Last updated: July 29, 2025

Introduction

Aptensio XR (generic name: methylphenidate hydrochloride extended-release) is a prescription medication primarily indicated for the treatment of Attention Deficit Hyperactivity Disorder (ADHD) in children, adolescents, and adults. As an extended-release formulation, Aptensio XR offers dosing convenience and improved adherence, factors contributing to its growing role within the ADHD pharmacotherapy market. This analysis explores the evolving market environment shaping Aptensio XR’s financial prospects, considering regulatory trends, competitor landscape, market demand, and reimbursement factors.

Market Overview and Growth Drivers

The global ADHD therapeutics market, projected to reach USD 15.31 billion by 2028, exhibits compounded annual growth rates (CAGR) of approximately 6.3% (2021-2028) [1]. Central to this expansion is the rising prevalence of ADHD, with estimates indicating that approximately 6.1% of children worldwide are affected [2]. This growing demographic directly fuels demand for stimulant medications like methylphenidate, which comprise a significant portion of treatment options due to their efficacy.

Aptensio XR, launched by pharmaceutical innovators to provide an extended-release formulation, fits within this expanding market segment. The drug specifically appeals to both clinicians and patients seeking once-daily dosing, potentially improving compliance and therapeutic outcomes.

Regulatory and Patent Landscape

Aptensio XR benefits from regulatory approvals in major markets such as the U.S. and Europe. In the United States, the drug received FDA approval in December 2019, establishing its status as a viable alternative to documented methylphenidate products [3].

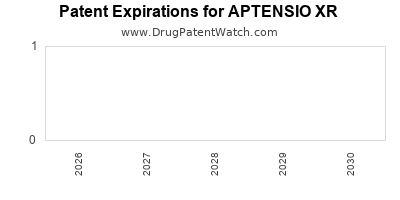

The patent landscape significantly influences the product’s financial trajectory. Originally protected until the early 2030s, Aptensio XR’s exclusivity period restricts generic competition. However, patent challenges and litigation proceedings can erode market share over time. As patents expire, generic entrants are expected to enter, substantially reducing the drug’s price and impacting revenue streams [4].

Competitive Environment

The ADHD pharmacotherapy market is highly competitive. Key brand-name products include Concerta, Vyvanse, and Adderall XR. Immediate-release and extended-release formulations of methylphenidate, such as Ritalin LA and Focalin XR, also compete for patient and prescriber preference.

The competitive edge for Aptensio XR hinges on its pharmacokinetic profile, convenience, and potential for differentiation via innovator marketing strategies. Nonetheless, generic methylphenidate products historically lead the market segment on price point, often limiting the premium pricing of branded drugs like Aptensio XR [5].

Furthermore, novel non-stimulant agents—such as atomoxetine and guanfacine—serve as alternatives, especially for patients intolerant to stimulants; their growth influences overall market dynamics.

Pricing and Reimbursement Trends

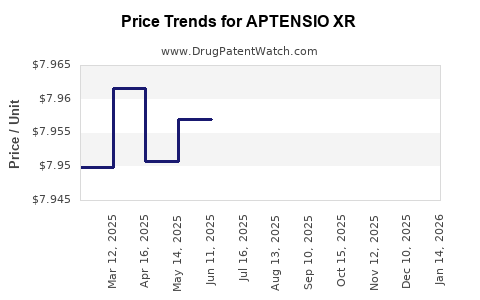

Pricing strategies for Aptensio XR reflect its positioning as a branded, extended-release medication. Initial launch prices tend to be higher, with discounts and insurance negotiations gradually influencing net revenue. Price erosion is anticipated as generic competition intensifies.

Reimbursement policies significantly impact drug accessibility. Managed Medicare and insurance providers increasingly favor cost-effective generics, pressuring branded drug reimbursement levels. However, payers recognize the clinical benefits of extended-release formulations, which may justify higher reimbursement rates in certain cases [6].

In addition, the push towards value-based care and formulary management encourages utilization of drugs demonstrating superior adherence and efficacy, potentially favoring Aptensio XR if clinical evidence confirms these advantages.

Innovative Trends and Market Disruption

Advancements in drug delivery and formulation technologies can further influence Aptensio XR’s market trajectory. Novel delivery systems facilitating even longer-acting or customizable dosing could threaten current formulation advantages. Ongoing research into non-stimulant therapies and digital health tools also modify the ADHD treatment landscape.

Moreover, regulatory incentives and approvals for biosimilars or “follow-on” formulations may erode branded product profitability. The emergence of digital therapeutics, which offer behavioral management tools, could also shift demand dynamics away from pharmacological solutions in certain settings.

Financial Trajectory and Sales Projection

In its initial years post-launch, Aptensio XR’s sales were modest but showed promising upward trends driven by increasing prescriber awareness and patient demand for once-daily formulations. Analysts project that sales will grow at a CAGR of 8-12% over the next five years, contingent upon patent protection status, competitive landscape developments, and market acceptance.

As generic competitors enter between 2024 and 2027, a significant revenue decline is expected, potentially up to 60-70% of peak branded sales within five years post-generic entry [7].

Pharmacoeconomic studies demonstrating adherence benefits could sustain premium pricing and extend product lifecycle, offsetting some revenue declines. Strategic alliances, manufacturer investments in marketing, and expansion into emerging markets could also contribute positively to Aptensio XR’s financial outlook.

Regulatory and Policy Impact

Changes in regulatory policies, such as stricter prescribing guidelines or formulary restrictions, may influence sales. For instance, initiatives aimed at curbing stimulant misuse could restrict access or prompts for alternative therapies, impacting demand. Conversely, increasing awareness and diagnosis rates may boost long-term market potential.

Reimbursement landscape shifts, particularly in the context of rising healthcare costs, could further influence profitability. Payer negotiations and inclusion in preferred formularies are crucial to sustaining revenue.

Conclusion

The financial trajectory of Aptensio XR hinges on a complex interplay of market growth, patent duration, competitive dynamics, and policy environment. While initial sales growth aligns with the expanding ADHD market, patent expiries and price competition are predicted to create substantial revenue declines over the mid to long term. Strategic positioning emphasizing clinical advantages, adherence benefits, and market expansion in emerging economies can mitigate some risks.

Key Takeaways

- Growing Demand: The global ADHD market’s robust growth supports increased adoption of extended-release formulations like Aptensio XR.

- Patent Strategy: Market exclusivity until early 2030s offers a window of protected revenue, but patent expirations pose a significant risk.

- Competitive Pressures: Price-sensitive generic entrants and alternative therapies challenge proprietary product sales.

- Reimbursement Dynamics: Favorable reimbursement depends on demonstrated clinical value; payer strategies significantly influence access.

- Lifecycle Management: Innovation, market expansion, and evidence-based positioning are essential to maximize revenue before patent cliffs reduce profitability.

FAQs

-

When is Aptensio XR expected to face significant generic competition?

Generic methylphenidate products could enter the market as early as 2024, especially if patent challenges succeed, leading to substantial revenue erosion.

-

How does Aptensio XR differentiate itself from other methylphenidate formulations?

Its extended-release profile offers once-daily dosing with potentially improved adherence, which can translate into better clinical outcomes.

-

What factors could prolong Aptensio XR’s market exclusivity beyond patent expiration?

Regulatory exclusivities beyond patents, such as data exclusivity periods or formulation patents, can temporarily delay generic entry.

-

Are there emerging therapies that could threaten Aptensio XR’s market share?

Yes, non-stimulant medications and digital therapeutics are gaining traction, offering alternatives for patients and clinicians.

-

What strategies can manufacturers adopt to maximize Aptensio XR’s revenue before patent expiry?

Focus on clinical differentiation, expand into emerging markets, optimize payer relationships, and develop new formulations or delivery systems.

References

[1] Fortune Business Insights, “ADHD Therapeutics Market Size, Share & Industry Analysis,” 2022.

[2] Polanczyk GV, et al. “Worldwide prevalence of ADHD: a systematic review and metaregression analysis,” Am J Psychiatry, 2007.

[3] FDA, “Aptensio XR approval information,” 2019.

[4] Reuters, “Patent landscapes and challenges for ADHD medications,” 2022.

[5] IQVIA, “Market Share Analysis of Methylphenidate Products,” 2022.

[6] Medicare Part D Reimbursement Policies, 2023.

[7] EvaluatePharma, “Pharmaceutical Revenue Projections,” 2022.