Share This Page

Drug Sales Trends for ZOHYDRO ER

✉ Email this page to a colleague

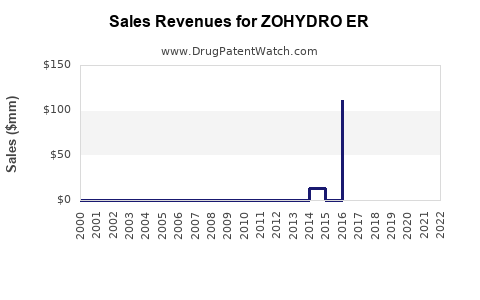

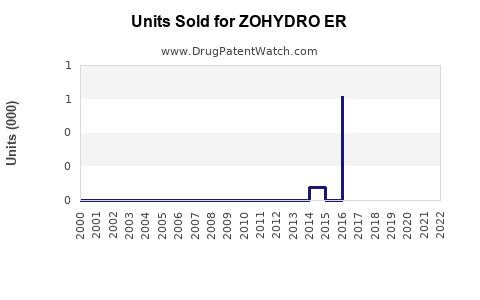

Annual Sales Revenues and Units Sold for ZOHYDRO ER

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ZOHYDRO ER | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ZOHYDRO ER | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ZOHYDRO ER | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| ZOHYDRO ER | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| ZOHYDRO ER | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| ZOHYDRO ER | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| ZOHYDRO ER | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for ZOHYDRO ER

Introduction

Zohydro ER, the extended-release formulation of hydrocodone, is a powerful opioid analgesic indicated for managing moderate to severe chronic pain where other treatments are inadequate. Approved by the U.S. Food and Drug Administration (FDA) in 2013, Zohydro ER faced a dynamic market environment shaped by opioid prescribing trends, regulatory measures, the ongoing opioid epidemic, and evolving pain management practices. This analysis evaluates the market landscape and projects sales trajectories for Zohydro ER, emphasizing factors influencing demand, competitive positioning, and potential growth opportunities.

Market Landscape

Global and U.S. Opioid Market Overview

The global opioid analgesics market was valued at approximately USD 8.2 billion in 2020, with projected compound annual growth rate (CAGR) estimated at 4.6% through 2028 (source: Grand View Research). The U.S. remains the dominant market, accounting for over 60% of global consumption, driven by high prevalence of chronic pain, surgical procedures, and the volume of opioid prescriptions.

In the U.S., opioid prescriptions peaked around 2012, exceeding 255 million prescriptions annually [1]. However, subsequent tightening of regulations, increased awareness of opioid misuse, and legislative efforts have significantly curtailed prescribing volumes, with data indicating a decline to approximately 150 million prescriptions in recent years [2].

Regulatory Dynamics and Prescribing Trends

Post-2013, the regulatory landscape has become more stringent. Initiatives from the CDC Guidance for Prescribing Opioids for Chronic Pain (2016) advocate for cautious opioid use, emphasizing non-opioid alternatives and risk mitigation. States have enacted prescription drug monitoring programs (PDMPs), tamper-resistant formulations, and prescribing limits.

In this context, the market shift favors formulations that are less prone to misuse, such as abuse-deterrent formulations (ADFs). Zohydro ER, being a non-abuse-deterrent formulation, faces constraints in market appeal but remains relevant in specific patient populations requiring potent, long-acting opioids.

Competitive Landscape

Zohydro ER competes primarily with:

-

Extended-release oxycodone and hydrocodone products, including Prescription Drug Abuse Prevention Efforts

-

Abuse-deterrent formulations (e.g., Xtampza ER, ER formulations of oxycodone such as OxyContin, and reformulated hydrocodone products)

-

Combination opioids (e.g., hydrocodone-acetaminophen or hydrocodone ibuprofen)

Given its non-abuse-deterrent status, Zohydro ER's market share has been affected by competitors developing abuse-deterrent versions and by regulatory restrictions on high-dose, non-abuse-deterrent opioids.

Market Drivers and Barriers

Drivers:

- Strong efficacy for moderate to severe pain

- Long-acting formulation useful in specific patient populations

- Persistent unmet needs in pain management, particularly in patients intolerant to other opioids

Barriers:

- Growing regulatory restrictions and risk of misuse

- Public and provider concern about opioid epidemic repercussions

- Competition from abuse-deterrent and non-opioid modalities

- Reimbursement challenges owing to formulary and insurance policies

Sales Projections

Historical Sales Data

Since its approval in 2013, Zohydro ER experienced initial uptake driven by prescribers seeking long-acting opioid options. In 2015, peak sales were estimated at around USD 85 million, according to IQVIA data [3].

Following increased regulatory scrutiny and the rise of abuse-deterrent alternatives, sales declined, reaching approximately USD 30 million by 2018. Since then, the market stabilizes with incremental growth possible under favorable conditions.

Forecasting Assumptions

- Market penetration will remain limited due to competitive pressures and regulatory constraints

- Prescriber acceptance will depend on evolving pain management guidelines and risk mitigation strategies

- Reimbursement and formulary coverage trends will influence prescribing patterns

- Potential product innovations (e.g., reformulations or abuse-deterrent versions) could alter market dynamics

Projection Scenarios

| Scenario | 2023 (USD Million) | 2025 (USD Million) | 2028 (USD Million) | Commentary |

|---|---|---|---|---|

| Conservative | 20 | 15 | 10 | Market declines continue; reduced prescriber preference |

| Moderate Growth | 35 | 45 | 55 | Slight market stabilization; incremental growth with targeted use |

| Optimistic | 50 | 70 | 90 | Adoption of new formulations or expanded indications; less regulatory resistance |

Note: These projections assume the absence of significant formulary or legislative changes but may be influenced by healthcare policies, societal trends, and product innovation.

Impact of Regulatory and Market Factors

- Opioid prescribing restrictions will likely limit overall growth; however, a subset of patients requiring strong, long-acting opioids might sustain stable demand.

- Development of abuse-deterrent formulations by competitors can siphon share unless Zohydro ER introduces reformulated versions.

- Legislative actions, such as the rescheduling of certain opioids or tightening of prescribing limits, could further constrain sales.

Competitive Outlook and Strategic Opportunities

To enhance market positioning, manufacturers may consider:

- Developing abuse-deterrent formulations to meet regulatory and prescriber demands

- Engaging in targeted education campaigns highlighting efficacy in appropriate patient populations

- Collaborating with payers for formulary inclusion and reimbursement strategies

- Exploring indications beyond chronic pain where opioid necessity is justified, such as specific postoperative or palliative care settings

Key Market Segments

- Pain Management Clinics: Small but steady prescriber base; sensitive to regulatory guidance

- Hospitals and Palliative Care: Potential short-term use; constrained by hospital formularies

- Specialty Pain Physicians: High-necessity patients, but cautious due to regulatory scrutiny

Conclusion

Zohydro ER occupies a niche within the opioid analgesic market, characterized by high potency and extended-release efficacy but constrained by regulatory, societal, and competitive factors. While the overall market trend is declining, targeted utilization in specific populations sustains a modest sales potential. Strategic product development, abuse deterrence, and regulatory navigation will be critical to capitalize on remaining opportunities.

Key Takeaways

- The global and U.S. opioid markets are shrinking due to regulatory and societal pressures focused on reducing misuse.

- Zohydro ER's sales peaked early but face ongoing decline due to the rise of abuse-deterrent formulations and legislative restrictions.

- Conservative sales forecasts project continued decline, with moderate growth scenarios contingent on reformulation efforts and regulatory easing.

- Market success hinges on innovation, strategic positioning, and adherence to evolving pain management guidelines.

- Stakeholders should monitor regulatory developments, prescriber trends, and competitor innovation to refine strategic decisions.

FAQs

1. What are the main factors influencing Zohydro ER sales?

Regulatory restrictions, societal concerns over opioid misuse, competition from abuse-deterrent formulations, and prescribing guidelines are primary drivers and barriers impacting sales.

2. How does the opioid epidemic affect Zohydro ER's market potential?

The epidemic has led to tighter regulations and reduced prescribing, diminishing the market size for high-potency, non-abuse-deterrent opioids like Zohydro ER.

3. Are there plans for reformulating Zohydro ER to include abuse deterrence?

As of now, no publicly announced reformulation exists, but industry trends indicate potential development to improve market acceptance and compliance.

4. Who are the primary competitors for Zohydro ER?

Abuse-deterrent formulations of oxycodone, reformulated hydrocodone products, and multimodal pain management approaches constitute the main competition.

5. What strategies could improve Zohydro ER's market outlook?

Developing abuse-deterrent versions, targeted marketing, adhering to prescribing guidelines, and engaging with payers for formulary access could enhance prospects.

References

[1] CDC. "Prescription Opioid Data." Centers for Disease Control and Prevention, 2021.

[2] IQVIA. "Opioid Prescribing Trends," 2022.

[3] IQVIA. "Pharmaceutical Market Data," 2015.

More… ↓