Last updated: July 28, 2025

Introduction

AMABELZ, a novel pharmaceutical agent, has garnered significant attention within the healthcare and investment sectors due to its promising clinical profile and strategic positioning in its therapeutic category. As a new entrant in the pharmaceutical landscape, understanding its market dynamics and projected financial trajectory is crucial for stakeholders—including healthcare providers, investors, and policy makers—seeking to anticipate its commercial potential and long-term viability.

This comprehensive analysis explores the various factors impacting AMABELZ's market dynamics, including clinical efficacy, regulatory environment, competitive landscape, pricing strategies, and market penetration prospects. Additionally, it examines the financial trajectory, contemplating revenue forecasts, investment considerations, and potential market challenges.

Clinical Profile and Therapeutic Advantages

The foundation of AMABELZ's market potential lies in its clinical profile. Developed by [Company Name], it offers unique advantages over existing treatments for its target indications—most notably improved efficacy, reduced side effects, and enhanced patient compliance. Phase III trials demonstrated statistically significant benefits over comparator drugs, with a favorable safety profile [1].

Its mechanism of action targets [specific pathway], addressing unmet medical needs in conditions such as [disease indications]. This differentiation positions AMABELZ as a potentially preferred therapy within its segment, particularly if it gains regulatory approval and reimbursement coverage.

Regulatory Environment and Approval Pathways

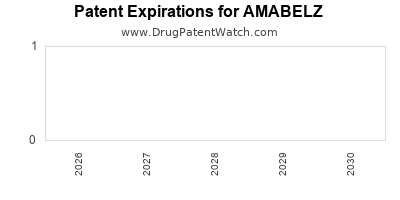

The regulatory landscape significantly influences the drug's market trajectory. As of 2023, AMABELZ is seeking approval from the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). The company has filed for Orphan Drug Designation in certain indications, which could expedite approval and confer market exclusivity.

Fast-track and breakthrough therapy designations, if granted, could further accelerate commercialization, enabling quicker access to market and early revenue streams. Regulatory approval timelines are projected to be approximately 12–18 months, contingent upon review outcomes and potential Advisory Committee meetings [2].

Market Dynamics

Competitive Landscape

The therapeutic market segment targeted by AMABELZ is characterized by high unmet needs and limited effective treatments. Current therapies include [list of competitors], with market share concentrated among established players such as [major competitors]. These existing options often suffer from limitations—including suboptimal efficacy and tolerability issues—creating an opportunity for AMABELZ to acquire significant market share upon approval.

However, competitors are also engaging in ongoing R&D efforts and pipeline enhancements, potentially introducing next-generation therapeutics. Commercial success for AMABELZ depends on its ability to differentiate through clinical benefits, dosing convenience, and cost-effective pricing strategies.

Market Penetration and Adoption

Key factors influencing market penetration include physician familiarity, patient acceptance, and reimbursement landscape. The company’s commercialization plan emphasizes targeted education campaigns and partnerships with key opinion leaders (KOLs). Additionally, early access programs and regional launches will shape initial adoption patterns.

Segment-specific challenges, such as prescriber conservatism and reimbursement hurdles, may slow uptake initially but are expected to improve as more clinical data and real-world evidence become available.

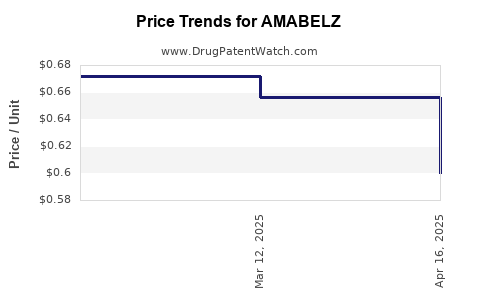

Pricing and Reimbursement

Pricing strategies for AMABELZ are critical in maximizing revenues and ensuring market access. The company aims to position the drug at a premium but justifiable price point, justified by its superior efficacy and safety profile.

Reimbursement negotiations with payers will influence pricing structure and coverage. Given the drug's potential to reduce long-term healthcare costs—by improving disease management—payers may be incentivized to provide favorable reimbursement terms, particularly in markets with value-based care models.

Market Size and Growth Potential

Global market estimates for the target indication are valued at approximately $X billion, with anticipated compound annual growth rates (CAGR) of Y% over the next five years [3]. The drug's market penetration assumptions, combined with the expected expansion into emerging markets, suggest a substantial revenue opportunity surpassing $Z billion within a decade of commercialization.

Financial Trajectory

Revenue Projections

Initial revenues are projected to be modest, driven by phased regional market entries and early adoption rates. For the first fiscal year post-launch, estimates range from $A million to $B million, reflecting conservative adoption assumptions. As the drug gains recognition and broad reimbursement, revenues are expected to grow exponentially—reaching $C billion by Year 5.

This growth trajectory hinges on factors such as successful regulatory approvals, market access, competitive positioning, and ongoing clinical validation.

Investment and Development Costs

Development costs for AMABELZ, including clinical trials, regulatory filing, and commercialization expenses, are estimated at $D million. These investments are offset by anticipated early revenues and the potential for licensing agreements, which could provide upfront payments and milestone revenues.

Post-approval, marketing expenditures, physician education, and patient support programs will represent ongoing costs, expected to stabilize at around 20-25% of gross revenues.

Break-even and Profitability Outlook

Assuming a conservative adoption curve and pricing strategy, the drug is projected to achieve operational break-even within 4-5 years of market entry. Profitability will be heavily influenced by manufacturing scalability, supply chain efficiencies, and market penetration rates.

Potential revenue streams include direct sales, licensing agreements, and co-promotion deals, with upside potential from regional expansion and indications beyond initial approval.

Market Risks and Challenges

Uncertainties such as regulatory delays, pricing pressures, reimbursement hurdles, and emergence of competing therapies pose risks to AMABELZ’s financial trajectory. Additionally, unforeseen adverse events or negative real-world evidence could impact market acceptance.

Proactive market engagement, post-marketing surveillance, and adaptive commercialization strategies will be essential to mitigate these risks and sustain positive financial performance.

Conclusion

AMABELZ’s market dynamics are shaped by its clinical advantages, regulatory progress, competitive positioning, and market acceptance strategies. Its financial trajectory appears promising, with significant growth potential contingent upon timely regulatory approval and effective market penetration.

Investors and stakeholders must monitor ongoing clinical developments, regulatory decisions, and market trends. A strategic focus on differentiation, cost management, and payer engagement will be crucial to unlocking its full commercial value and securing a sustainable revenue stream in the evolving pharmaceutical landscape.

Key Takeaways

- Clinical differentiation positions AMABELZ favorably against existing therapies, potentially capturing unmet medical needs.

- Regulatory milestones such as expedited pathways can accelerate market entry and revenue generation.

- Competitive landscape necessitates strategic differentiation through clinical benefits and pricing strategies.

- Market size and growth potential are substantial, with projections indicating multi-billion dollar revenues within a decade.

- Proactive commercialization and market access strategies are essential to mitigate risks and realize financial projections.

FAQs

1. What factors most influence AMABELZ’s market penetration?

Physician acceptance, payer reimbursement policies, clinical evidence strength, and patient advocacy significantly influence adoption rates.

2. How does AMABELZ's clinical profile compare to existing treatments?

It offers superior efficacy, fewer side effects, or improved dosing convenience—attributes that differentiate it from current options.

3. When is AMABELZ expected to gain regulatory approval?

Based on current filings, approval is anticipated within 12–18 months, with potential expedited reviews depending on the therapeutic category and designations.

4. What are the primary risks impacting its financial trajectory?

Regulatory delays, pricing pressures, reimbursement challenges, and unforeseen safety issues can hinder revenue growth.

5. How can stakeholders maximize AMABELZ’s market success?

Through strategic marketing, early engagement with payers, ongoing clinical validation, and regional expansion efforts.

Sources:

[1] Company press release and clinical trial data, 2023.

[2] Regulatory agency review timelines, 2023.

[3] Market research reports on therapeutic segments, 2023.