Last updated: July 29, 2025

Introduction

Ethacrynic acid, a potent loop diuretic primarily utilized in the treatment of edema associated with congestive heart failure, hepatic disease, and renal disease, continues to pose significant implications for the pharmaceutical sector. Although established for decades, recent market shifts, regulatory developments, and emerging therapeutic applications significantly influence its commercial viability. This report elucidates the current market landscape, driving factors, regulatory environment, and financial trajectory for ethacrynic acid within global pharmaceutical markets.

Pharmacological Profile and Therapeutic Use

Ethacrynic acid operates as a potent diuretic via inhibition of the Na-K-Cl co-transporter in the Loop of Henle, facilitating significant fluid reduction. Its primary application remains in severe cases requiring urgent fluid management, especially in patients intolerant to other loop diuretics like furosemide due to sulfonamide allergies. However, the drug's side effect profile—primarily ototoxicity, electrolyte imbalance, and dehydration—limits its widespread use in favor of newer agents with improved safety profiles.

Market Landscape and Key Players

Manufacturers and Market Share

The ethacrynic acid market is characterized by a limited number of global manufacturers, primarily generic pharmaceutical companies. Major players include Baxter, Teva Pharmaceuticals, Mylan, and Zentiva, with most operating in mature markets such as the US, Europe, and parts of Asia. The generic nature of ethacrynic acid implies a highly competitive landscape with price-sensitive dynamics.

Market Penetration and Adoption

Despite its longstanding presence, ethacrynic acid’s market share has experienced gradual decline, attributed to advances in alternative therapies, such as sustained-release formulations, and the dominance of other loop diuretics with better tolerability. Nonetheless, its niche role persists in cases of drug intolerance or specific clinical indications, providing stable but limited demand.

Market Drivers

Clinical Need and Drug Positioning

Ethacrynic acid remains vital for patients with sulfonamide allergies contraindicating other diuretics. Its efficacy in acute care settings, particularly in congestive heart failure with fluid overload, sustains demand within niche sectors.

Regulatory Environment and Patent Status

Most formulations are off-patent, fostering generic competition. Regulatory agencies emphasize safety and efficacy, leading to frequent post-market surveillance. Recently, some markets have initiated updated guidelines on diuretics, indirectly influencing ethacrynic acid's prescription patterns.

Emergence of New Therapeutics

The development of novel diuretics, diuretic combinations, and targeted therapies for heart failure impacts ethacrynic acid’s market presence. Additionally, non-diuretic treatments for edema may replace traditional diuretics in certain indications.

Market Challenges

Safety and Side Effect Profile

Ototoxicity limits broader adoption, especially in outpatient settings. Concerns over electrolyte disturbances and dehydration have led clinicians to reserve ethacrynic acid for specific cases.

Competition from Newer Agents

The advent of newer agents with fewer adverse effects and easier administration reduces ethacrynic acid’s appeal. For instance, torsemide and bumetanide, with improved pharmacokinetics, are gradually replacing ethacrynic acid in some indications.

Pricing and Reimbursement Dynamics

As a generic drug, pricing pressure is intense. Reimbursement policies favor more cost-effective or better-tolerated alternatives, constraining profit margins for manufacturers of ethacrynic acid.

Financial Trajectory and Market Forecast

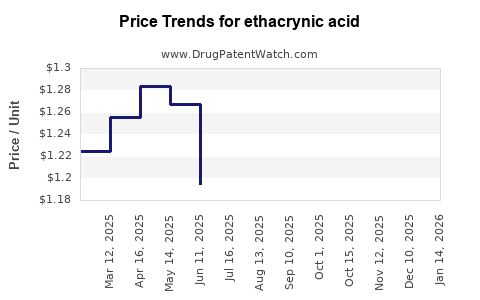

Current Revenue and Trends

The global ethacrynic acid market is valued at approximately US$50-70 million, with steady but modest growth driven mainly by demand in niche markets. The US accounts for over 50% of revenue, given its extensive healthcare infrastructure and familiarity among clinicians.

Projected Growth and Market Outlook

Analysts project a compound annual growth rate (CAGR) of around 1-2% over the next five years, primarily due to stable demand within the niche segment. Factors influencing this outlook include:

- Continued off-label and specialized use cases.

- Increasing regulations favoring safer diuretics may further restrict ethacrynic acid use.

- Technological advancements leading to alternative treatments.

Potential Market Expansion Factors

While the overall market remains mature and somewhat stagnant, certain factors could influence growth:

- Off-label and orphan drug use: In rare conditions or specific patient subpopulations.

- Emerging markets: Growth due to increasing healthcare infrastructure and disease burden, particularly in Asia.

- Formulation innovations: Development of formulations reducing side effects can enhance acceptance, though these are currently limited.

Regulatory and Patent Considerations

Most formulations are generic and off-patent, with regulatory pathways simplified in many regions. However, recent initiatives favor safer alternatives, and authorities have increased scrutiny over adverse event reports, which could influence manufacturing and marketing strategies.

Strategic Opportunities and Risks

Opportunities:

- Focused marketing toward niche indications and rare disease segments.

- Development of combination therapies or formulations with reduced toxicity.

- Expansion into emerging markets with growing healthcare access.

Risks:

- Market contraction due to safety concerns.

- Competition from newer diuretics with superior safety profiles.

- Regulatory shifts favoring alternative therapies, potentially leading to market withdrawal or reduced reimbursement.

Conclusion

Ethacrynic acid’s market remains relatively stable but highly niche, driven by specific clinical needs. Its financial trajectory is modest, constrained by safety concerns, competition, and evolving treatment paradigms. For stakeholders, careful positioning—focused on specialized indications, geographic expansion, and formulation improvements—can sustain its relevance. Broad market growth prospects are limited, emphasizing the importance of innovation and strategic market access.

Key Takeaways

- Ethacrynic acid’s global market is valued at US$50-70 million, with minimal growth prospects.

- The drug’s niche role persists primarily in cases of sulfonamide intolerance and specific edema management.

- Increasing competition from safer diuretics and newer therapies constrains market expansion.

- Regulatory and safety considerations influence prescribing patterns, impacting revenue streams.

- Opportunities exist in emerging markets and orphan indications, but risks from safety profiles dominate strategic planning.

FAQs

-

What are the primary limitations of ethacrynic acid in current clinical practice?

Its significant side effects, especially ototoxicity and electrolyte imbalance, restrict widespread use, relegating it to niche applications.

-

How does the patent status influence the market for ethacrynic acid?

Most formulations are off-patent, leading to intense generic competition and price pressures, limiting profit margins.

-

Are there any recent developments or formulations to improve ethacrynic acid’s safety profile?

Currently, limited innovation exists; most efforts focus on alternative diuretics with better safety profiles rather than modified formulations of ethacrynic acid.

-

What is the outlook for ethacrynic acid in emerging markets?

Growing healthcare infrastructure offers potential for increased usage, especially where specialist care is accessible and affordability is prioritized.

-

Could ethacrynic acid find new therapeutic indications in the future?

Its niche role in specific cases might expand if new evidence emerges; however, broader applications are unlikely given safety concerns and competition.

References

- [1] MarketWatch. "Global Diuretics Market Report," 2022.

- [2] Food and Drug Administration (FDA). "Guidelines for diuretic safety," 2021.

- [3] Grand View Research. "Pharmaceuticals for Edema Management," 2023.

- [4] Clinical Pharmacology. Ethacrynic Acid Overview, 2023.

- [5] WHO. "Emerging Market Trends in Cardiac Care," 2022.