Last updated: July 28, 2025

Introduction

Selenium sulfide, a sulfur-containing organic compound with the formula SeS₂, plays an integral role in the dermatological pharmaceutical sector, primarily as an active ingredient in antifungal and anti-seborrheic formulations. Predominantly used in medicated shampoos like Selsen Blue and Head & Shoulders Clinical Strength, selenium sulfide’s market trajectory is shaped by a confluence of regulatory, consumer, and technological factors. This analysis examines the market dynamics influencing selenium sulfide, alongside its financial prospects, amid evolving industry landscapes.

Market Overview and Current Position

Selenium sulfide’s pharmaceutical utilization chiefly addresses seborrheic dermatitis, dandruff, and psoriasis-related scalp conditions. Its efficacy in controlling Malassezia yeast strains underpins its therapeutic utility, which sustains considerable industry demand. The global medicated shampoo market, estimated to reach USD 12.5 billion by 2027 (CAGR ~4.8%), inherently supports the selenium sulfide segment, given its longstanding presence as an active ingredient.

Despite its established role, selenium sulfide faces increasing competition from alternative antifungal agents, such as ketoconazole, ciclopirox, and zinc pyrithione. These agents often offer comparable or superior safety profiles and cosmetic appeal, intensifying the competitive landscape. Nevertheless, selenium sulfide’s affordability and proven effectiveness maintain its foothold, especially in regions with limited access to newer preparations.

Market Drivers

1. Persistent Demand for Antidandruff and Antifungal Products

The global burden of dandruff and seborrheic dermatitis fuels consistent demand for selenium sulfide-containing formulations. Increased awareness and diagnosis, coupled with a preference for over-the-counter (OTC) products, foster a steady revenue stream. The proliferation of personal care consciousness and hygienic practices further amplifies these demands.

2. Regulatory Endorsements and Restrictions

Regulatory frameworks, including the FDA and European Medicines Agency (EMA), permit the use of selenium sulfide within specified limits, ensuring market continuity. However, concerns related to long-term safety have prompted restrictions—particularly regarding carcinogenicity potential in high doses or prolonged exposure—where regulatory bodies advocate for cautious usage, influencing product formulation and market entry.

3. Regional Variations and Emerging Markets

Developing markets in Asia-Pacific, Latin America, and Africa exhibit high growth potential, driven by rising urbanization, increasing consumer spending on personal care, and expanding healthcare infrastructure. These markets often favor affordable, effective treatments like selenium sulfide, reinforcing its sales volume.

4. Consumer Preferences and Shift Towards Natural Alternatives

While efficacy sustains selenium sulfide use, shifting consumer preferences towards natural and organic products challenge its dominance. This trend compels formulators to innovate or combine selenium sulfide with natural ingredients, potentially affecting market shares.

Market Restraints

1. Safety and Side Effect Concerns

Reported side effects, including skin irritation, odor issues, and rare hypersensitivity reactions, impact consumer perception. Regulatory advisories caution against use in pregnant women and children, limiting certain applications and constraining growth.

2. Competition and Innovation

Emergence of novel agents, such as topical antifungal creams and shampoos with improved tolerability and cosmetic appeal, erodes selenium sulfide’s market share. Continuous R&D by competitors introduces alternatives that may outperform selenium sulfide in safety, convenience, or efficacy.

3. Regulatory Upgrades

Potential future restrictions owing to safety concerns could further suppress market expansion. Stringent regulatory controls, requiring extensive safety data and post-marketing surveillance, increase market entry costs for new formulations containing selenium sulfide.

Financial Trajectory and Investment Considerations

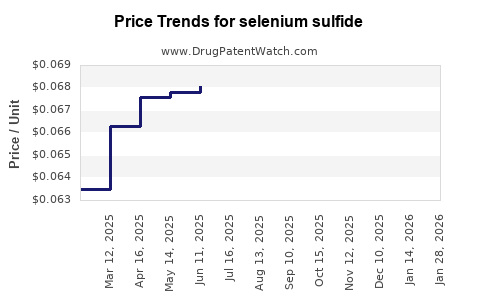

1. Revenue Trends

Though selenium sulfide’s revenue remains relatively stable in mature markets, growth prospects hinge upon expanding markets, formulation improvements, and targeted marketing strategies. The segment's profitability is also shaped by manufacturing costs, patent status (if applicable), and regulatory compliance expenses.

2. R&D and Product Diversification

Investments in research to develop selenium sulfide derivatives with improved safety profiles or delivery systems—such as encapsulation—could rejuvenate the segment’s financial performance. Additionally, integrating selenium sulfide into combination products (antifungal + anti-dandruff) may optimize revenues.

3. Strategic Collaborations and Market Entry

Pharmaceutical companies and cosmeceutical players seek licensing agreements, partnerships, and distribution rights to gain footholds in emerging markets. These strategic moves can significantly influence financial outcomes, especially amid rising demand for dermatological treatments.

4. Impact of Supply Chain Dynamics

Raw material procurement, especially selenium and sulfur, impacts production costs. Current geopolitical tensions, environmental regulations, and resource scarcity could induce volatility, affecting profit margins and market stability.

Future Outlook and Industry Projections

The outlook for selenium sulfide is cautiously optimistic. Market analysts project a compound annual growth rate (CAGR) of approximately 2-3% over the next five years, driven predominantly by demand in non-Western markets and ongoing innovation efforts. However, the growth trajectory may be tempered by safety concerns and competition from natural and synthetic alternatives.

Regulatory agencies' evolving stance and consumer preferences favoring natural ingredients could catalyze reformulation efforts or innovations incorporating selenium sulfide while mitigating safety issues. Companies investing in delivery technology improvements, such as nanoemulsions or controlled-release formulations, may unlock new revenue streams.

Regulatory Landscape

Regulatory oversight governs selenium sulfide’s formulation and allowable concentrations. For instance, the FDA permits its inclusion in OTC scalp products at concentrations of 1%. The EMA imposes additional restrictions owing to safety issues. Companies aiming for global market penetration must navigate a complex regulatory environment, aging product lines, and safety re-evaluations to sustain profitability.

Key Market Participants

Major pharmaceutical and consumer health companies involved include Procter & Gamble, Johnson & Johnson, and Unilever. These entities hold extensive distribution networks and invest significantly in product formulation and marketing. Smaller biotech firms and generic manufacturers also participate, especially in regional markets, offering opportunities for innovation and price competition.

Conclusion

Selenium sulfide retains a strategic position within the antifungal and anti-seborrheic market segments. Its steady demand, especially in emerging markets, contrasts with challenges posed by safety concerns, regulatory scrutiny, and competitive innovations. Its financial trajectory depends upon product reformulation, market expansion, and strategic positioning amid industry shifts.

Key Takeaways

- Steady Demand in Established Markets: Selenium sulfide remains a mainstay active ingredient in dandruff and seborrheic dermatitis treatments, supported by a robust OTC market.

- Growth Opportunities in Emerging Markets: Developing regions present significant expansion potential driven by increasing personal care awareness and consumer affordability.

- Safety and Regulation as Critical Factors: Ongoing safety concerns and regulatory restrictions necessitate innovation and cautious market entry strategies.

- Competitive Landscape: Increased competition from alternative antifungal agents and natural ingredients necessitates product differentiation and innovation.

- Innovation and R&D: Investment in delivery systems and formulation improvements can bolster the financial outlook and address safety issues.

Frequently Asked Questions (FAQs)

1. What are the main therapeutic uses of selenium sulfide?

Selenium sulfide is primarily used in medicated shampoos to treat dandruff, seborrheic dermatitis, and psoriasis-related scalp conditions due to its antifungal properties.

2. How does regulatory oversight impact the selenium sulfide market?

Regulatory agencies such as the FDA and EMA set concentration limits and safety guidelines for selenium sulfide use. Stricter regulations can restrict formulations, influence product labeling, and necessitate safety re-evaluation, impacting market availability and innovation.

3. What are the primary competitors to selenium sulfide in antifungal treatments?

Competing agents include ketoconazole, ciclopirox, zinc pyrithione, and natural options like tea tree oil. These alternatives often offer comparable efficacy with improved safety or cosmetic profiles.

4. Is there potential for growth in the selenium sulfide market?

Yes, particularly in emerging markets where affordability and efficacy drive demand. However, growth may be moderated by safety concerns, regulatory challenges, and consumer preferences for natural products.

5. What innovations could influence selenium sulfide's market future?

Advancements in delivery systems (such as nanoencapsulation), combination formulations, and safer derivatives could enhance efficacy, safety, and consumer acceptance, fostering future growth.

References

[1] MarketsandMarkets, "Medicated Shampoo Market," 2021.

[2] FDA, "OTC Topical Drug Products," 2022.

[3] Grand View Research, "Antidandruff Shampoo Market," 2022.