Last updated: July 29, 2025

Introduction

Ropinirole is a dopamine agonist primarily indicated for the treatment of Parkinson’s disease and Restless Legs Syndrome (RLS). Since its approval in the late 1990s, it has established itself as a cornerstone therapy within its indicated domains. As a versatile medication, understanding its current market position, potential growth drivers, and sales forecasting is critical for stakeholders including pharmaceutical companies, investors, and healthcare providers.

This analysis provides a comprehensive overview of Ropinirole’s market landscape, examining key factors influencing its sales, emerging trends, competitive dynamics, and future sales projections.

Market Overview and Therapeutic Context

Indications and Patient Population

Ropinirole is primarily prescribed for Parkinson’s disease, which affects over 10 million people globally, with incidence increasing with age. The drug also addresses Restless Legs Syndrome, a condition impacting approximately 7–10% of the adult population, especially prevalent among women and the elderly (1). These sizable patient populations underpin the drug’s market potential.

Mechanism of Action and Clinical Advantages

As a non-ergoline dopamine agonist, ropinirole offers benefits such as reduced motor fluctuations and locomotor improvements with a side effect profile manageable within clinical settings (2). Its oral administration and once-daily dosing enhance patient adherence, making it a preferred choice among clinicians.

Regulatory Status and Market Access

Ropinirole holds regulatory approvals across major markets, including the US (FDA), Europe (EMA), and Japan (PMDA). Patent protections largely expired around 2012, leading to availability of generic formulations, which has significantly impacted pricing dynamics and overall market growth.

Market Dynamics Influencing Ropinirole Sales

Competition and Market Share

Ropinirole faces competition from other dopamine agonists, such as pramipexole and rotigotine, and from levodopa-based therapies which remain first-line. The advent of newer, more selective agents and combination formulations also influence competitive positioning.

Despite this, ropinirole maintains substantial market share due to its established safety profile, affordability (especially with generics), and consistent efficacy. The advent of long-acting formulations and combination pills (e.g., with entacapone) presents opportunities to broaden market access and adherence.

Pipeline and Innovative Therapies

Emerging therapies, including gene therapies and novel dopaminergic agents, could reshape the landscape over the next decade. However, current formulations of ropinirole are expected to retain relevance, especially in settings where newer therapies are unavailable or cost-prohibitive.

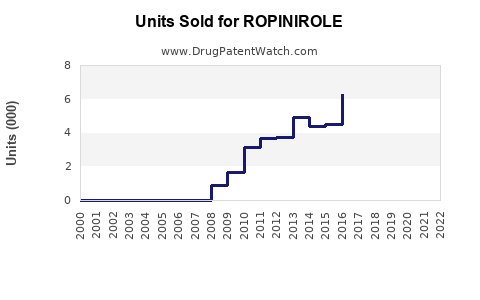

Patent Expirations and Generics Impact

The expiration of key patents around 2012 allowed multiple manufacturers to offer generic ropinirole. This led to dramatic price reductions—up to 80%—in multiple markets, catalyzing market expansion due to increased affordability. The global generic landscape is highly competitive, driving down revenue per unit but expanding total volume.

Geographic Market Trends

-

United States: The largest single-market, with an estimated 1 million Parkinson’s patients and significant RLS cases. Strict regulatory pathways and payer policies influence sales.

-

Europe: Similar prevalence rates, with high generic penetration following patent expiry.

-

Emerging Markets: Growing awareness and increasing diagnosis rates support expansion, though affordability remains a critical barrier.

Pricing and Reimbursement Factors

Pricing strategies are heavily impacted by generic competition. Reimbursement policies favor cost-effective generics, although brand-name formulations may maintain premium pricing in some regions due to clinical differentiation.

Sales Projections and Forecasting (2023–2030)

Methodology

Projection models incorporate epidemiological data, market penetration rates, pricing trends, competitive forces, and pipeline developments. Analyses consider both established uses and potential new indications or formulations.

Current Market Size

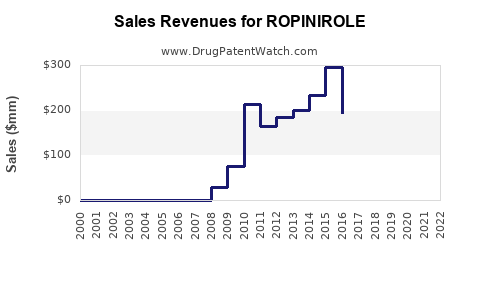

The global Ropinirole market was valued at approximately $1.2 billion in 2022, with the majority attributable to North America and Europe, reflecting the prevalence of Parkinson’s disease and RLS, and mature generic markets.

Forecasted Growth Drivers

-

Expanded Diagnosis and Treatment Rates: Increasing awareness leads to higher diagnosis rates; an aging global population sustains demand.

-

Generic Market Stability: Continued generic competition will suppress average prices but expand volume sales.

-

New Formulation Introductions: Extended-release and combination therapies could penetrate additional patient segments, stimulating sales.

-

Geographical Expansion: Growing markets in Asia-Pacific and Latin America could provide incremental revenues.

Projected Sales Figures

-

2023–2025: Compound annual growth rate (CAGR) around 2–3%, driven mainly by volume increases rather than price.

-

2025–2030: Moderated growth with CAGR stabilizing at 1–2%, influenced by market saturation and emerging therapies.

By 2030, global sales are anticipated to reach $1.4–1.6 billion, with regional variations based on regulatory and economic factors.

Market Challenges and Opportunities

Challenges

-

Aggressive Generic Competition: Continual price wars undermine margins.

-

Emergence of Alternative Treatments: Deep brain stimulation (DBS), gene therapy prospects, and novel pharmacologics threaten long-term demand.

-

Market Saturation: In mature markets, growth stabilizes, limited by patient pool and treatment guidelines.

Opportunities

-

Formulation Innovation: Development of transdermal patches, extended-release, or combination pills can capture underserved segments.

-

New Indications: Ongoing research into off-label uses or secondary indications could expand its therapeutic footprint.

-

Market Penetration in Developing Countries: Growing healthcare infrastructure and increasing awareness posit significant upside potential.

Regulatory and Reimbursement Outlook

Regulatory agencies exhibit a focus on affordability and access, leading to broader approval of generics and biosimilars. Reimbursement policies are increasingly favoring cost-effective treatments, which benefits ropinirole’s market through continued generic proliferation.

Key Factors Influencing Future Sales

| Factor |

Impact |

Strategic Implication |

| Demographic trends |

Positive |

Align marketing to aging populations |

| Generic penetration |

Negative |

Innovate with new formulations/license deals |

| Pipeline of alternatives |

Negative |

Monitor and adapt to emerging therapies |

| Market expansion |

Positive |

Focus on emerging economies |

| Regulatory environment |

Neutral to positive |

Engage proactively in approval processes |

Conclusion

Ropinirole remains a vital, cost-effective option for Parkinson’s disease and RLS management. While patent expirations and intense generic competition have compressed margins, the intrinsic demand driven by disease prevalence sustains sales growth. Strategic focus on formulation innovation, geographic expansion, and pipeline development will be crucial in maintaining and growing its market share.

Key Takeaways

- Stable Demand Underpins Market: The sizeable and growing patient populations globally support consistent demand for ropinirole.

- Price and Volume Dynamics: Generic competition has reduced prices but expanded volumes, balancing revenue streams.

- Pipeline and Formulation Evolution: Innovation in delivery methods and combination therapies can unlock new market segments.

- Emerging Markets as Growth Engines: Developing regions offer untapped potential, contingent on affordability and healthcare infrastructure.

- Competitive Landscape Monitoring: Continuous assessment of emerging therapies and generics is essential for strategic positioning.

FAQs

-

What are the main indications for ropinirole?

Ropinirole is primarily indicated for Parkinson’s disease and Restless Legs Syndrome, offering symptomatic relief through dopaminergic stimulation.

-

How have patent expirations affected ropinirole sales?

Patent expirations around 2012 allowed generic manufacturers to enter the market, significantly reducing prices and increasing sales volumes, which stabilized overall revenue despite lower per-unit profits.

-

What future formulations or therapies could impact ropinirole sales?

Long-acting formulations, combination therapies, and emerging treatments like gene therapy could influence market share, either as competitors or new therapeutic options.

-

Which regions are expected to drive future growth?

Emerging markets in Asia-Pacific, Latin America, and Africa offer significant growth opportunities due to increasing diagnosis rates and expanding healthcare access.

-

What are the main challenges facing the ropinirole market?

Challenges include intense generic competition, impending emergence of novel therapies, and market saturation in established regions.

References

[1] National Institute of Neurological Disorders and Stroke. "Restless Legs Syndrome Fact Sheet."

[2] European Medicines Agency. "Ropinirole: Summary of Product Characteristics."