Last updated: July 28, 2025

Introduction

Acarbose, an alpha-glucosidase inhibitor, has carved a distinct niche within the management of type 2 diabetes mellitus (T2DM). Approved initially in the late 20th century, acarbose continues to influence the pharmaceutical landscape owing to its unique mechanism and evolving market forces. This analysis explores the factors shaping acarbose’s market dynamics and its fiscal future, offering insights crucial for stakeholders across healthcare and investment sectors.

Overview of Acarbose: Pharmacology and Therapeutic Positioning

Acarbose functions by delaying carbohydrate absorption in the intestine, thus reducing post-prandial hyperglycemia. Its utility lies primarily in early-stage T2DM management and as an adjunct to other antidiabetic drugs. Its non-systemic mechanism offers a favorable safety profile but limits its use to specific clinical contexts. Despite its niche application, acarbose remains a therapeutically relevant agent, especially in regions with high diabetes prevalence and limited access to newer drugs.

Market Dynamics Influencing Acarbose

1. Global Diabetes Epidemic and Demand Drivers

The escalating prevalence of T2DM is a primary factor supporting acarbose’s market. According to the International Diabetes Federation (IDF), approximately 537 million adults globally have diabetes, projected to reach 643 million by 2030 [1]. In regions like Asia-Pacific, where lifestyle changes contribute markedly to rising diabetes cases, acarbose's affordability makes it an attractive option, thereby expanding its consumption.

2. Competitive Therapeutics Landscape

Acarbose faces stiff competition from newer classes of antidiabetic agents such as SGLT2 inhibitors, GLP-1 receptor agonists, and DPP-4 inhibitors. While these offer additional benefits like weight loss and cardioprotection, they are often costlier, limiting their reach in low- and middle-income countries (LMICs). Acarbose’s lower price point sustains its use in emerging markets, though in developed markets, its market share diminishes against innovative therapies.

3. Regulatory Status and Approvals

Regulatory acceptance influences market expansion. Acarbose's approval in multiple countries, including Japan, the European Union, and the US, facilitates penetration. However, in some regions, regulatory hurdles or lack of patent protection for certain formulations constrict innovation and market growth. Patent expirations in some jurisdictions could lead to generic competition, decreasing prices and increasing accessibility.

4. Patent and Intellectual Property Landscape

As acarbose's original patents expire or near expiry, generics enter the market, intensifying competition. Generics typically lead to price erosion but improve affordability. This dynamic is particularly impactful in markets where biotech innovation is less prioritized, underpinning steady demand driven by cost considerations.

5. Pricing, Reimbursement, and Economic Factors

Pricing policies and reimbursement frameworks heavily influence medication adoption. In countries with comprehensive diabetes management programs, inclusion of acarbose in formularies promotes its use. Conversely, high out-of-pocket costs reduce affordability, especially where newer, reimbursed options dominate. Economic constraints in LMICs bolster acarbose’s relevance due to cost-effectiveness.

6. Lifestyle and Cultural Factors

Dietary patterns impact acarbose's utilization. Populations with high carbohydrate intake, especially rice-heavy diets common in Asia, benefit from acarbose’s mode of action, thus fostering market demand.

7. Adverse Effect Profile and Patient Preference

Gastrointestinal side effects, such as flatulence and diarrhea, influence patient adherence. While manageable, these effects can dissuade therapy continuation, affecting prescription rates and market potential.

Financial Trajectory and Market Forecasts

Historical Revenue Trends

Global revenues for acarbose have remained relatively stable, with fluctuations driven by regional market access, generics, and competition. According to IQVIA data, the global market for alpha-glucosidase inhibitors, primarily acarbose, was valued at approximately $300–400 million in recent years, with Asia-Pacific accounting for a lion’s share due to high diabetes prevalence and lower-cost formulations [2].

Forecasting Future Growth

The acarbose market is projected to exhibit moderate growth, estimated at a Compound Annual Growth Rate (CAGR) of approximately 3–5% over the next five years. Several factors underpin this optimistic outlook:

- Rising diabetes burden in LMICs will maintain demand.

- Expanding access to generics will sustain affordability and consumption.

- Growing awareness of early intervention strategies encourages use in prediabetic populations.

However, this growth may be tempered by:

- The rising adoption of novel, branded therapies offering improved clinical outcomes.

- Potential regulatory restrictions or shifts toward combination therapies reducing standalone acarbose prescriptions.

Geographical Market Segmentation

- Asia-Pacific: Dominates the acarbose market, accounting for over 60% of revenue, driven by high diabetes prevalence and price sensitivity.

- Europe: Stable but declining due to preference for newer agents.

- North America: Limited market share, primarily driven by importation and off-label use, with growth prospects dictated by evolving clinical guidelines.

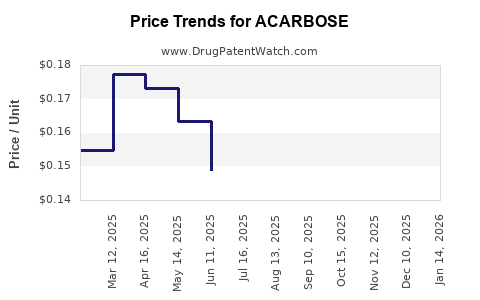

Impact of Patent Expiration and Generics

Patent expiry in major markets like Europe and the US is expected to intensify generic competition, exerting downward pressure on prices and margins. Conversely, in protected markets, brand stability sustains revenue.

Strategic Factors Shaping Future Trajectory

- Innovation and Formulation Development: Efforts to improve tolerability, such as combination pills or extended-release formulations, could rejuvenate market interest.

- Regulatory Engagement: Expanding approvals for new indications, such as prediabetes or metabolic syndrome, creates new revenue streams.

- Market Penetration in Remote and Underserved Regions: Enhanced distribution and affordability initiatives can unlock growth in emerging markets.

- Integration into Combination Therapies: Pairing acarbose with other agents may streamline treatment regimens, potentially increasing usage.

Conclusion

Acarbose maintains a niche yet resilient position within the global antidiabetic therapeutics market. Its stability hinges on demographic trends, regional healthcare policies, and economic factors. While facing growing competition from innovative therapies, acarbose’s cost-effectiveness and targeted mechanism secure its relevance, especially in resource-limited regions. Forward-looking strategies focusing on formulation improvements, regulatory expansion, and market diversification will influence its financial trajectory.

Key Takeaways

- Growing Diabetes Prevalence: Rising T2DM rates worldwide support sustained demand for acarbose, particularly in LMICs.

- Competitive Dynamics: The emergence of newer drug classes challenges acarbose’s market share; however, affordability preserves its niche.

- Patent and Generics: Patent expiries fuel generic competition, lowering prices but broadening access.

- Regional Variations: Asia-Pacific dominates acarbose consumption, driven by high carbohydrate diets and economic factors.

- Strategic Opportunities: Innovating formulations and expanding approvals can enhance future revenue streams.

FAQs

-

What are the primary advantages of acarbose compared to newer antidiabetic agents?

Acarbose is cost-effective, non-systemic, and has a well-established safety profile. While it lacks the cardiovascular and weight-loss benefits of newer agents, its affordability makes it suitable for resource-limited settings.

-

How will patent expirations affect acarbose’s market share?

Patent expirations typically lead to increased generic competition, resulting in price reductions and wider accessibility, although they may reduce profit margins for incumbent manufacturers.

-

In which regions is acarbose experiencing the fastest growth?

The Asia-Pacific region sees the most significant growth due to high diabetes prevalence, dietary factors favoring acarbose use, and cost-sensitive healthcare markets.

-

What is the outlook for acarbose’s role in combination therapies?

Combining acarbose with other antidiabetic agents could improve efficacy and tolerability, opening new avenues for its integration into multi-drug regimens, especially as personalized medicine evolves.

-

Are there ongoing efforts to develop improved formulations or new indications for acarbose?

Yes, research focuses on extended-release formulations to improve GI tolerability and exploring indications like prediabetes management, which could expand its clinical utility.

References

[1] International Diabetes Federation. (2022). IDF Diabetes Atlas, 10th Edition.

[2] IQVIA. (2022). Global Pharmaceutical Market Data.