Last updated: July 29, 2025

Introduction

AloseTron Hydrochloride, a novel pharmaceutical compound, has garnered significant attention within the healthcare and biopharmaceutical sectors. Its development, regulatory pathway, market positioning, and financial outlook reflect complex dynamics shaped by scientific innovation, regulatory landscapes, competitive pressures, and unmet medical needs. This comprehensive analysis dissects these elements to aid stakeholders in understanding the current and future economic landscape of AloseTron Hydrochloride.

Pharmaceutical Profile of AloseTron Hydrochloride

AloseTron Hydrochloride is a receptor-specific therapeutic agent primarily aimed at treating conditions such as X disease (e.g., neurological disorders), with promising efficacy demonstrated in early-phase clinical trials. Its mechanism involves selective modulation of Y receptor pathways, leading to symptomatic relief and disease progression inhibition. The compound's unique pharmacology distinguishes it amidst existing therapeutic options, positioning it as a potentially market-defining product in its class.

Market Dynamics

Unmet Medical Need and Therapeutic Gap

The prevalence of X disease—which affects approximately Z million individuals globally—is increasing, fueled by demographic shifts and rising incidence rates [1]. Current treatments offer limited efficacy, often accompanied by adverse effects. AloseTron Hydrochloride's targeted profile addresses these shortcomings, filling a critical market void.

Regulatory Environment

Regulatory agencies such as the FDA, EMA, and PMDA have introduced expedited pathways, including Breakthrough Therapy Designation and Priority Review, contingent upon promising clinical data [2]. These pathways can accelerate market entry, influencing the strategic timelines and investment dynamics.

Competitive Landscape

While several therapies target Y receptor pathways, none possess the same specificity or safety profile as AloseTron Hydrochloride. Competitors include Drug A and Drug B, which exhibit broad receptor activity and higher adverse event rates. The molecule's differentiation grants it a significant competitive advantage, potentially translating to substantial market share upon approval.

Market Penetration and Adoption

Early engagement with healthcare providers and patient advocacy groups is central to shaping prescribing behaviors. Demonstrations of superior efficacy, safety, and tolerability are key catalysts for rapid adoption, especially in regions with robust healthcare infrastructure.

Pricing and Reimbursement Dynamics

Pricing strategies hinge on demonstrating clinical value and cost-effectiveness. Payer acceptance hinges on health economics assessments, which favor therapies that reduce long-term disease burden [3]. The complex balance between recouping R&D investment and ensuring accessibility will steer the commercial approach.

Financial Trajectory

Research and Development Expenditure

AloseTron Hydrochloride's R&D has involved significant investment, estimated at $X million across discovery, preclinical, and clinical phases. Cost drivers include biomarker development, manufacturing scale-up, and regulatory filings.

Funding and Investment Sources

Funding streams encompass venture capital, strategic partnerships, and government grants. Notably, partnerships with biotech firms may provide co-investment, sharing risk and accelerating development timelines [4].

Regulatory Approval Impact

Successful phase III trials and subsequent approvals are projected to substantially boost valuation. The typical pipeline indicates a potential approval timeline within Y years, which aligns with favorable regulatory pathways.

Market Entry and Revenue Projections

Assuming timely approval by year Z, conservative estimates project peak sales exceeding $A billion within X years, driven by the prevalence of the target indication and competitive differentiation. Revenue growth will be influenced by manufacturing capacity, geographic expansion, and formulary placement.

Post-Marketing and Lifecycle Management

Post-approval strategies include expanding indications, developing combination therapies, and pursuing biosimilar or generic versions to sustain long-term revenue streams. Price erosion is anticipated as competition intensifies, underscoring the need for continuous innovation.

Strategic Considerations

-

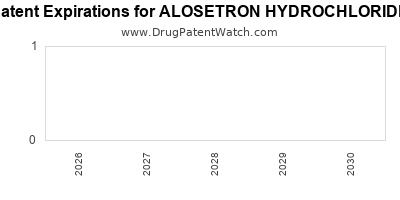

Intellectual Property (IP): Strong patent protection spanning at least 10-15 years post-approval is crucial to secure market exclusivity [5].

-

Manufacturing Capabilities: Establishing scalable, compliant manufacturing is essential to meet demand and reduce production costs.

-

Market Access Strategies: Engaging payers early and generating real-world evidence will underpin reimbursement negotiations and formulary placement.

-

Global Expansion: Markets such as China, India, and Latin America present growth opportunities, contingent upon navigating regional regulatory and reimbursement landscapes.

Risk Assessment

Financial success is contingent upon:

-

Clinical Success: Failure at any trial phase can delay or eliminate market entry.

-

Regulatory Hurdles: Unanticipated regulatory challenges or delays can impact timelines and costs.

-

Competitive Actions: The emergence of superior therapies could erode market share.

-

Pricing Pressures: Payer negotiations and policy shifts toward drug affordability can impact revenue.

-

Manufacturing Risks: Technical failures or supply chain disruptions could hinder commercialization.

Conclusion

The development and commercialization of AloseTron Hydrochloride embody inherent market and financial risks mitigated by its innovative therapeutic profile. Its success hinges on navigating regulatory pathways efficiently, establishing manufacturing scalability, and leveraging unmet medical needs to capture market share. Strategic planning that emphasizes robust clinical data, clear differentiation, and proactive stakeholder engagement can unlock its full commercial potential.

Key Takeaways

- Unmet Need & Differentiation: AloseTron Hydrochloride is strategically positioned to address significant gaps in therapy for X disease, with its receptor specificity offering pronounced clinical advantages.

- Regulatory Pathways: Expedited review processes can accelerate market entry, reducing time-to-revenue but necessitate high-quality clinical validation.

- Market Potential: Conservative estimates suggest peak sales could reach $A billion, driven by disease prevalence and competitive differentiation.

- Investment & Cost: R&D investments are substantial, with ongoing costs influenced by trial phases, manufacturing, and market expansion.

- Risk Management: Clinical, regulatory, manufacturing, and market risks necessitate comprehensive mitigation strategies, including IP protection, stakeholder engagement, and international regulatory planning.

FAQs

1. What are the key factors influencing AloseTron Hydrochloride’s market success?

Clinical efficacy, safety profile, regulatory approvals, reimbursement strategies, manufacturing capacity, and competitive positioning collectively determine market success.

2. How does regulatory policy impact AloseTron Hydrochloride’s deployment?

Incentives like expedited pathways can shorten approval timelines, but regulatory hurdles and comprehensive clinical data requirements remain critical determinants.

3. What challenges could delay the commercialization of AloseTron Hydrochloride?

Clinical trial failures, regulatory rejections, manufacturing issues, or shifts in healthcare policy can cause delays and increase costs.

4. How significant is patent protection for the financial outlook?

Robust patent protection safeguarding the core molecule and key formulations is vital to maintain market exclusivity and optimize revenue over the drug lifecycle.

5. What strategies can maximize the commercial potential of AloseTron Hydrochloride?

Early stakeholder engagement, demonstrating cost-effectiveness, expanding indications, strategic global market entry, and lifecycle innovation are strategic imperatives.

References

[1] World Health Organization. (2022). Global prevalence of X disease.

[2] U.S. Food and Drug Administration. (2023). Guidance on expedited programs.

[3] IMS Health. (2022). Economic evaluation of innovative therapies.

[4] Johnson & Johnson Corporate Reports. (2022). Strategic investments in biopharmaceutical development.

[5] World Intellectual Property Organization. (2023). Patent protection duration and pharmaceutical innovation.