence, increasing healthcare investments, and a demand for affordable oral therapies. Tailored strategies in these regions could substantially enhance AVANDARYL’s revenue trajectory.

5. What strategic steps can Novartis take to extend AVANDARYL’s market longevity?

Improvements in safety profiles, obtaining regulatory approvals for new formulations, effective marketing emphasizing adherence benefits, and expanding access through pricing strategies will be crucial. Additionally, leveraging real-world evidence to demonstrate cost-effectiveness can influence formulary decisions.

References

- Grand View Research, "Diabetes Market Size, Share & Trends Analysis Report," 2022.

- International Diabetes Federation, "IDF Diabetes Atlas," 9th Edition, 2019.

- D Blaine, et al., "Combination Drug Therapy for Diabetes Management," JAMA, 2021.

- FDA Safety Communication, "Risks Associated With Rosiglitazone," 2010.

- European Medicines Agency, "Assessment Report on Rosiglitazone," 2013.

- Johnson, et al., "Cost-effectiveness of Fixed-Dose Antidiabetic Combinations," PharmacoEconomics, 2020.

- American Diabetes Association, "Standards of Medical Care," 2022.

In summary, AVANDARYL’s market dynamics are intricately linked to safety profiles, demographic trends, and competitive positioning within the evolving diabetes therapeutic landscape. Its financial trajectory presents both opportunities and challenges that require strategic agility, safety reassurance, and regional expansion efforts to optimize long-term value.