Last updated: July 27, 2025

Introduction

Nitazoxanide, an antiparasitic and broad-spectrum antiviral agent, has garnered attention for its potential across multiple therapeutic areas, including parasitic infections, viral diseases, and emerging antimicrobial resistance (AMR). Originally approved in 2002 for treating gastrointestinal parasites, its expanding clinical research landscape suggests a significant shift in its market trajectory, driven by evolving healthcare needs and technological innovations. This analysis explores the dynamic market factors influencing nitazoxanide’s trajectory, anticipated revenue streams, competitive landscape, regulatory environment, and strategic opportunities shaping its future.

Pharmacological Profile and Clinical Utility

Nitazoxanide (marketed as Alinia among other brands) functions by inhibiting parasite electron transport and modulating host immune responses. Its relatively safe profile and broad-spectrum activity facilitated its initial deployment against protozoa like Giardia lamblia and Cryptosporidium parvum. Recent studies have expanded its potential applications to viral infections such as hepatitis C, influenza, and emerging viral pathogens including SARS-CoV-2, signing a pivotal change in its market landscape.

Market Dynamics

1. Growing Disease Burden and Unmet Medical Needs

The expanding scope of nitazoxanide stems from the persistent global burden of parasitic and viral diseases. According to WHO, diarrheal diseases caused by protozoal agents remain a leading cause of morbidity in developing countries [1]. The ongoing COVID-19 pandemic propelled interest in repurposing existing drugs, with notable studies indicating antiviral properties of nitazoxanide against SARS-CoV-2, thereby catalyzing COVID-related clinical trials [2]. This surge in research aligns with an urgent demand for inexpensive, safe antivirals, favorably positioning nitazoxanide as a versatile candidate.

2. Competitive Landscape and Off-Label Use

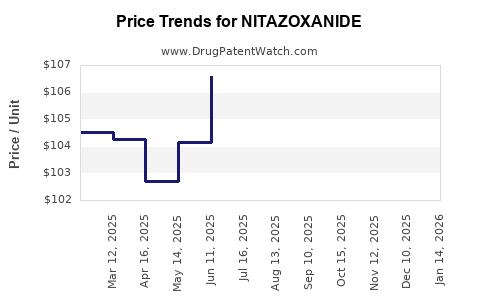

Despite initial commercial success, nitazoxanide faces intensified competition from newer antiparasitic and antiviral agents, as well as supportive therapies. Its off-label use, particularly for viral indications, complicates patent exclusivity and revenue projections. While patent protections have expired in many jurisdictions, clinical evidence and regulatory approvals serve as barriers or enablers, influencing market penetration and pricing strategies.

3. Regulatory Environment and Approvals

In the United States, nitazoxanide maintains FDA approval solely for parasitic infections, limiting its mainstream antiviral application. Conversely, in some countries like India and Mexico, regulatory agencies have granted broader indications based on local clinical trials. Governmental policies emphasizing affordable healthcare and the potential for drug repurposing under emergency use authorizations (EUAs) significantly shape market pathways.

4. Commercialization and Strategic Partnerships

Pharmaceutical companies exploring nitazoxanide’s antiviral potential are pursuing partnerships with biotech firms and academic institutions, accelerating clinical trials. Companies like Romark, the original patent holder, have sought regulatory extensions and marketing strategies focused on parasite indications, while others are aiming to develop combination therapies that include nitazoxanide.

5. Patent Landscape and Intellectual Property

The expiration of primary patents has prompted generic manufacturing, affecting pricing strategies and market share. Innovative formulations, such as extended-release versions or combination products, are potential avenues to extend market exclusivity and revenue.

Financial Trajectory

1. Revenue Opportunities

The global antiparasitic market was valued at approximately USD 4 billion in 2022, with an anticipated compound annual growth rate (CAGR) of 5.3% through 2030 [3]. Nitazoxanide’s current market share remains modest but has growth potential in the antiviral segment, especially if approved for COVID-19 or other emergent viral illnesses.

The drug's affordability and safety profile position it favorably for use in low- and middle-income countries (LMICs), constituting sizable markets with substantial unmet needs. The expansion into viral indications, if supported by robust clinical evidence and regulatory approval, could catalyze revenue growth, potentially adding hundreds of millions of dollars annually.

2. Investment in R&D and Clinical Trials

To capitalize on its broad-spectrum potential, stakeholders are investing heavily in Phase II and III trials targeting viral infections, including COVID-19 and influenza. Successful trial outcomes often correlate with spike in stock price, licensing deals, and favorable reimbursement policies. For example, early studies suggesting efficacy against SARS-CoV-2 have stimulated partnerships and funding, notably from United States government agencies during the pandemic.

3. Pricing Dynamics and Reimbursement

The drug’s low-cost manufacturing coupled with approval in basic healthcare settings suggests high affordability, a key driver in LMICs’ uptake. However, regulatory hurdles and payer policies influence reimbursement models in high-income countries. The cost-effectiveness of nitazoxanide for COVID-19 or hepatitis C remains a critical factor in its financial viability.

4. Global Market Penetration

Expansion strategies focus on both direct-to-consumer sales in developed markets and widespread distribution through government procurement in LMICs. The current pipeline includes generic versions, which tend to put downward pressure on prices but broaden access.

Challenges and Risks

- Regulatory Uncertainty: Fast-tracking approvals during global health crises may lead to compliance challenges post-pandemic.

- Clinical Evidence Variability: Divergent study results create ambiguity over efficacy across indications, impacting market confidence.

- Intellectual Property and Competition: Patent expiries and the emergence of generics dilute revenues.

- Market Penetration Barriers: Lack of awareness, limited formulation options, and logistical challenges hinder adoption—especially in resource-limited regions.

Future Outlook and Strategic Opportunities

The upcoming years will determine whether nitazoxanide sustains its role as a versatile therapeutic agent or remains confined to niche parasitic indications. The strategic emphasis on rigorous clinical trials against viral pathogens, coupled with targeted regulatory filings, will be pivotal. Technological advances such as nanoformulations and combination therapies can enhance efficacy, spectrum, and market attractiveness. Strategic alliances with public health agencies could facilitate large-scale distribution, especially amid global health emergencies.

The potential for developing a diversification pipeline—covering parasitic, viral, and bacterial indications—positions nitazoxanide favorably within the broader antimicrobial resistance context. Continuous monitoring of regulatory outcomes, clinical trial milestones, and market uptake is vital for stakeholders prioritizing investments or market entry.

Key Takeaways

- Evolving Indications: Nitazoxanide's expansion from antiparasitic to antiviral markets hinges on successful clinical trials, regulatory approvals, and strategic positioning.

- Market Growth Drivers: Global disease burden, urgent need for antivirals, and affordability make nitazoxanide a compelling candidate in emerging infectious disease management.

- Competitive and Regulatory Challenges: Patent expirations, off-label use restrictions, and variable regulatory environments influence revenue stability.

- Strategic Opportunities: Innovation in formulations, combination therapies, and strategic partnerships can sustain and grow its market share.

- Financial Outlook: While current revenues are modest, promising clinical data could unlock substantial growth, especially if positioned within global health frameworks.

FAQs

Q1. What are the primary therapeutic indications for nitazoxanide today?

Nitazoxanide is primarily indicated for treating gastrointestinal parasitic infections such as Giardia lamblia and Cryptosporidium parvum. Its investigational uses in viral illnesses, including hepatitis C and COVID-19, are still undergoing clinical evaluation.

Q2. How has the COVID-19 pandemic influenced nitazoxanide’s market prospects?

The pandemic accelerated research into nitazoxanide's antiviral properties, leading to multiple clinical trials and emergency use considerations. This period highlighted its potential as an affordable, broad-spectrum antiviral, boosting interest and investment.

Q3. What are the main barriers to commercial growth for nitazoxanide?

Key barriers include the expiry of patents allowing generics, regulatory restrictions on off-label antiviral uses, inconsistent clinical trial results, and limited awareness in high-income markets.

Q4. Which regions represent the most significant growth opportunities for nitazoxanide?

Lower-resource regions with high parasitic disease prevalence (e.g., Africa, parts of Asia) are primary markets for parasitic indications. Emerging interest in viral indications may bolster prospects in North America and Europe following regulatory approvals.

Q5. What strategic steps should stakeholders consider to enhance nitazoxanide’s market trajectory?

Focusing on conducting well-designed clinical trials for viral indications, securing regulatory approvals, developing advanced formulations, fostering public-private partnerships, and expanding access through affordable pricing models are critical steps.

References

[1] WHO. Diarrhoeal Disease. World Health Organization. 2022.

[2] Wang M, et al. "Repurposing Nitazoxanide for COVID-19." J Virol. 2020;94(16):e00923-20.

[3] Grand View Research. Antiparasitic Drugs Market Size, Share & Trends Analysis Report. 2023.