Share This Page

Drug Sales Trends for SEROQUEL XR

✉ Email this page to a colleague

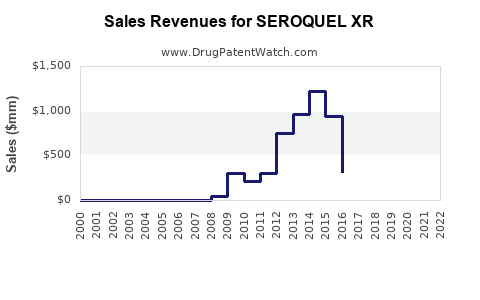

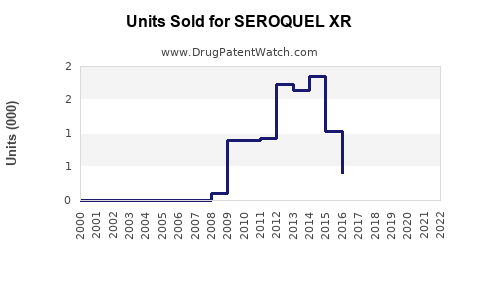

Annual Sales Revenues and Units Sold for SEROQUEL XR

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| SEROQUEL XR | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| SEROQUEL XR | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| SEROQUEL XR | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for SEROQUEL XR

Introduction

SEROQUEL XR (quetiapine fumarate extended-release) is an atypical antipsychotic primarily indicated for schizophrenia, bipolar disorder, and major depressive disorder in its extended-release formulation. Since its approval by the FDA, SEROQUEL XR has established a significant presence in the neuropsychiatric therapeutics market. This analysis explores current market dynamics, competitive positioning, and future sales forecasts, providing investment and strategic insights for stakeholders.

Market Overview

Therapeutic Landscape

The global antipsychotics market is projected to expand at a CAGR of approximately 4.5% from 2023 to 2030, driven by rising prevalence of schizophrenia, bipolar disorder, and depression. The World Health Organization estimates that over 20 million people suffer from schizophrenia worldwide, emphasizing the market’s substantial potential [1].

Key Indications and Patient Demographics

- Schizophrenia: Predominant indication, especially among adults aged 18-35.

- Bipolar Disorder: Includes manic/mixed episodes and maintenance therapy.

- Major Depressive Disorder: As adjunct therapy, expanding market scope.

The increasing awareness and destigmatization of mental health conditions, coupled with broader insurance coverage, are fostering greater medication adherence and market penetration.

Regulatory and Safety Profile

SEROQUEL XR's improved safety profile, particularly its once-daily dosing and reduced metabolic side effects compared to first-generation antipsychotics, enhances its market appeal. However, side effects such as sedation and weight gain remain challenges influencing formulary decisions and patient adherence.

Competitive Positioning

Market Share and Key Competitors

SEROQUEL XR's primary competitors include:

- Risperdal Consta (risperidone)

- Abilify (aripiprazole)

- Latuda (lurasidone)

- Vraylar (cariprazine)

As of 2022, Teva’s SEROQUEL XR holds approximately 10-15% in the atypical antipsychotic segment, buoyed by its extended-release formulation, which improves compliance over immediate-release versions [2].

Strategic Advantages

- Once-daily dosing improves adherence.

- Broader indication spectrum.

- Favorable pharmacokinetics for long-term management.

Pricing and Reimbursement

SEROQUEL XR's pricing remains competitive within the atypical antipsychotics market. Reimbursement policies vary globally but generally favor medications with established efficacy and safety profiles, bolstering market access.

Current Market Dynamics

Global Sales Data

In 2022, SEROQUEL XR generated approximately $1.2 billion in worldwide revenue, reflecting consistent growth since its launch in 2009. North America remains the largest revenue contributor, accounting for nearly 60%, followed by Europe and emerging markets in Asia-Pacific.

Market Penetration and Adoption Trends

Despite its established presence, SEROQUEL XR faces increasing competition from newer agents with favorable side-effect profiles and more convenient dosing schedules, impacting its growth potential.

Future Sales Projections

Key Drivers

- Increasing prevalence of target disorders: Projected global diagnoses of schizophrenia and bipolar disorder to increase by 3-4% annually.

- Off-label and adjunct uses: Growing evidence for adjunctive use in depression and agitation among dementia patients may expand indications.

- Market expansion in emerging economies: Middle East, Asia-Pacific, and Latin America present untapped markets with rising mental health awareness.

Projected Revenue Forecasts (2023-2030)

| Year | Estimated Global Sales (USD Billion) | CAGR | Remarks |

|---|---|---|---|

| 2023 | 1.3 | — | Post-pandemic stabilization |

| 2025 | 1.7 | 15% | Increased adoption, new markets |

| 2027 | 2.2 | 12% | Competitive pressures, pipeline advances |

| 2030 | 2.8 | 10% | Market maturation, biosimilar entry |

These projections assume steady growth driven by increasing prevalence, improved access, and potential new indications, offset by intensifying competition and patent considerations.

Potential Impact of Biosimilars and Patent Expiry

Patent protections on SEROQUEL XR are set to expire by 2027 in key markets, opening avenues for biosimilars or generic formulations, which could significantly erode revenue streams but also catalyze broader market adoption due to lower costs.

Risks and Challenges

- Generic competition: Erosion of exclusivity post-2027 could lead to market share decline.

- Regulatory pressures: Ongoing safety concerns and label updates may impact prescribing.

- Market saturation: In mature markets, growth will rely on new indications, formulary placements, and patient adherence improvements.

- Pricing pressures: Payer negotiations may reduce profit margins over time.

Strategic Outlook

To sustain growth, the manufacturer should focus on:

- Expanding indications via clinical trials.

- Enhancing formulation benefits or combination therapies.

- Penetrating emerging markets through strategic partnerships.

- Monitoring biosimilar developments carefully to inform pricing and patent strategies.

Key Takeaways

- SEROQUEL XR remains a leading player in the atypical antipsychotic market with stable sales and a strong brand presence.

- The forecast indicates gradual growth reaching approximately $2.8 billion by 2030, driven by increasing mental health disorder prevalence and market expansion.

- Patent expiry around 2027 presents both risks from biosimilar competition and opportunities through market penetration strategies.

- Competitive advantages like once-daily dosing and broad indications reinforce its market position; however, rival agents and emerging therapies pose ongoing threats.

- Stakeholders should focus on pipeline development, emerging markets, and strategic patent management to maximize long-term value.

FAQs

1. How does SEROQUEL XR differ from its immediate-release formulation?

SEROQUEL XR offers once-daily extended-release dosing, improving adherence and providing more stable plasma drug levels compared to the twice-daily immediate-release version, which can enhance tolerability and therapeutic consistency.

2. What are the main factors influencing SEROQUEL XR’s market share?

Key factors include its safety profile, dosing convenience, regulatory approvals, reimbursement policies, and competition from newer antipsychotics and biosimilars upon patent expiry.

3. How will patent expiration impact SEROQUEL XR sales?

Patent expiration around 2027 will likely lead to biosimilar entries, reducing prices and revenue. Strategic market positioning and expanding indications will be vital to mitigate this impact.

4. Which regions present the highest growth potential for SEROQUEL XR?

Emerging economies in Asia-Pacific, Latin America, and the Middle East are poised for rapid growth due to increasing mental health awareness, improving healthcare infrastructure, and broader insurance coverage.

5. Are there ongoing developments that could influence SEROQUEL XR’s future?

Yes, ongoing clinical trials are exploring new indications, combination therapies, and formulation improvements. Also, regulatory developments and biosimilar advances will shape the competitive landscape.

References

[1] World Health Organization. Mental health factsheet, 2023.

[2] IQVIA. Global Pharmaceuticals Market Data, 2022 Insights.

More… ↓