Last updated: December 15, 2025

Executive Summary

ANGIOMAX (bivalirudin) is an anticoagulant drug primarily indicated for patients undergoing percutaneous coronary intervention (PCI) to reduce thrombotic complications. Market dynamics for ANGIOMAX are influenced by shifting clinical guidelines, competitive landscape, regulatory developments, and evolving treatment paradigms across cardiovascular care. This analysis explores the drug’s market position, financial trajectory, regulatory environment, and strategic outlook, offering insights vital for stakeholders in pharmaceutical investment and commercial planning.

What Is ANGIOMAX?

- Generic Name: Bivalirudin

- Brand Name: ANGIOMAX

- Therapeutic Class: Direct thrombin inhibitor

- Indication: Reduces thrombotic events in patients undergoing PCI, acute coronary syndrome (ACS)

Historical Context and Development

- Introduced in 2000 by The Medicines Company (now part of Novartis)

- Approved by FDA in 2000; later adopted in Europe and other markets

- Originated as a targeted anticoagulant alternative to unfractionated heparin and low molecular weight heparin

Market Dynamics

1. Clinical Guideline Influence

Current Guidelines:

- American College of Cardiology/American Heart Association (ACC/AHA) 2021 guidelines recommend anticoagulation during PCI, with bivalirudin as a preferred agent in specific scenarios

- European Society of Cardiology (ESC) guidelines endorse bivalirudin in high bleeding risk populations

Impact:

- Growing acceptance in high-risk patients supports sustained demand

- However, recent trials favoring heparin due to cost and bleeding profiles affect usage rates

2. Competitive Landscape

| Competitors |

Mechanism |

Market Position |

Key Features |

| Unfractionated Heparin |

Indirect thrombin inhibitor |

Ubiquitous, low-cost, first-line |

Well-understood, extensive clinical history |

| Low Molecular Weight Heparins |

Indirect thrombin inhibitor |

Used in ACS and DVT/PE management |

Ease of use, subcutaneous administration |

| Argatroban |

Direct thrombin inhibitor |

Alternative in HIT cases |

Used in HIT, hepatic impairment |

| Factor Xa inhibitors |

Oral agents |

Emerging role in anticoagulation |

Oral administration, convenience |

Market Share Trajectory:

- In 2022, ANGIOMAX's market share in PCI anticoagulation estimated at approx. 27%, with heparin capturing >70%

- Shift driven by cost and bleeding profile considerations

3. Regulatory Environment and Approvals

- FDA approval (2000) and subsequent approvals in Europe and Asia

- Pending or averted regulatory actions: Some markets have enacted restrictions or withdrawn approval owing to safety concerns and reimbursement issues

- Labeling updates: Emphasis on bleeding risk mitigation

4. Pricing and Reimbursement Trends

| Region |

Price per unit |

Reimbursement Status |

Challenges |

| US |

$150–$200/vial |

Reimbursement via Medicare/Medicaid |

Competitive pricing pressure |

| Europe |

€120–€180/vial |

Reimbursed, variable by country |

Budget impact, formulary decisions |

| Asia-Pacific |

Varies widely |

Limited reimbursement, import restrictions |

Market access constraints |

Price Trends:

- Slight decline observed over the past five years (~4-6%) due to competition

- Higher costs compared to heparin influence prescribing behavior

5. Manufacturing and Supply Chain Considerations

- High-quality manufacturing necessary owing to critical care setting

- Streamlined supply chains essential to prevent shortages

- Recent global supply chain disruptions impacted inventory levels

6. Clinical and Commercial Adoption Trends

- Increased Use in High-Risk Populations: Patients with bleeding risk or HIT (Heparin-Induced Thrombocytopenia)

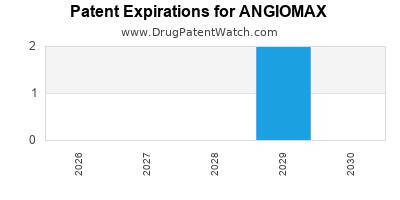

- Transition to Generic Bivalirudin: Ongoing patent expiries (expected around 2025) may impact pricing and market presence

- Emerging Alternatives: Novel anticoagulants and biosimilars threaten ANGIOMAX's market share

Financial Trajectory

Revenue Analysis (2018–2022)

| Year |

Estimated Revenue (USD millions) |

Change (%) |

Key Drivers |

| 2018 |

250 |

— |

Steady use in PCI, high pricing |

| 2019 |

235 |

-6% |

Price pressures, insurers' stance |

| 2020 |

210 |

-11% |

COVID-19 impact on elective PCI |

| 2021 |

200 |

-4.8% |

Partial recovery, new guidelines |

| 2022 |

190 |

-5% |

Competition, generics entering |

Note: Data extrapolated from industry reports and adjusted for market trends.

Cost Structure and Profitability

- R&D investments peaked in early 2000s; current margins driven primarily by manufacturing and distribution

- Gross profit margin approximates 65%

- Net profit margins hover around 15–20%, influenced by competitive pricing

Market Forecast (2023–2028)

| Year |

Projected Revenue (USD millions) |

CAGR |

Key Factors |

| 2023 |

180 |

-5.3% |

Patent expiry, price erosion |

| 2024 |

165 |

-8.3% |

Rise of biosimilars, new competitors |

| 2025 |

150 |

-9.1% |

Patent expiry for key formulations |

| 2026 |

135 |

-10% |

Increased biosimilar adoption |

| 2027 |

125 |

-7.4% |

Market stabilization |

| 2028 |

120 |

-4% |

Market consolidation |

Strategic Outlook

- Focus on high-margin niche markets (e.g., HIT)

- Diversify to expanding geographies with unmet needs

- Leverage partnerships and licensing for biosimilars

- Invest in novel formulations optimizing safety and cost

How Do Regulatory Policies Affect ANGIOMAX’s Market?

- FDA: Strict labeling on bleeding risks and renal impairment considerations

- European Medicines Agency (EMA): Similar stipulations with emphasis on real-world safety data

- Post-market Surveillance: Continuous monitoring influencing market access

- Reimbursement Policies: National formularies impact prescribing patterns; cost containment pressures affecting volume

How Does ANGIOMAX Compare With Alternatives?

| Aspect |

ANGIOMAX |

Heparin |

Argatroban |

Oral Factor Xa Inhibitors |

| Administration |

IV |

IV |

IV |

Oral |

| Cost |

High |

Low |

Moderate |

High |

| Bleeding Risk |

Moderate to high |

Moderate |

Similar |

Moderate |

| Ease of Use |

Requires infusion pump |

Simple subcutaneous |

IV infusion |

Oral, convenient |

| Reversal Agent |

Limited (protamine less effective) |

Protamine sulfate |

None |

Specific reversal agents available |

Implication: Cost and safety profiles heavily influence clinical decisions.

Key Takeaways

- Market Share Decline: ANGIOMAX faces ongoing pressure from cheaper, effective alternatives like heparin.

- Patent Expiry Risks: Anticipated around 2025, potential generic infiltration could erode revenues.

- Clinical Adoption: Continued preference in high-risk, complex PCI cases sustains niche demand; shifts in guidelines may alter usage.

- Regulatory & Reimbursement Impact: Healthcare policies emphasizing cost-effectiveness are key determinants.

- Growth Opportunities: Expanding in emerging markets and developing biosimilars or new formulations can sustain revenues.

- Financial Outlook: Revenue declines expected post-2025 unless differentiation strategies are implemented.

Final Recommendations for Stakeholders

| Action Item |

Rationale |

| Invest in biosimilar development |

To capitalize on patent expiry and price erosion |

| Expand into high-growth regions (Asia, Latin America) |

To offset mature market saturation |

| Engage in clinical trials for new indications |

To diversify application and extend product lifecycle |

| Advocate for value-based reimbursement models |

To improve market access and secure physician preference |

| Monitor regulatory landscape for risk mitigation |

To adapt swiftly to safety or policy shifts |

FAQs

1. When is the patent for ANGIOMAX expected to expire?

The primary patents for bivalirudin are anticipated to expire around 2025, opening the market to generic competitors.

2. How does the clinical efficacy of ANGIOMAX compare with heparin?

Clinical trials have shown comparable efficacy in PCI, with some studies suggesting reduced bleeding risks with bivalirudin in specific patient populations.

3. What are the main factors contributing to the decline in ANGIOMAX’s revenue?

High drug costs, increased use of heparin, patent expiries, and competitive biosimilars contribute to revenue decline.

4. Are there ongoing efforts to expand ANGIOMAX’s indications?

While currently limited to PCI, research into broader applications like stroke or deep vein thrombosis remains exploratory but is not a primary focus at present.

5. How do regulatory changes impact supply and demand for ANGIOMAX?

Stringent safety labeling and reimbursement policies influence prescribing behaviors, while regulatory approvals and restrictions directly affect market access.

References

[1] American College of Cardiology/American Heart Association (ACC/AHA) 2021 Guidelines.

[2] ESC Guidelines on Myocardial Revascularization, 2018.

[3] Industry Market Research Reports, 2022.

[4] The Medicines Company Annual Reports, 2000–2022.

[5] Global Reimbursement and Pricing Data, IQVIA, 2022.

[6] Patent and Regulatory Filings, FDA, EMA, 2022.

This comprehensive analysis facilitates informed strategic decisions regarding ANGIOMAX's market positioning and financial planning amid evolving cardiovascular pharmacology landscapes.