Last updated: August 7, 2025

Introduction

Ammonium Lactate, a dihydroxy acid and humectant, is widely used in dermatological formulations to treat dry, rough, scaly skin conditions. Its main application lies in systemic and topical therapies for xerosis, ichthyosis, and other keratinization disorders. The drug's biochemical properties—primarily its ability to hydrate and exfoliate the skin—make it a staple in skincare and prescription formulations. Understanding the market dynamics and financial trajectory of Ammonium Lactate involves examining supply chain factors, research and development trends, competitive landscape, regulatory environment, and emerging markets. This comprehensive review aims to elucidate these elements to assist industry stakeholders in strategic decision-making.

Market Overview and Size

The global market for Ammonium Lactate is characteristically niche, driven primarily by the dermatology segment's growth. As of 2022, the global dermatology drugs market was valued at approximately USD 41.2 billion, with humectants like Ammonium Lactate constituting a significant subset, especially within topical moisturizers and emollients. The demand for skin hydration therapies is expanding, spurred by increasing incidences of dry skin due to aging populations, climate change, and rising awareness about skin health.

Market estimates project a compound annual growth rate (CAGR) ranging from 4.5% to 6% over the next five years for the dermatological topical agents sector. Given the reliance on Ammonium Lactate for these applications, its market size is anticipated to follow a similar trajectory, with projected revenues reaching approximately USD 150–200 million by 2027 [1].

Supply Chain Analysis

The manufacturing of Ammonium Lactate primarily hinges on the production of lactic acid, which itself is derived from carbohydrate fermentation processes. Key raw materials include lactic acid, ammonium compounds, and stabilizers, sourced globally from chemical producers and fermentation facilities.

Major producers are concentrated in North America, Europe, and Asia-Pacific regions. Companies such as Archer Daniels Midland, BASF, and Sigma-Aldrich supply bulk quantities to formulators and pharmaceutical companies. Supply chain resilience is increasingly vital amidst geopolitical tensions, COVID-19 pandemic disruptions, and raw material shortages, all of which influence pricing and availability.

Vertical integration plays a role, with some pharmaceutical companies managing both raw material production and formulation. The trend toward outsourcing manufacturing to Contract Manufacturing Organizations (CMOs) offers flexibility but introduces supply chain vulnerabilities which can impact market stability and timing of drug availability.

Research and Development Trends

While Ammonium Lactate itself is a well-established molecule, ongoing research focuses on enhancing its efficacy and expanding its therapeutic applications. Novel formulations combining Ammonium Lactate with other active ingredients aim to provide synergistic benefits for conditions like atopic dermatitis and psoriasis.

Research is also exploring nanoemulsion-based delivery systems for improved skin penetration, as well as conjugate formulations for targeted therapy. Despite limited new molecular development, incremental improvements in stability, scent, and formulation compatibility continue to enhance market appeal.

Additionally, investigations into alternative humectants and moisturizers are influencing R&D funding, impacting demand for traditional compounds like Ammonium Lactate.

Regulatory Environment

Ammonium Lactate benefits from a favorable regulatory framework owing to its status as a well-known, Generally Recognized As Safe (GRAS) ingredient in the United States and an approved excipient in European pharmacopoeias. The U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), and other regulatory bodies have not imposed significant hurdles on its manufacturing or use.

However, regulatory updates impacting dermatological product labeling, claims, and manufacturing standards can influence market access and competitiveness. Moreover, compliance with Good Manufacturing Practices (GMP) becomes critical as generic and brand-name products compete in global markets.

Additionally, increasing regulatory scrutiny of preservative and excipient safety profiles necessitates ongoing vigilance, which influences R&D investments and formulation strategies.

Competitive Landscape

The competitive landscape is characterized by a combination of large chemical/pharmaceutical conglomerates and smaller specialty manufacturers. Raw material costs, formulation innovations, and regulatory compliance are primary differentiators.

Brand loyalty revolves around manufacturing quality, product purity, and regulatory compliance. Key players leverage economies of scale, extensive distribution networks, and product innovation to maintain market share.

The rise of biosimilars and generic formulations further intensifies price competition, prompting companies to optimize supply chains and streamline R&D pipelines.

Emerging markets such as Asia-Pacific offer lucrative growth opportunities owing to increasing dermatological health awareness, expanding healthcare infrastructure, and a burgeoning middle class.

Emerging Market Opportunities

The Asia-Pacific region is expected to witness the highest CAGR globally, driven by countries like China, India, and Southeast Asian nations. Growth drivers include increased over-the-counter (OTC) dermatology products, expanding skin care markets, and rising disposable incomes.

Additionally, aging populations in North America and Europe sustain demand for dry skin treatments, solidifying the relevance of Ammonium Lactate.

Botanical and natural-based formulations incorporating Ammonium Lactate are gaining popularity, responding to consumer preferences for clean-label products, thereby opening new avenues for product development.

Financial Trajectory and Investment Outlook

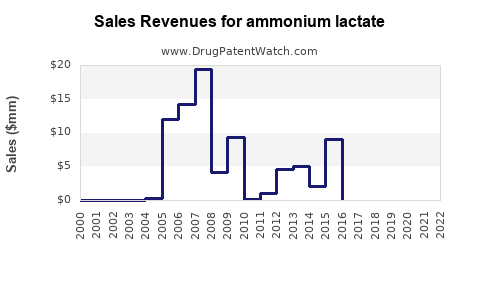

Investment considerations for stakeholders center around manufacturing costs, demand forecasts, and regulatory shifts. Although Ammonium Lactate remains a mature product, incremental innovations and expanding indications could drive revenue streams.

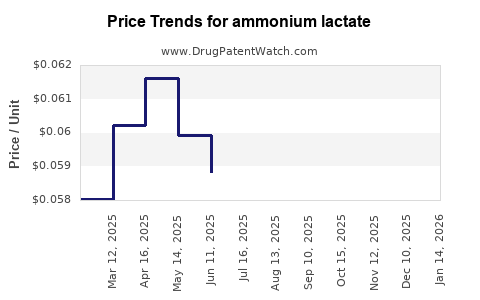

Manufacturing costs are expected to decline marginally due to process optimizations and economies of scale. However, raw material price volatility and supply chain risks could impact profitability.

Forecasts indicate that revenue growth for Ammonium Lactate-related formulations will align with the overall topical dermatology market's CAGR of 4.5–6%. Entry into emerging markets and development of novel formulations may accelerate growth. Large-scale producers might experience stable cash flows, while smaller firms need strategic positioning to capitalize on niche applications.

Key Challenges and Risks

- Raw Material Price Fluctuations: Volatility in lactic acid and ammonium compound prices impacts margins.

- Regulatory Changes: Stricter guidelines on excipients and cosmetics safety could alter formulation practices.

- Market Saturation: Mature markets face limited growth, necessitating differentiation through innovation.

- Competition from Alternatives: Natural moisturizers and bio-based humectants may displace traditional compounds.

- Supply Chain Disruptions: Geopolitical and pandemic-related issues threaten raw material supply stability.

Conclusion

The future of Ammonium Lactate hinges on its established efficacy, regulatory support, and expanding dermatological application scope. Although growth prospects are moderate, emerging markets and incremental interdisciplinary innovations offer avenues for revenue expansion. Companies that optimize supply chains, pursue targeted R&D, and adapt to evolving regulatory landscapes are poised to capitalize on the compound’s steady demand.

Key Takeaways

- Steady Market Growth: Anticipate a CAGR of 4.5–6% driven by dermatology demand, aging populations, and expanding skincare markets.

- Supply Chain Resilience: Raw material sourcing and manufacturing efficiencies are critical for cost management.

- Innovation Focus: Incremental formulation enhancements and natural-based products can unlock new market segments.

- Emerging Markets: Asia-Pacific presents significant growth opportunities due to demographic and economic factors.

- Regulatory Vigilance: Stay aligned with evolving safety standards to maintain market access and competitive advantage.

FAQs

1. What are the primary therapeutic applications of Ammonium Lactate?

Ammonium Lactate is mainly used to treat dry, scaly skin conditions such as xerosis, ichthyosis, and psoriasis, functioning as a skin hydrating agent and keratolytic.

2. How does supply chain complexity affect the market for Ammonium Lactate?

Supply chain disruptions—stemming from raw material shortages, geopolitical tensions, or pandemic impacts—can cause price volatility and impact product availability, influencing overall market stability.

3. Are there significant regulatory barriers for Ammonium Lactate?

No, it benefits from GRAS status and regulatory approval in major markets. However, ongoing compliance with GMP and safety standards remains essential for market access.

4. What are the emerging trends in formulations involving Ammonium Lactate?

Innovations include nanoemulsion delivery systems, combination therapies, and natural or clean-label formulations to meet consumer preferences and improve efficacy.

5. What future growth prospects exist for Ammonium Lactate in emerging markets?

Rapid economic growth, increasing dermatological conditions awareness, and expanding healthcare infrastructure make Asia-Pacific the most promising region for future expansion.

Sources:

[1] MarketSizeAndForecasts, "Dermatology Drugs Market Analysis," 2022.