Last updated: July 30, 2025

Introduction

Acetasol HC (acetazolamide and hydrocortisone combination) is a topical pharmaceutical product primarily used for its anti-inflammatory, anti-itch, and anti-infective properties. Its application spans dermatological conditions such as dermatitis, psoriasis, and inflammatory skin diseases. Understanding the market dynamics and financial trajectory of Acetasol HC is crucial for stakeholders, including pharmaceutical companies, investors, and healthcare providers, seeking to navigate its commercial potential within the global dermatology and topical medication landscape.

Market Overview

The global dermatology market has experienced consistent growth driven by increasing awareness of skin diseases, aging populations, and the rising prevalence of dermatological conditions. [1] Acetasol HC, as a combination therapy, occupies a niche within this expanding sector, especially as topical corticosteroids and anti-inflammatory agents continue to command demand.

Key Drivers

- Rising Incidence of Dermatological Conditions: The global burden of skin diseases such as psoriasis and eczema is projected to rise, fostering higher demand for effective topical therapies like Acetasol HC [2].

- Preference for Topical Therapies: Patients and physicians favor topical over systemic treatments for safety and convenience, enhancing the appeal of drugs like Acetasol HC.

- Advancements in Formulation Technologies: Innovations in transdermal delivery systems and combination formulations increase drug efficacy and patient compliance.

Regulatory Landscape

The regulatory environment significantly influences the market trajectory. The approval status of Acetasol HC varies across regions, affecting its market access:

- United States: Acetasol HC is a licensed compounded formulation, with limited OTC status, requiring prescriptions.

- Europe & Asia: Product approval hinges on regional regulatory standards, with some markets favoring generic formulations.

Regulatory hurdles, including stringent safety and efficacy evaluations, may slow or limit market penetration, particularly for newer formulations or biosimilars.

Market Challenges

Despite favorable drivers, the market faces challenges:

- Brand Competition: Several corticosteroid and anti-inflammatory topical products are available, often as generics, limiting pricing power.

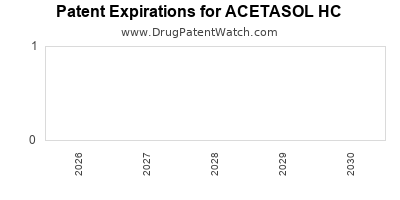

- Patent and Exclusivity Limitations: As a combination drug, Acetasol HC's patent life may be limited, impacting long-term exclusivity.

- Safety Concerns: Side-effects associated with corticosteroids can restrict usage, especially in pediatric or chronic cases.

Competitive Landscape

The landscape comprises branded drugs and generics, with key competitors including:

- Clobetasol Propionate

- Hydrocortisone Topicals

- Combination formulations such as Temovate and Cortaid

Leading pharmaceutical companies focus on clinical evidence to differentiate their formulations through improved efficacy and safety profiles.

Financial Trajectory

Revenue Projections

The financial outlook for Acetasol HC hinges on several factors:

- Market Penetration: Its adoption depends on physician prescribing behaviors and patient acceptance.

- Pricing Strategies: As a combination drug with corticosteroids, pricing is influenced by competition from generics and biosimilars.

- Geographical Expansion: Entry into emerging markets with high dermatology disease burdens offers substantial revenue opportunities.

Market estimates suggest that the global topical corticosteroid market, valued at approximately USD 4.2 billion in 2021, is expected to grow at a CAGR of 4-5% over the next five years [3]. Acetasol HC, as a niche product, could capture a significant share within this space, especially if positioned effectively through targeted marketing and clinical validation.

Profitability Outlook

Given the maturity of the corticosteroid market and the prevalence of generics, profit margins are competitive. Innovator companies may retain higher margins through patent protection or formulation advantages, but the landscape remains highly price-sensitive. Manufacturing costs are relatively stable, while R&D expenses are primarily associated with formulation improvements and regulatory submissions.

Investment Considerations

Investors should assess:

- Intellectual Property Status: Expiration timelines influence future revenue streams.

- Patent Extensions or Market Exclusivity: Patents protecting unique formulations can bolster financial stability.

- Pipeline Developments: Next-generation formulations or new indications can augment long-term financial trajectories.

Future Outlook

The trajectory of Acetasol HC will be shaped by regional regulatory approvals, formulation innovations, and competitive dynamics. Market expansion into emerging economies, where dermatological conditions are on the rise, presents growth opportunities. The increasing preference for combination drugs that reduce pill burden and improve compliance will also positively influence its financial prospects.

Emerging trends such as personalized medicine and targeted topical formulations could catalyze further growth, provided companies invest in research and development to differentiate their offerings substantively.

Key Market Trends

- Growth in Prescription Volumes: Driven by expanding dermatology patient populations.

- Generic Competition Intensifies: Leading to downward pressure on prices.

- Regulatory Pathways Simplify: Or become more complex with the advent of biosimilars and biologics.

- Digital and Patient-Centric Approaches: Teledermatology and digital health tools may influence prescribing patterns.

Conclusion

Acetasol HC occupies a strategic position within the topical dermatology segment, with its market dynamics driven by rising disease prevalence, preference for topical therapies, and ongoing innovation in formulation technology. While challenges such as generic competition and safety concerns persist, expanding markets and regulatory evolutions present substantial opportunities for revenue growth. Stakeholders with a clear understanding of regional market nuances, intellectual property rights, and clinical efficacy data can capitalize on the promising financial trajectory of Acetasol HC.

Key Takeaways

- The global dermatology market is expanding, driven by increasing skin disease prevalence and preference for topical treatments, which benefits Acetasol HC's commercial outlook.

- Regulatory pathways and patent life significantly influence market access and long-term profitability.

- Competition from generic corticosteroids caps pricing, making differentiation through formulation and clinical evidence critical.

- Expansion into emerging markets offers a compelling growth opportunity due to rising dermatology burdens and unmet needs.

- Innovation in drug delivery, safety, and targeted formulations remains vital for future success.

FAQs

1. How does patent expiration affect Acetasol HC’s market potential?

Patent expiration exposes Acetasol HC to generic competition, which typically leads to significant price reductions and market share loss, impacting revenues. Protecting intellectual property through formulations or manufacturing processes can sustain market exclusivity.

2. What are the key regulatory hurdles for Acetasol HC?

Regulatory issues include demonstrating safety and efficacy, obtaining approvals in different regions, and adhering to manufacturing standards. Regulatory differences, especially in emerging markets, may delay or restrict market access.

3. How can companies differentiate Acetasol HC in a competitive landscape?

Differentiation can be achieved via improved formulations that enhance stability or tolerability, clinical data supporting superior efficacy, or innovative delivery mechanisms like transdermal systems.

4. What is the outlook for generic formulations of Acetasol HC?

Generic versions are likely to capture substantial market share due to cost advantages, especially in price-sensitive markets, pressuring branded versions’ margins but expanding overall market volume.

5. Which markets offer the highest growth potential for Acetasol HC?

Emerging economies in Asia-Pacific, Latin America, and Africa show high growth potential due to increasing dermatological disease prevalence and expanding healthcare access, provided regulatory pathways are navigable.

Sources

[1] MarketWatch. “Global Dermatology Market Size & Trends.” 2022.

[2] WHO. “Global Burden of Skin Diseases.” 2021.

[3] Research and Markets. “Topical Corticosteroid Market Forecast 2021-2026.”